Question: Question 1: ------ Question 2: ----- Thank you! Will rate thumbs up upon being provided both correct answers Blossom Corp is issuing a 10-year bond

Question 1: ------

------

Question 2:

-----

-----

Thank you! Will rate thumbs up upon being provided both correct answers

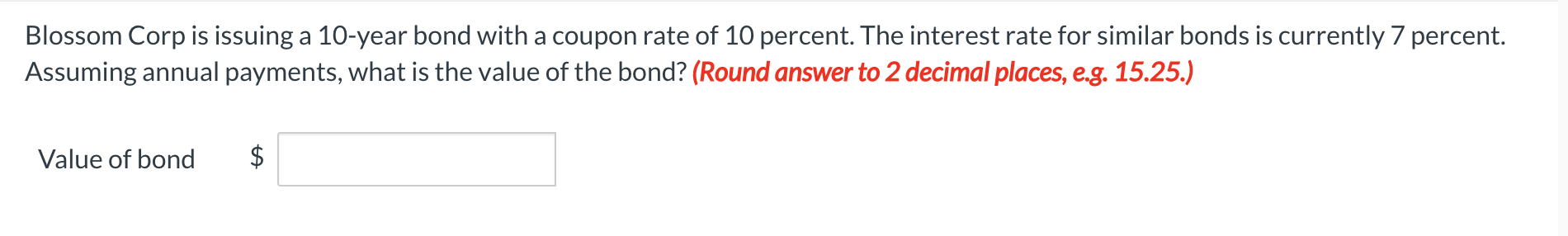

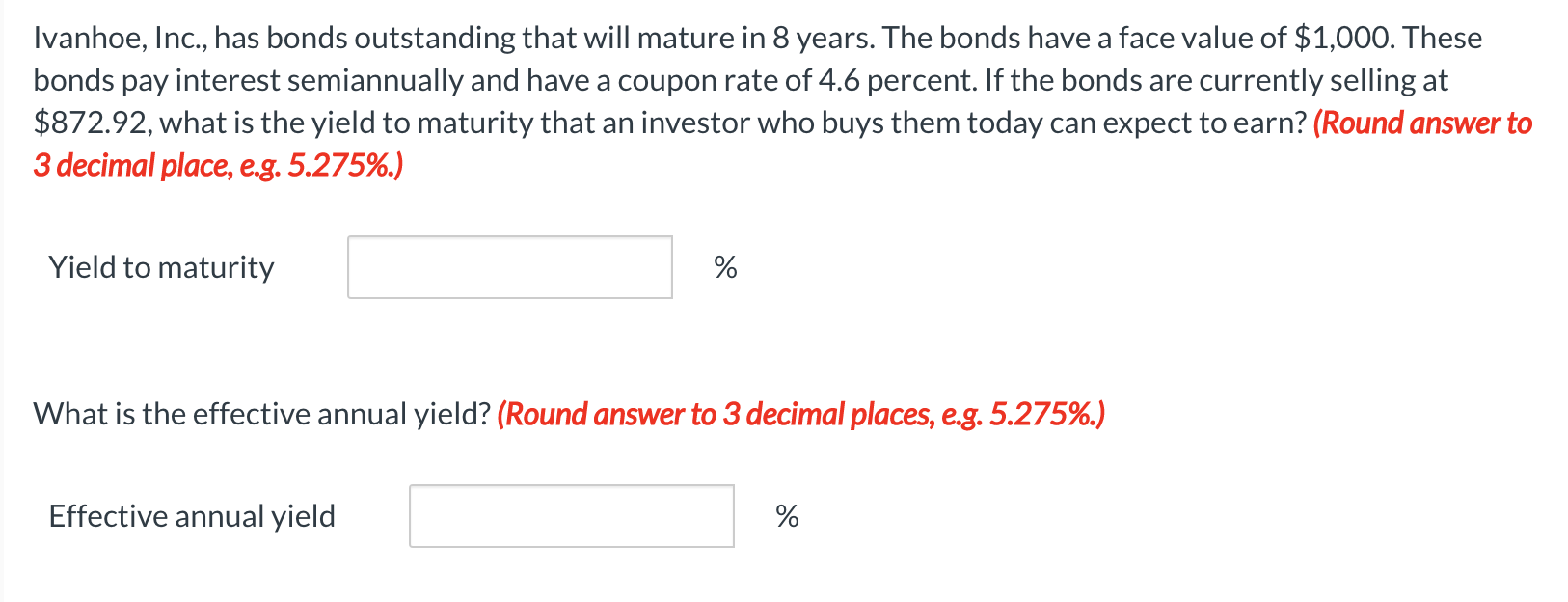

Blossom Corp is issuing a 10-year bond with a coupon rate of 10 percent. The interest rate for similar bonds is currently 7 percent. Assuming annual payments, what is the value of the bond? (Round answer to 2 decimal places, e.g. 15.25.) Value of bond $ Ivanhoe, Inc., has bonds outstanding that will mature in 8 years. The bonds have a face value of $1,000. These bonds pay interest semiannually and have a coupon rate of 4.6 percent. If the bonds are currently selling at $872.92, what is the yield to maturity that an investor who buys them today can expect to earn? (Round answer to 3 decimal place, e.g. 5.275%.) Yield to maturity % What is the effective annual yield? (Round answer to 3 decimal places, e.g. 5.275%.) Effective annual yield %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts