Question: Question 1: Question 2: Question 3: Question 4: Question 5: The following selected information was extracted from the 20x1 accounting records of Lone Oak Products

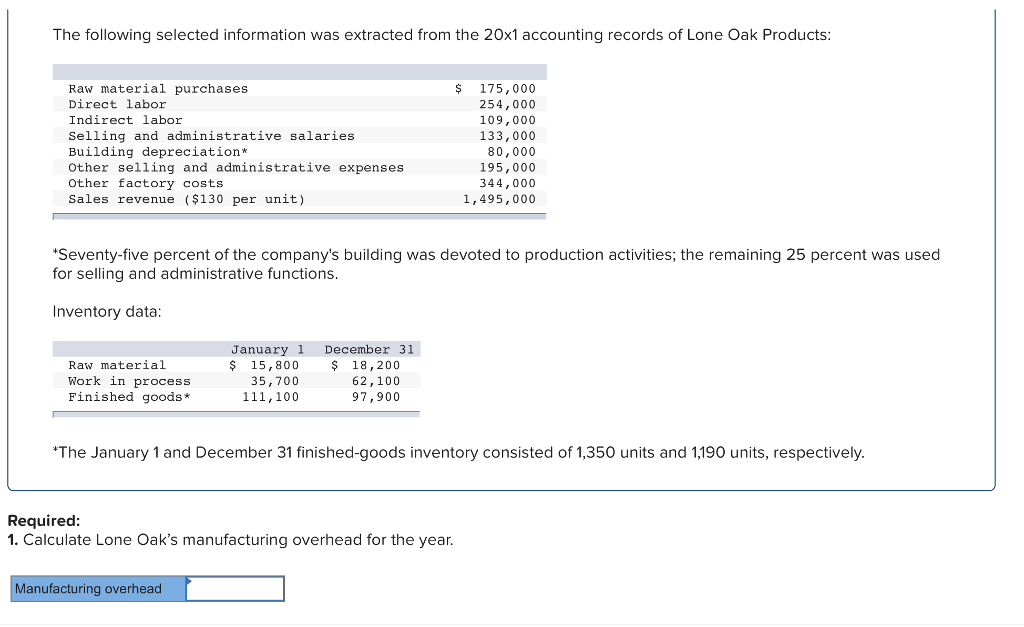

Question 1:

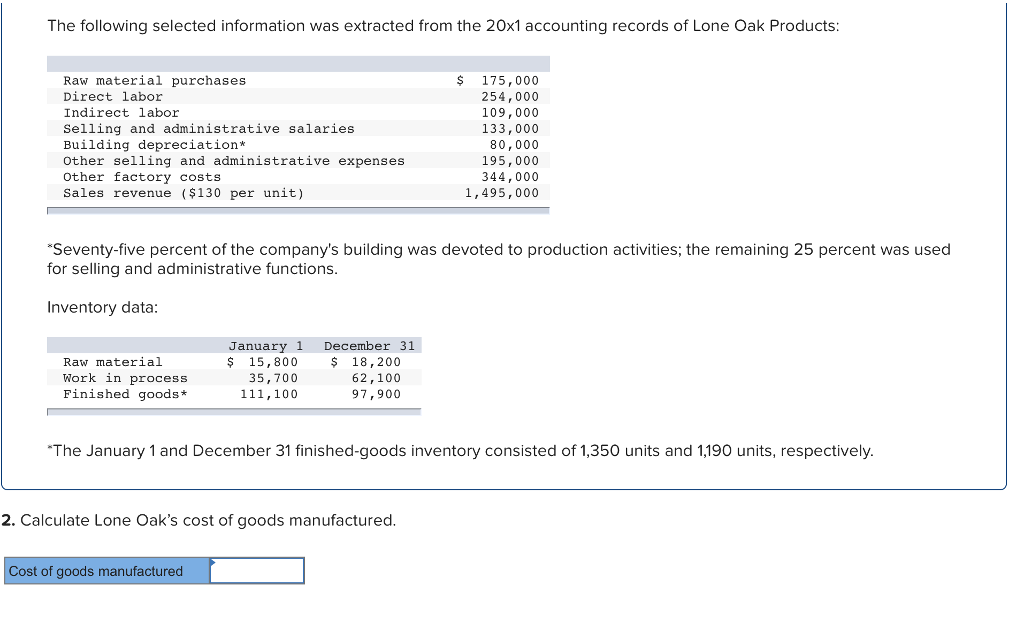

Question 2:

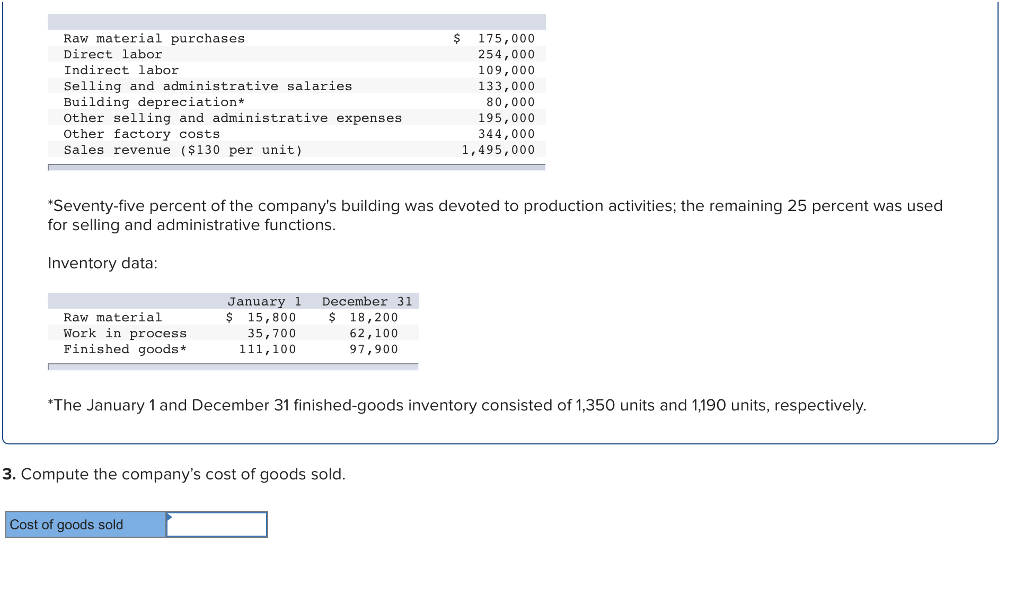

Question 3:

Question 3:  Question 4:

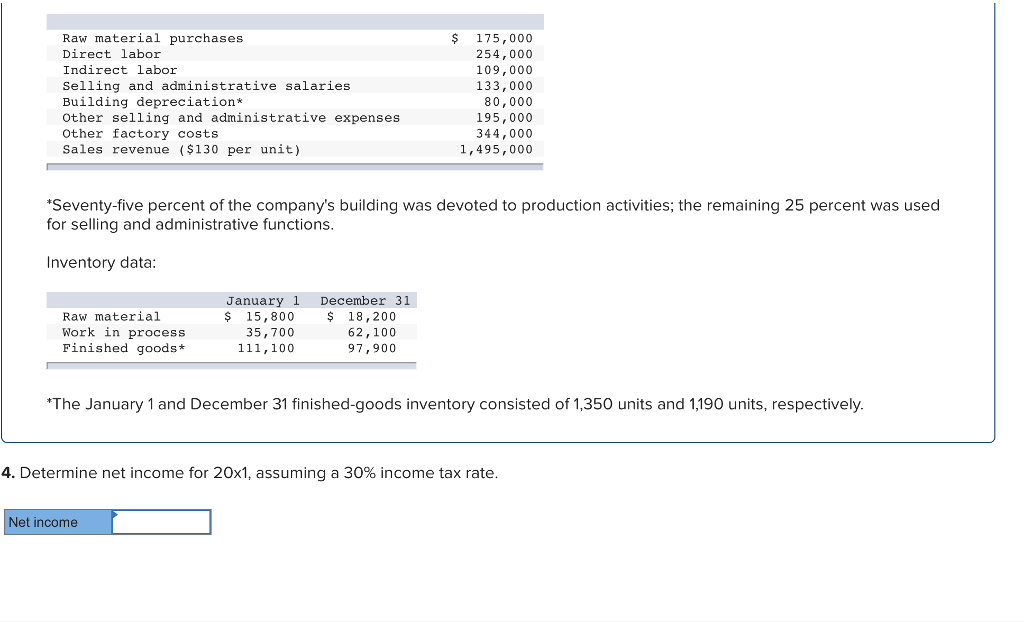

Question 4:  Question 5:

Question 5:

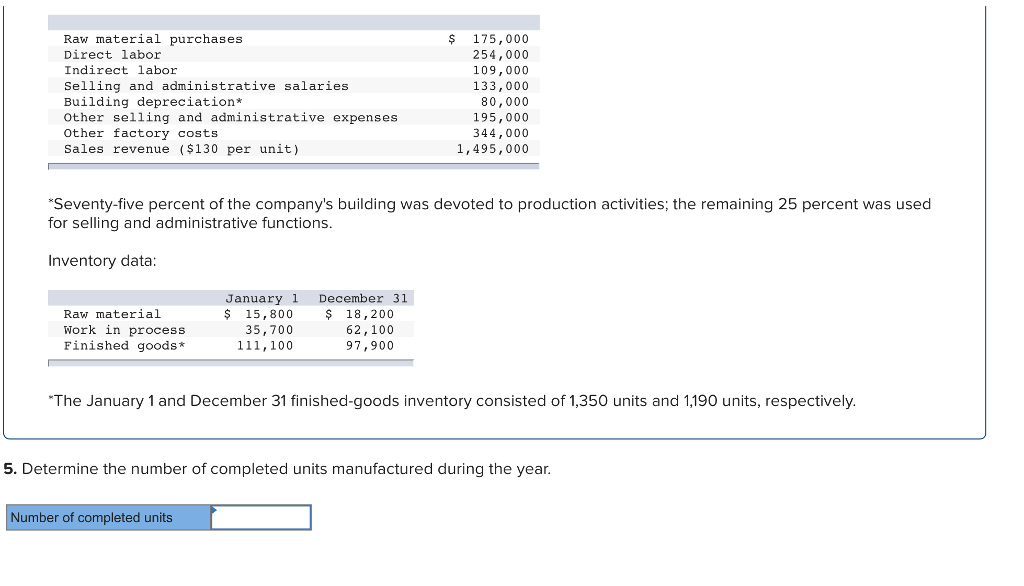

The following selected information was extracted from the 20x1 accounting records of Lone Oak Products Raw material purchases Direct labor Indirect labor Selling and administrative salaries Building depreciation* other selling and administrative expenses Other factory costs Sales revenue ($130 per unit) $175,000 254,000 109,000 133,000 80,000 195,000 344,000 1,495,000 Seventy-five percent of the company's building was devoted to production activities, the remaining 25 percent was used for selling and administrative functions Inventory data: January 1 December 31 Raw material Work in process Finished goods* 15,800 35,700 111,100 $ 18,200 62,100 97,900 The January 1 and December 31 finished-goods inventory consisted of 1,350 units and 1,190 units, respectively Required 1. Calculate Lone Oak's manufacturing overhead for the year Manufacturing overhead

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts