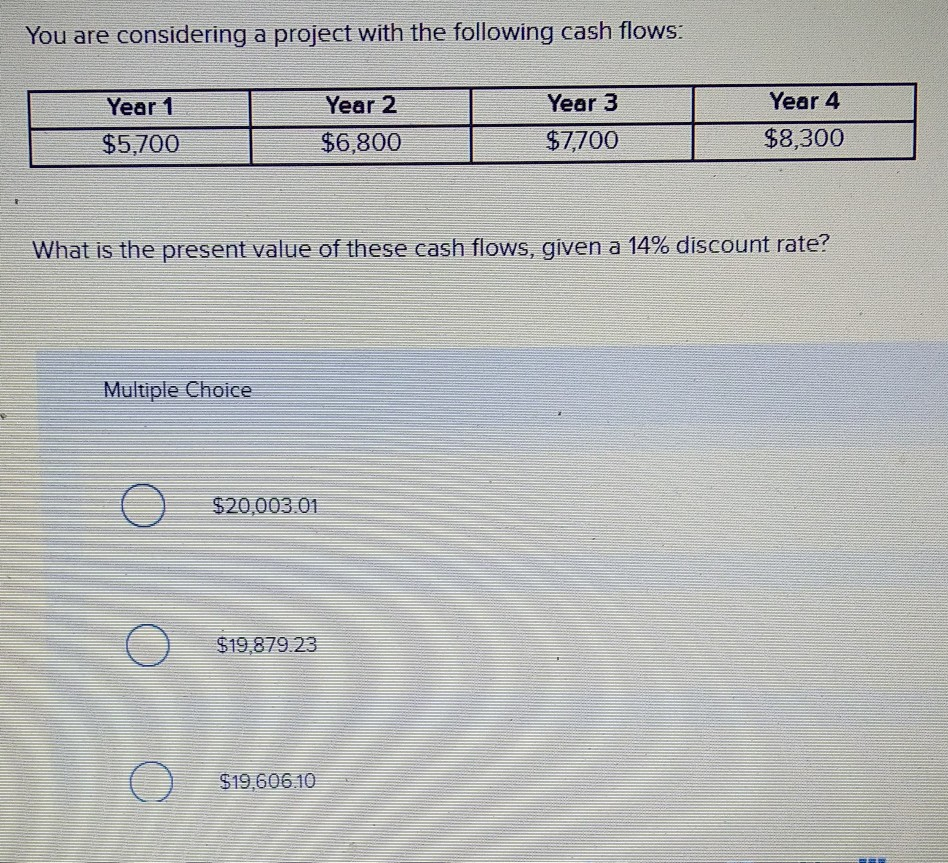

Question: Question 1 Question 2 You are considering a project with the following cash flows: Year 3 Year 4 Year 1 $5,700 Year 2 $6,800 $7700

Question 1

Question 2

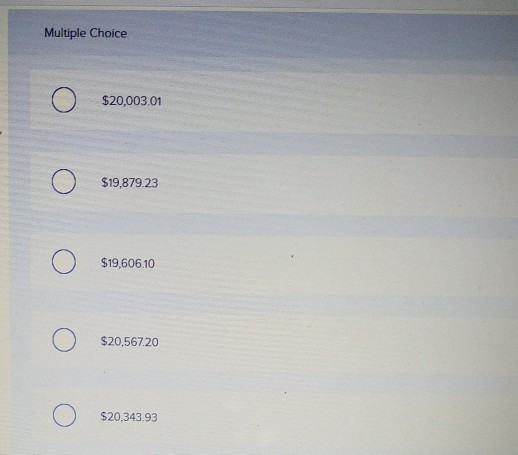

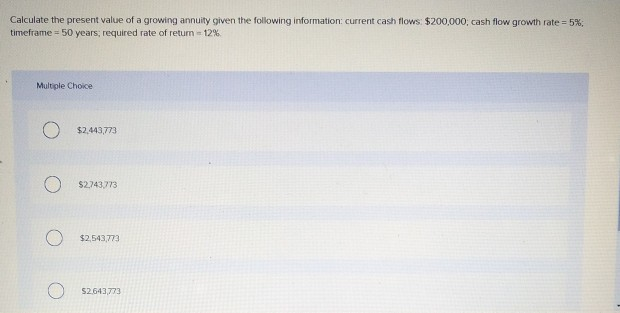

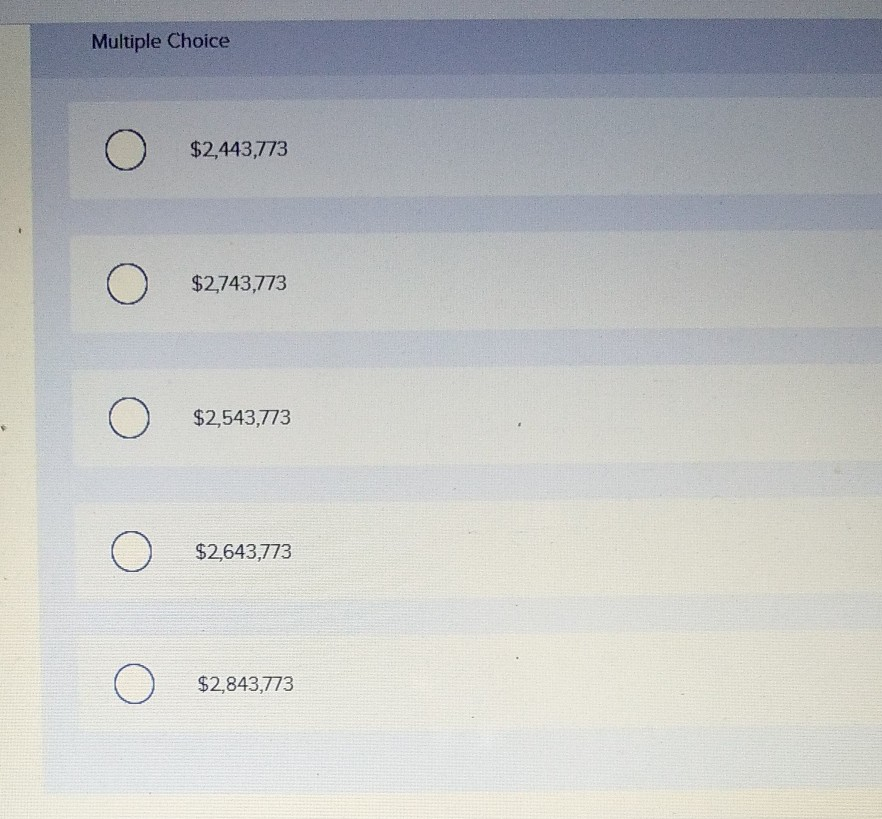

You are considering a project with the following cash flows: Year 3 Year 4 Year 1 $5,700 Year 2 $6,800 $7700 $8,300 What is the present value of these cash flows, given a 14% discount rate? Multiple Choice (0) $20.003.01 ) $19,879.23 $19,606.10 Multiple Choice $20,003.01 $19,879.23 $19,606.10 $20,567.20 $20,343.93 Calculate the present value of a growing annuity given the following information current cash flows $200,000, cash flow growth rate = 5% timeframe = 50 years, required rate of return -12% Multiple Choice $2.443,773 $2.743.773 $2,543,773 52.643,773 Multiple Choice O O $2,443,773 O $2,743,773 O $2,543,773 O $2,643,773 $2,843,773

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts