Question: Question #1: Question#2: CNBC.com reported mortgage applications increased 9.9% due to a decrease in the rate on 30-year fixed rate mortgages to 4.03%. Dennis Natali

Question #1:

Question#2:

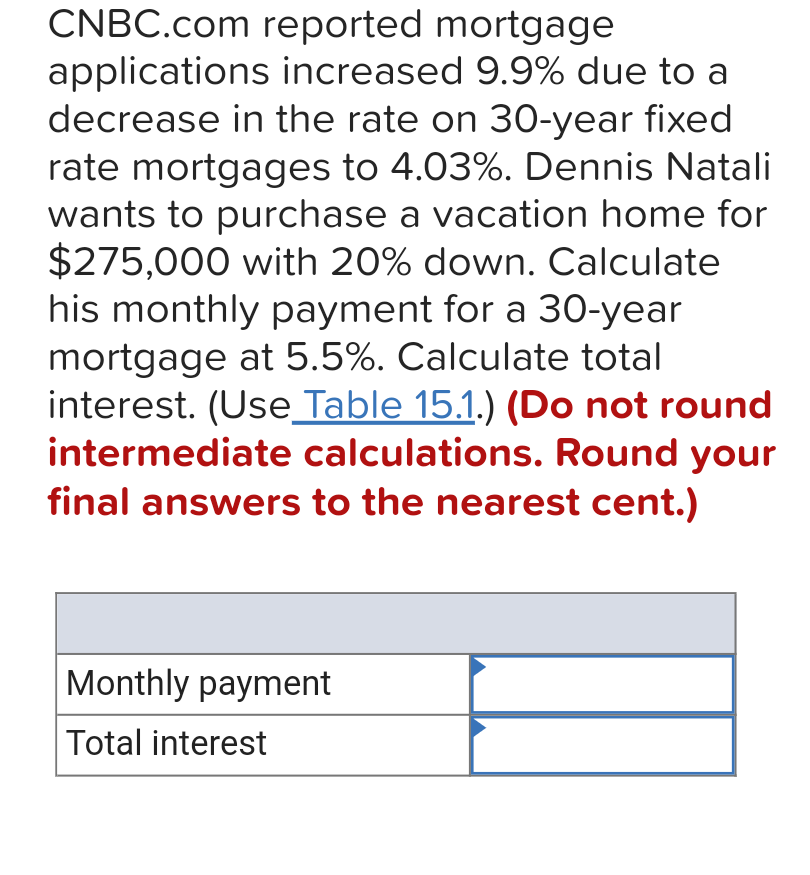

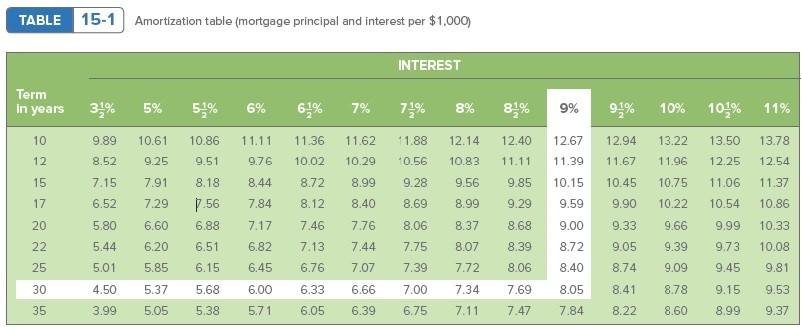

CNBC.com reported mortgage applications increased 9.9% due to a decrease in the rate on 30-year fixed rate mortgages to 4.03%. Dennis Natali wants to purchase a vacation home for $275,000 with 20% down. Calculate his monthly payment for a 30-year mortgage at 5.5%. Calculate total interest. (Use Table 15.1.) (Do not round intermediate calculations. Round your final answers to the nearest cent.) Monthly payment Total interest TABLE 15-1 Amortization table (mortgage principal and interest per $1,000) INTEREST Term in years 31% 5% 51% 6% 7% 72% 8% 81% 9% 10% 10,1% 11% 10 9.89 10.61 10.86 11.11 11.36 11.62 11.88 12.14 12.40 12.94 13.78 12.67 11.39 13.22 11.96 13.50 12.25 12 8.52 9.25 9.51 9.76 10.02 10.29 +0.56 10.83 11.11 11.67 12.54 15 7.15 7.91 8.18 8.44 8.72 8.99 9.28 9.56 9.85 10.15 10.45 10.75 11.06 11.37 17 6.52 7.29 7.84 8.12 8.40 8.69 8.99 9.29 9.59 9.90 10.22 10.54 10.86 20 6.60 1.56 6.88 6.51 7.46 7.76 9.00 5.80 5.44 9.99 7.17 6.82 8.06 7.75 8.37 8.07 8.68 8.39 9.33 9.05 9.66 9.39 22 6.20 7.13 7.44 8.72 9.73 10.33 10.08 9.81 25 5.01 5.85 6.15 6.45 6.76 7.07 7.39 7.72 8.06 8.40 8.74 9.09 9.45 30 5.37 5.68 6.00 6.33 7.00 7.34 7.69 8.41 8.78 9.15 9.53 4.50 3.99 6.66 6.39 8.05 7.84 35 5.05 5.38 5.71 6.05 6.75 7.11 7.47 8.22 8.60 8.99 9.37 Only the employer is responsible for paying A. Social security and Medicare taxes B. FUTA taxes C. Social Security, Medicare, and FUTA taxes D. Federal income taxes Which of the following statement is correct A. Income that has been earned but not yet received is called accrued income B. Unearned Subscription Income is a liability account C. Under the accrual basis of accounting, revenue is recognized and recorded in the period when it is earned regardless of when cash related to the transaction is received. D. All of these statements are correct. The adjusting entry for uncollectible accounts requires a debit to A. Allowance for Doubtful Accounts and a credit to Accounts Receivable B. Uncollectible Accounts Expense and a credit to Allowance for Doubtful Accounts C. Uncollectible Accounts Expense and a credit to Accounts Receivable D. Allowance for Doubtful Accounts and a credit to Uncollectible Accounts Expense A reversing entry should not be made for an adjusting entry to record A. The accrued salaries B. An accrued expense item that will involve future cash payment C. An accrued income item that will involve future cash receipts D. Depreciation Which of the following statements is not correct? A. The worksheet is the source of data for the general journal entries required to close the temporary accounts. B. In the closing process, the balance of the owner's drawing account is transferred to the deit side of the owner's capital account. C. In the closing process, the balance of the Purchases account is transferred to the Merchandise Inventory account. D. Closing the Revenue accounts is the first step in the closing process. The entry to record an additional cash investment by the owner is recorded in A. The cash payments journal B. The cash receipts journal C. The general journal D. The purchases journal Accrued expenses are A. Paid for in one period but not fully used until a later period B. Used in one period but not paid for until a later period C. Paid for, recorded, and used in one period D. Budgeted but not paid for or used during the period

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts