Question: Question 1 Reca Berhad is considering purchasing a new machine. The machine costs RM100,000 and requires installation costs of RM5,500 and modification cost of RM12,000.

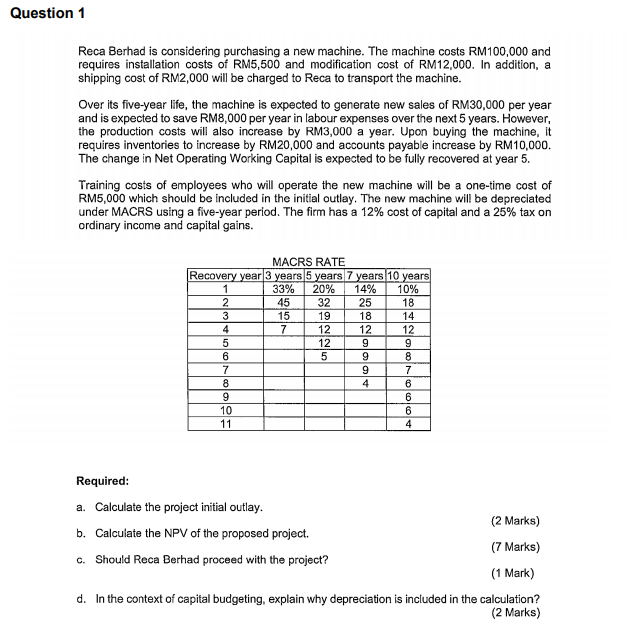

Question 1 Reca Berhad is considering purchasing a new machine. The machine costs RM100,000 and requires installation costs of RM5,500 and modification cost of RM12,000. In addition, a shipping cost of RM2,000 will be charged to Reca to transport the machine. Over its five-year life, the machine is expected to generate new sales of RM30,000 per year and is expected to save RM8,000 per year in labour expenses over the next 5 years. However, the production costs will also increase by RM3,000 a year. Upon buying the machine, it requires inventories to increase by RM20,000 and accounts payable increase by RM10,000 The change in Net Operating Working Capital is expected to be fully recovered at year 5. Training costs of employees who will operate the new machine will be a one-time cost of RM5,000 which should be included in the initial outlay. The new machine will be depreciated under MACRS using a five-year period. The firm has a 12% cost of capital and a 25% tax on ordinary income and capital gains. 5 MACRS RATE Recovery year 3 years 5 years 7 years 10 years 1 33% 20% 14% 10% 2 45 32 25 18 3 15 19 18 14 4 7 12 12 12 5 12 9 9 6 5 9 8 7 9 7 8 4 9 6 10 6 11 4 Required: a. Calculate the project initial outlay. (2 Marks) b. Calculate the NPV of the proposed project. (7 Marks) c. Should Reca Berhad proceed with the project? (1 Mark) d. In the context of capital budgeting, explain why depreciation is included in the calculation? (2 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts