Question: QUESTION 1 QUESTION 2 QUESTION 3 QUESTION 4 Scenario: Company XYZ installed a 50,000-lb/hour boiler for $525,000 in 2000 when the index had a value

QUESTION 1

QUESTION 2

QUESTION 3

QUESTION 4

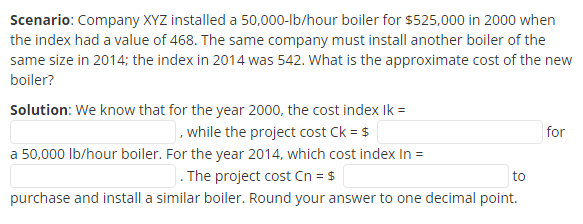

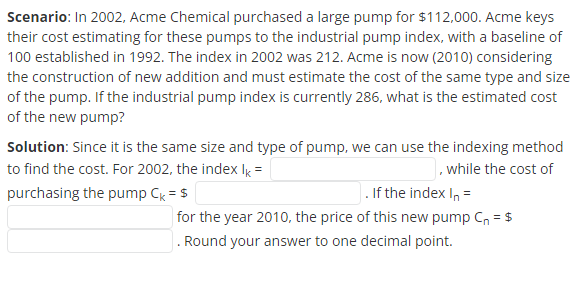

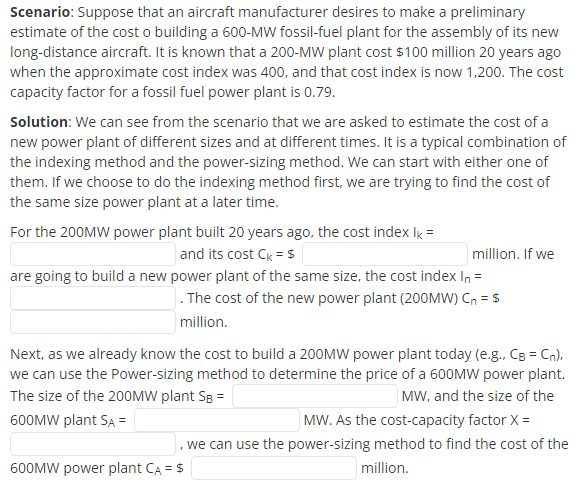

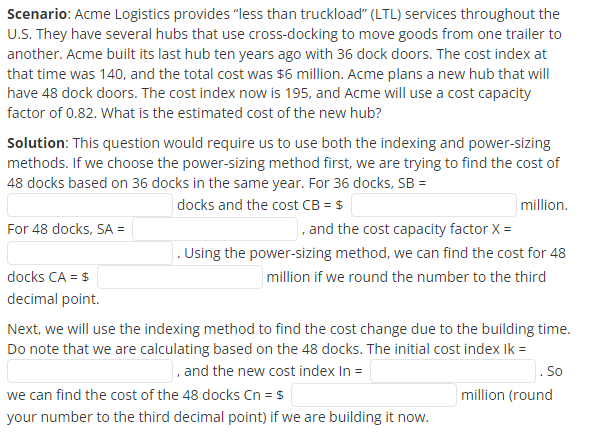

Scenario: Company XYZ installed a 50,000-lb/hour boiler for $525,000 in 2000 when the index had a value of 468 . The same company must install another boiler of the same size in 2014; the index in 2014 was 542 . What is the approximate cost of the new boiler? Solution: We know that for the year 2000 , the cost index Ik= , while the project cost Ck=$ for a 50,000lb/ hour boiler. For the year 2014, which cost index In = . The project cost Cn=$ to purchase and install a similar boiler. Round your answer to one decimal point. Scenario: In 2002, Acme Chemical purchased a large pump for $112,000. Acme keys their cost estimating for these pumps to the industrial pump index, with a baseline of 100 established in 1992. The index in 2002 was 212. Acme is now (2010) considering the construction of new addition and must estimate the cost of the same type and size of the pump. If the industrial pump index is currently 286 , what is the estimated cost of the new pump? Solution: Since it is the same size and type of pump, we can use the indexing method to find the cost. For 2002 , the index IK= , while the cost of purchasing the pump Ck=$ . If the index In= for the year 2010 , the price of this new pump Cn=$ . Round your answer to one decimal point. Scenario: Suppose that an aircraft manufacturer desires to make a preliminary estimate of the cost o building a 600-MW fossil-fuel plant for the assembly of its new long-distance aircraft. It is known that a 200-MW plant cost $100 million 20 years ago when the approximate cost index was 400, and that cost index is now 1,200. The cost capacity factor for a fossil fuel power plant is 0.79 . Solution: We can see from the scenario that we are asked to estimate the cost of a new power plant of different sizes and at different times. It is a typical combination of the indexing method and the power-sizing method. We can start with either one of them. If we choose to do the indexing method first, we are trying to find the cost of the same size power plant at a later time. For the 200MW power plant built 20 years ago, the cost index Ik= and its cost Ck=$ million. If we are going to build a new power plant of the same size, the cost index In= . The cost of the new power plant (200MW) Cn=$ million. Next, as we already know the cost to build a 200MW power plant today (e.g., CB=Cn ), we can use the Power-sizing method to determine the price of a 600MW power plant. The size of the 200MW plant SB= 600MW plant SA= MW, and the size of the MW. As the cost-capacity factor X= , we can use the power-sizing method to find the cost of the 600MW power plant CA=$ million. Scenario: Acme Logistics provides "less than truckload" (LTL) services throughout the U.S. They have several hubs that use cross-docking to move goods from one trailer to another. Acme built its last hub ten years ago with 36 dock doors. The cost index at that time was 140, and the total cost was $6 million. Acme plans a new hub that will have 48 dock doors. The cost index now is 195, and Acme will use a cost capacity factor of 0.82 . What is the estimated cost of the new hub? Solution: This question would require us to use both the indexing and power-sizing methods. If we choose the power-sizing method first, we are trying to find the cost of 48 docks based on 36 docks in the same year. For 36 docks, SB = docks and the cost CB=$ million. For 48 docks, SA = docks CA =$ decimal point. , and the cost capacity factor X= . Using the power-sizing method, we can find the cost for 48 million if we round the number to the third Next, we will use the indexing method to find the cost change due to the building time. Do note that we are calculating based on the 48 docks. The initial cost index lk= , and the new cost index in = So we can find the cost of the 48 docks Cn=$ million (round your number to the third decimal point) if we are building it now

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts