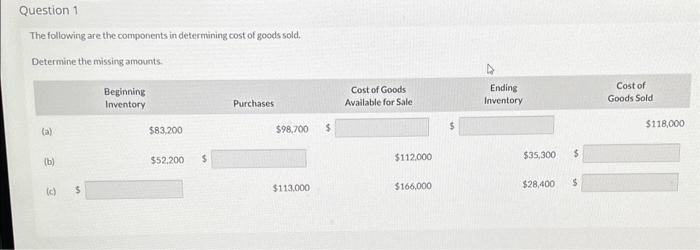

Question: question 1 question 2 question 3 question 4 question 5 The following are the components in determvining cost of goods sold. Determine the missing amounts.

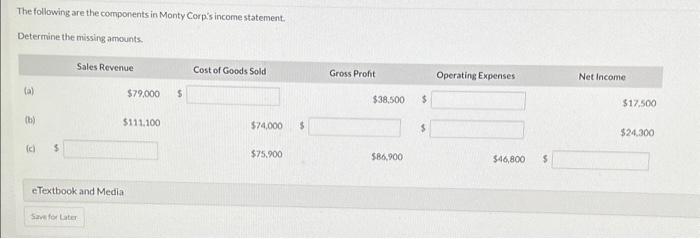

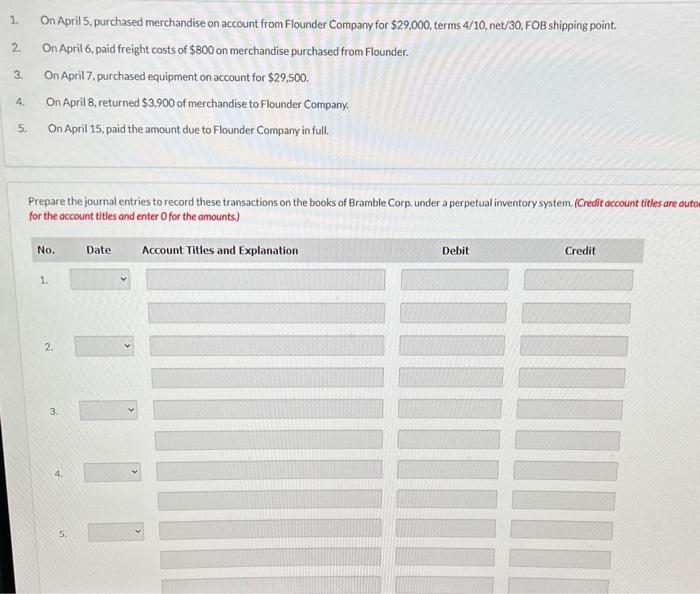

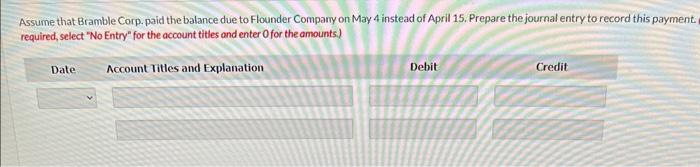

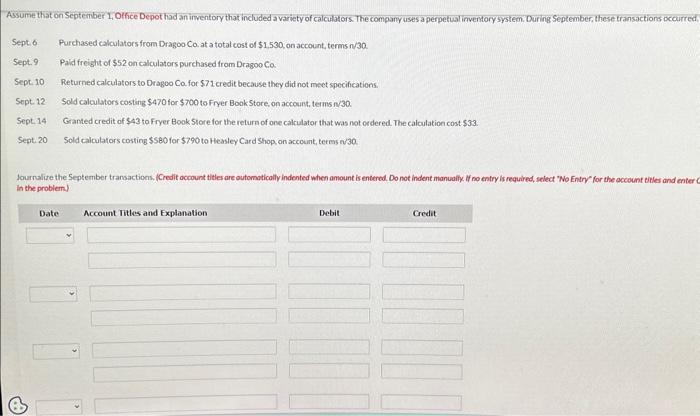

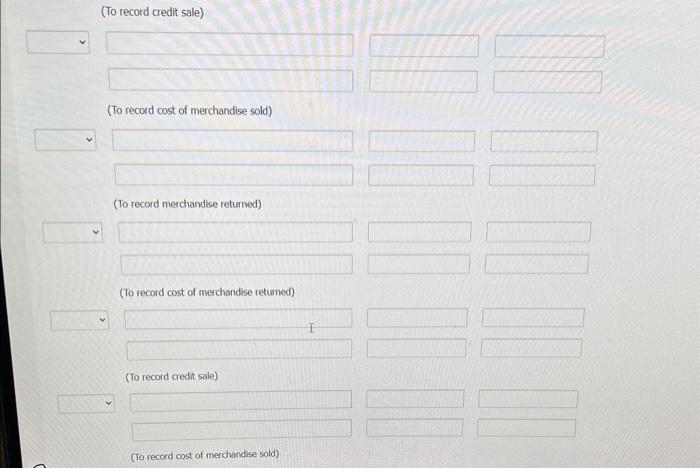

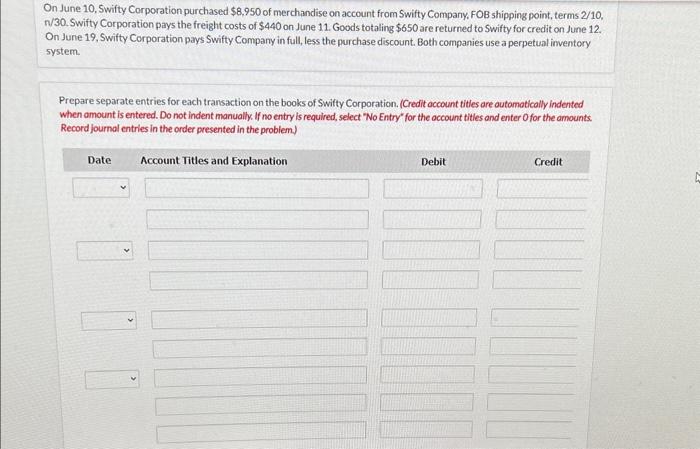

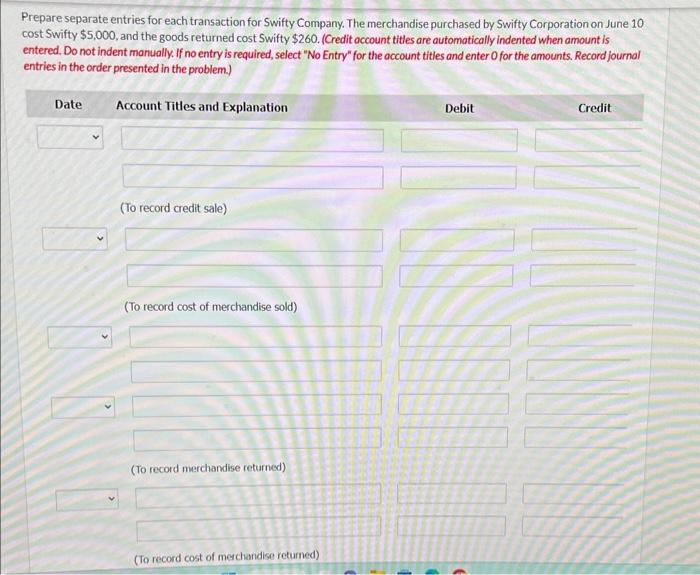

The following are the components in determvining cost of goods sold. Determine the missing amounts. The following are the components in Monty Corp's income statement. Determine the missing amounts. 1. On April 5, purchased merchandise on account from Flounder Company for $29,000, terms 4/10, net/30, FOB shipping point. 2. On April 6, paid freight costs of $800 on merchandise purchased from Flounder. 3. On April 7, purchased equipment on account for $29,500. 4. On April 8, returned $3,900 of merchandise to Flounder Company. 5. On April 15, paid the amount due to Flounder Company in full. Prepare the joumal entries to record these transactions on the books of Bramble Corp. under a perpetual inventory system. (Credit account titles are ou for the account titles and enter 0 for the amounts.) Assume that Bramble Corp. paid the balance due to Flounder Company on May 4 instead of April 15. Prepare the journal entry to record this payment required, select "No Entry" for the account titles and enter 0 for the amounts.) Assume that on September 1,Otfice Depot had an inventory that included a variety of calculatos. The company uses a perpetualinventorysystem. During September, these transactions occurred. Sept.6 Purchased calculators from Dragoo Co, at a total cost of $1,530, on account, terms n/30 Sept.9 Pald freight of $52 on calculators purchased from Drasoo Ca Sept. 10 Returned calculators to Dragoo Co for $71 credit because they did not mect specifications. Sept. 12 Sold calculators costing $470 for $700 to Fryer Book Store. on account, temins m30 Sept.14 Granted credit of $43 to fryer Book Store for the return of one calculator that was not ordered. The calculation cost $33. Sept. 20 Sold calculators costing $580 for $790 to Heasley Card Shop, on account, terms n/30. (To record credit sale) (To record cost of merchandise sold) (To record merchandise returned) (To record cost of merchandise retumed) (To record credit sale) (fo record cost of merchandise sold) On June 10, Swifty Corporation purchased $8,950 of merchandise on account from Swifty Company, FOB shipping point, terms 2/10, n/30. Swifty Corporation pays the freight costs of $440 on June 11. Goods totaling $650 are returned to Swifty for credit on June 12. On June 19, Swifty Corporation pays Swifty Company in full, less the purchase discount. Both companies use a perpetual inventory system. Prepare separate entries for each transaction on the books of Swifty Corporation. (Credit occount titles are automotically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount titles and enter O for the amounts. Record journal entries in the order presented in the problem.) Prepare separate entries for each transaction for Swifty Company. The merchandise purchased by Swifty Corporation on June 10 cost Swifty $5,000, and the goods returned cost Swifty $260. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Record journal entries in the order presented in the problem.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts