Question: Question 1: Question 2: Suppose that Fox Entertainment Group has just made an offer to acquire CKX, the firm that owns American Idol. Prior to

Question 1:

Question 1:  Question 2:

Question 2:

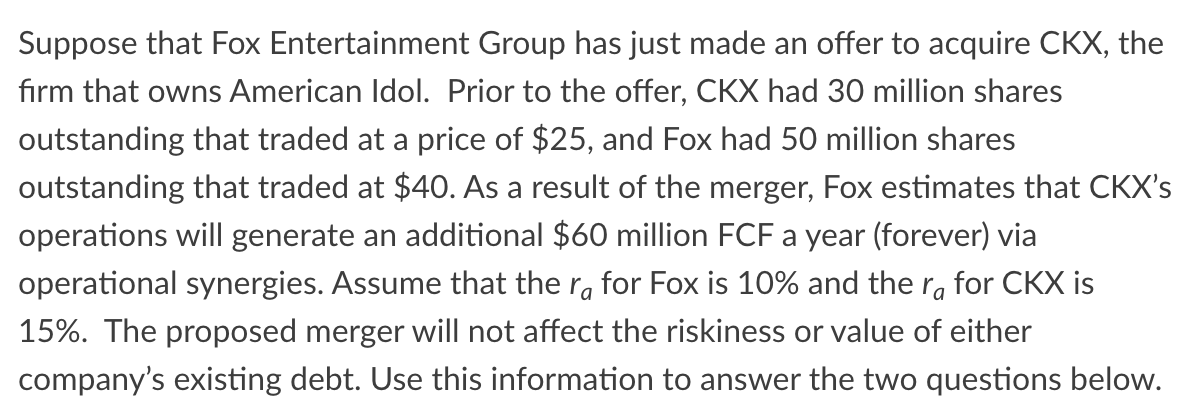

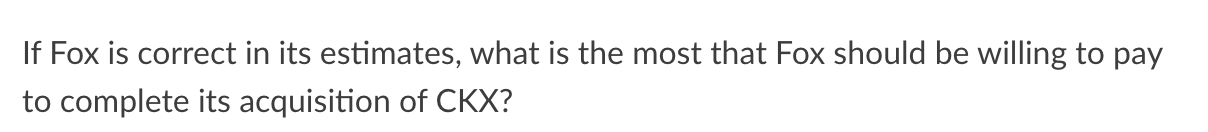

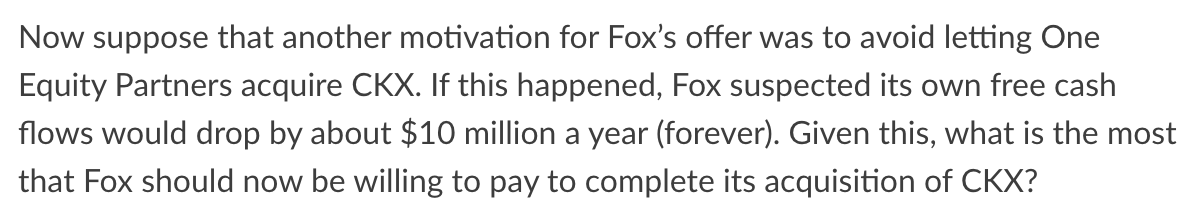

Suppose that Fox Entertainment Group has just made an offer to acquire CKX, the firm that owns American Idol. Prior to the offer, CKX had 30 million shares outstanding that traded at a price of $25, and Fox had 50 million shares outstanding that traded at $40. As a result of the merger, Fox estimates that CKX's operations will generate an additional $60 million FCF a year (forever) via operational synergies. Assume that the ra for Fox is 10% and the ra for CKX is 15%. The proposed merger will not affect the riskiness or value of either company's existing debt. Use this information to answer the two questions below. If Fox is correct in its estimates, what is the most that Fox should be willing to pay to complete its acquisition of CKX ? Now suppose that another motivation for Fox's offer was to avoid letting One Equity Partners acquire CKX. If this happened, Fox suspected its own free cash flows would drop by about $10 million a year (forever). Given this, what is the most that Fox should now be willing to pay to complete its acquisition of CKX

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts