Question: Question 1 Question Help Rover Company is analyzing a special investment project. The project will require the purchase of two machines for $20,000 and $9,000

Question 1

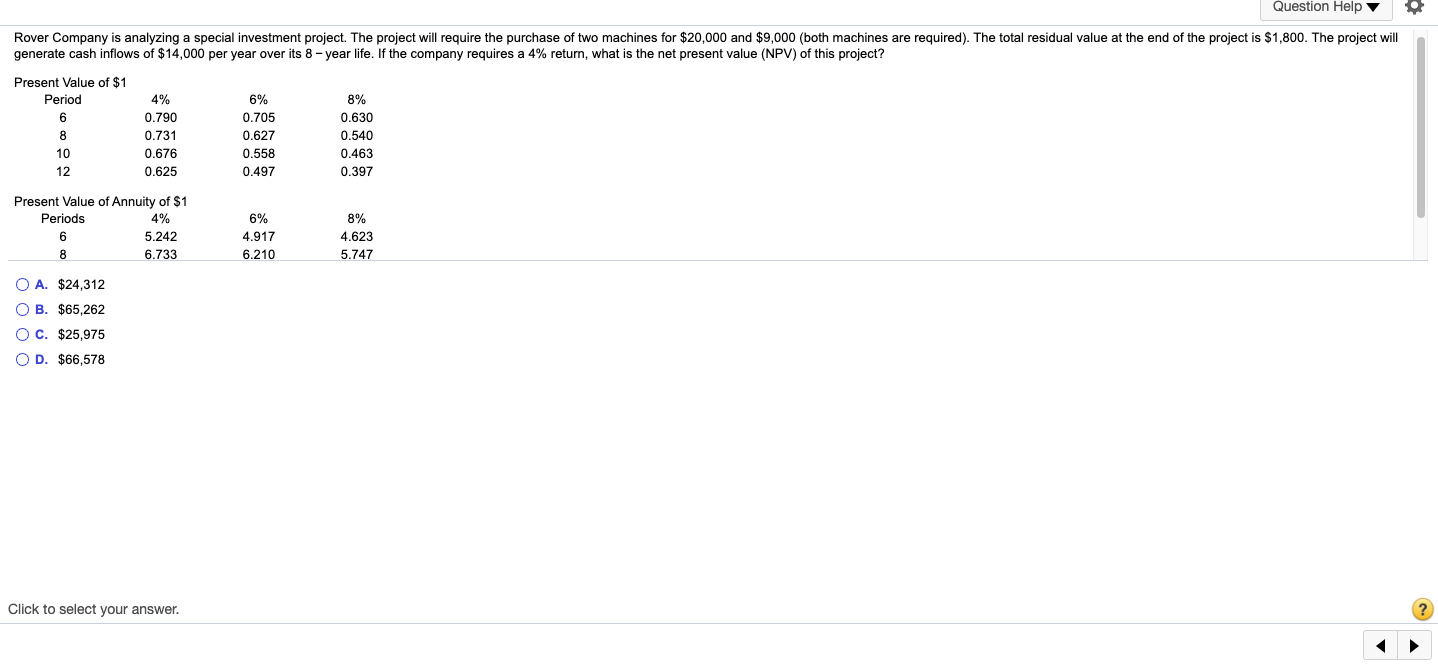

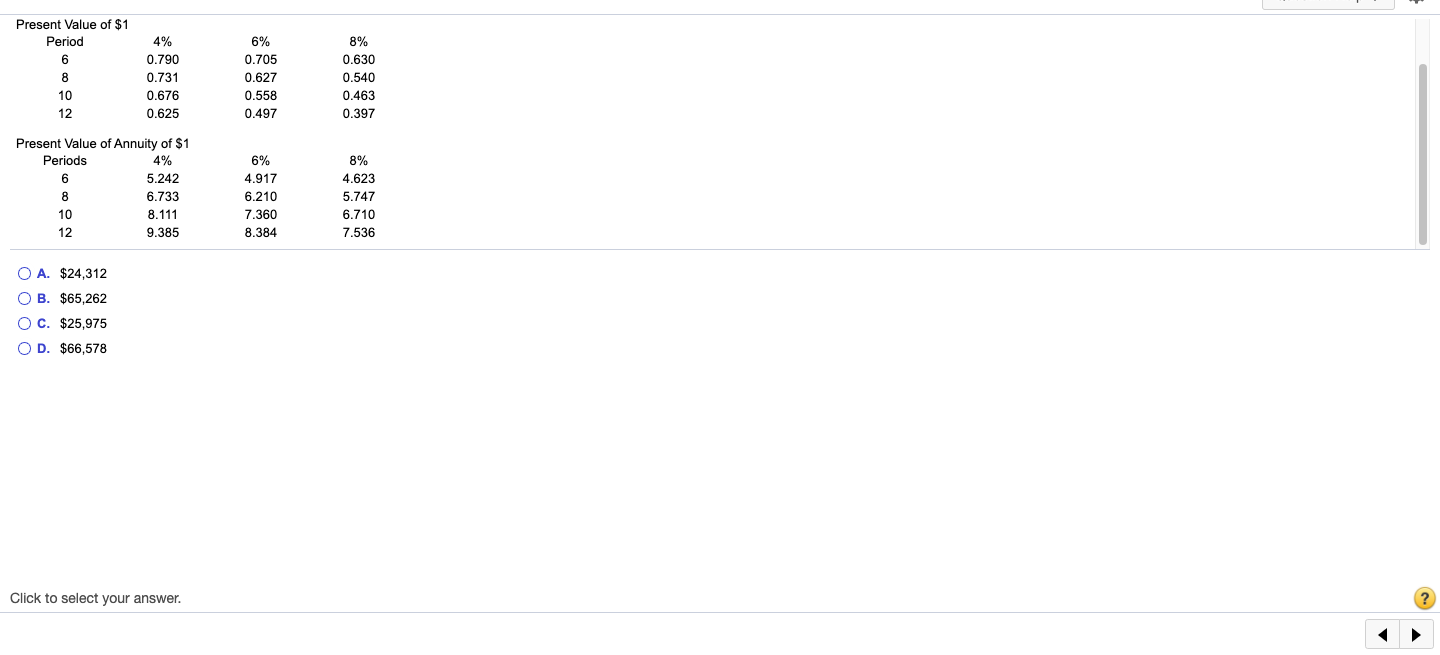

Question Help Rover Company is analyzing a special investment project. The project will require the purchase of two machines for $20,000 and $9,000 (both machines are required). The total residual value at the end of the project is $1,800. The project will generate cash inflows of $14,000 per year over its 8 - year life. If the company requires a 4% return, what is the net present value (NPV) of this project? Present Value of $1 Period 4% 6% 8% 6 0.790 0.705 0.630 0.731 0.627 0.540 0.676 0.558 0.463 12 0.625 0.497 0.397 Present Value of Annuity of $1 Periods 4% 6% 8% 5.242 4.917 4.623 8 6.733 6.210 5.747 O A. $24,312 O B. $65,262 O C. $25,975 O D. $66,578 Click to select your answer. ?Present Value of $1 Period 4% 6% 8% 6 0.790 0.705 0.630 8 0.731 0.627 0.540 10 0.676 0.558 0.463 12 0.625 0.497 0.397 Present Value of Annuity of $1 Periods 4% 6% 8% 6 5.242 4.917 4.623 8 6.733 6.210 5.747 10 8.111 7.360 6.710 12 9.385 8.384 7.536 O A. $24,312 O B. $65,262 O C. $25,975 O D. $66,578 Click to select your

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts