Question: question 1 question 2 The declaration, record, and payment dates in connection with a cash dividend of $38,800 on a corporation's common stock are January

question 1

question 2

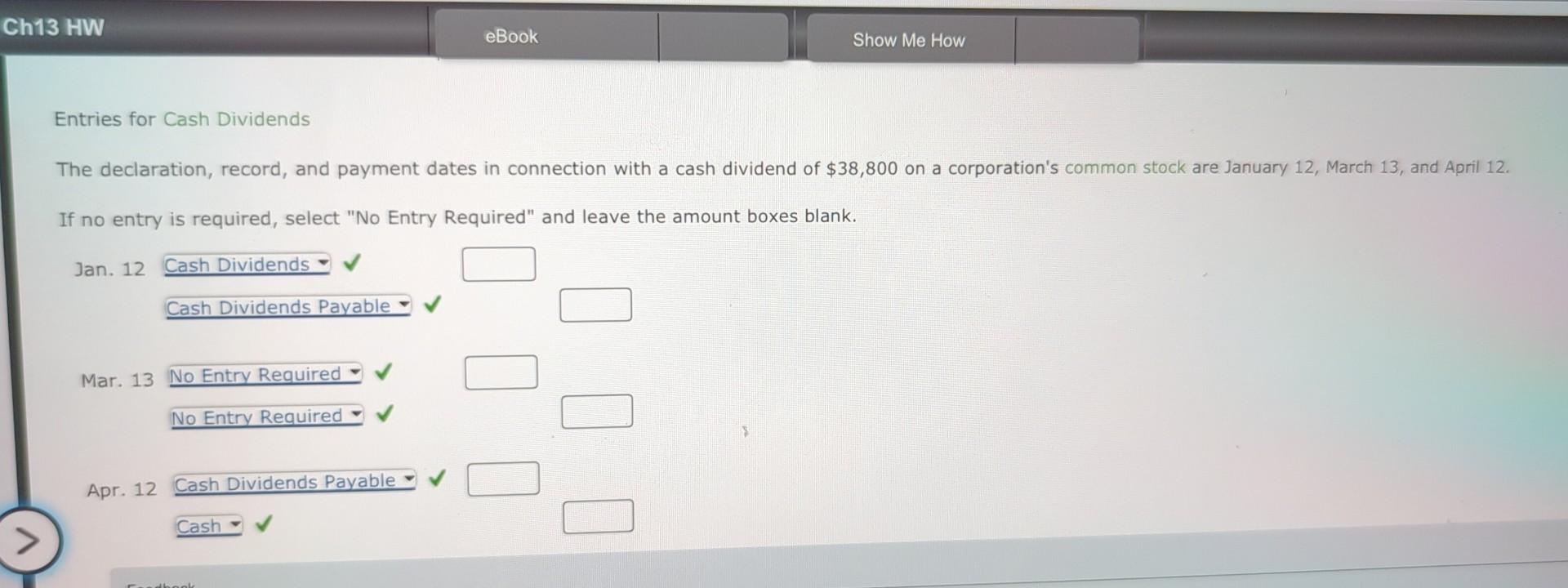

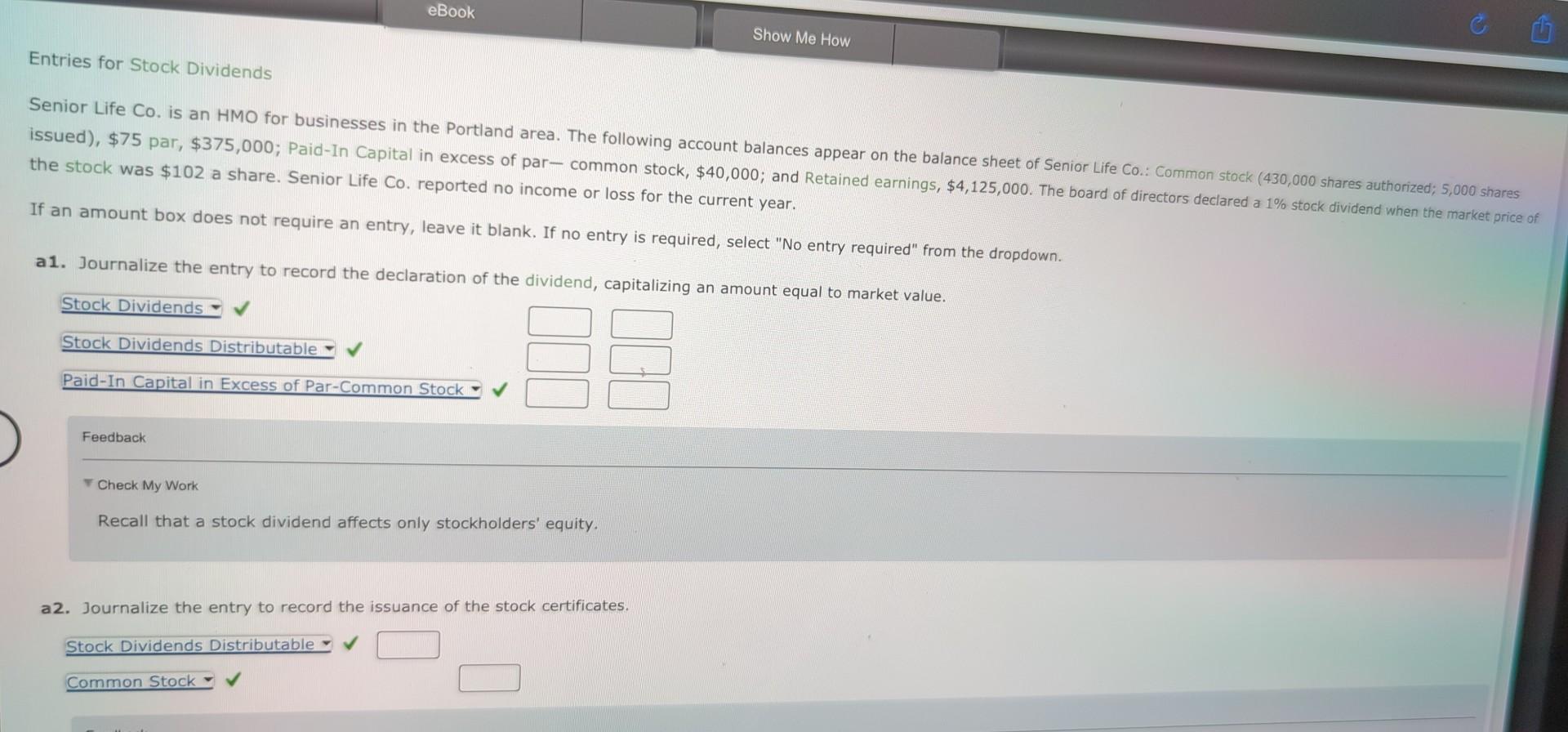

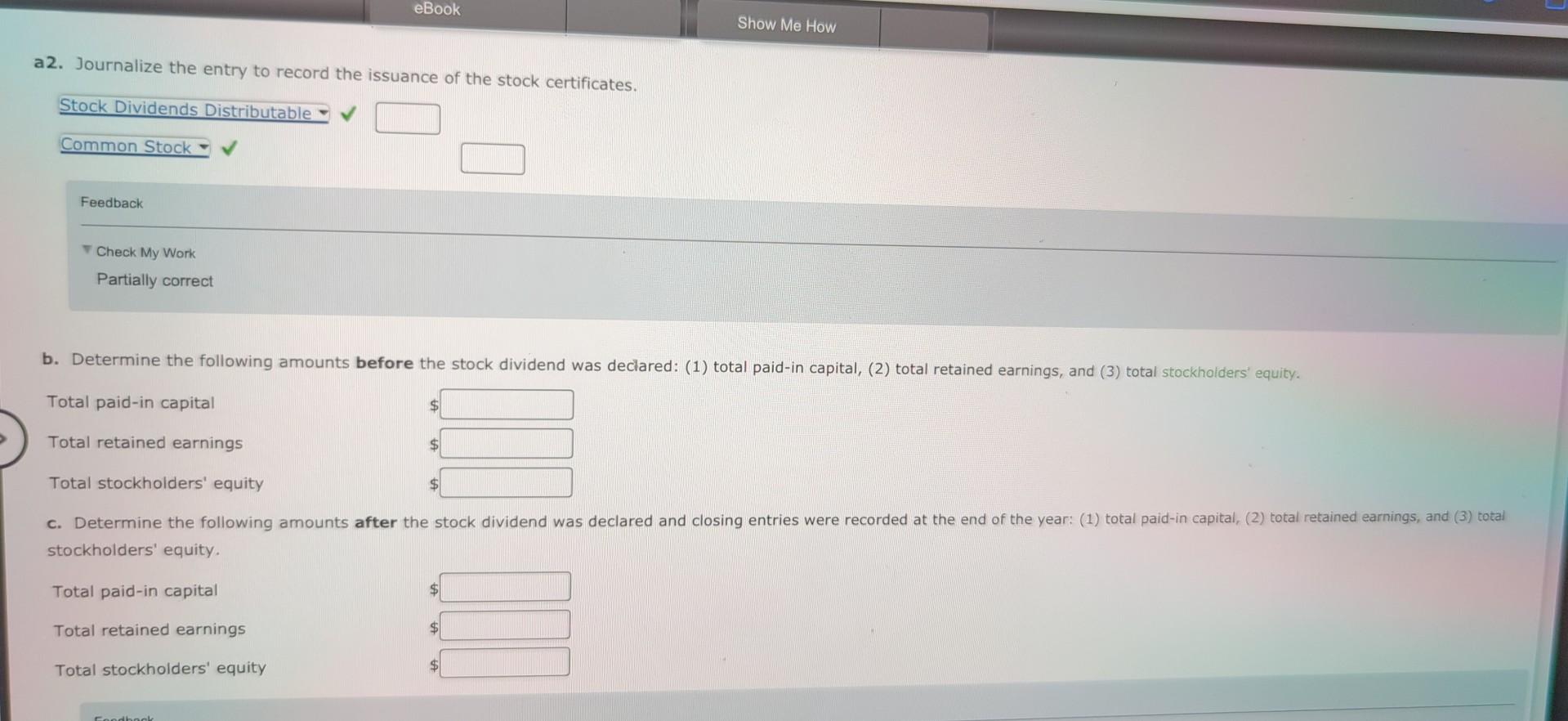

The declaration, record, and payment dates in connection with a cash dividend of $38,800 on a corporation's common stock are January 12 , March 13 , and April 12 . If no entry is required, select "No Entry Required" and leave the amount boxes blank. Entries for Stock Dividends Senior Life Co. is an HMO for businesses in the Portland area. The following account balances appear on the balance sheet of Senior Life Co.: Common stock (430,000 shares authorized; 5,000 shares issued), $75 par, $375,000; Paid-In Capital in excess of par-common stock, $40,000; and Retained earnings, $4,125,000. The board of directors declared a 1% stock dividend when the market price of the stock was $102 a share. Senior Life Co. reported no income or loss for the current year. If an amount box does not require an entry, leave it blank. If no entry is required, select "No entry required" from the dropdown. a1. Journalize the entry to record the declaration of the dividend, capitalizina an amount equal to market value. Feedback Theck My Work Recall that a stock dividend affects only stockholders' equity. a2. Journalize the entry to record the issuance of the stock certificates. a2. Journalize the entry to record the issuance of the stock certificates

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts