Question: Question 1: Reference Price effects In this case, you will notice that past prices impact current demand. This is because consumers have certain reference prices

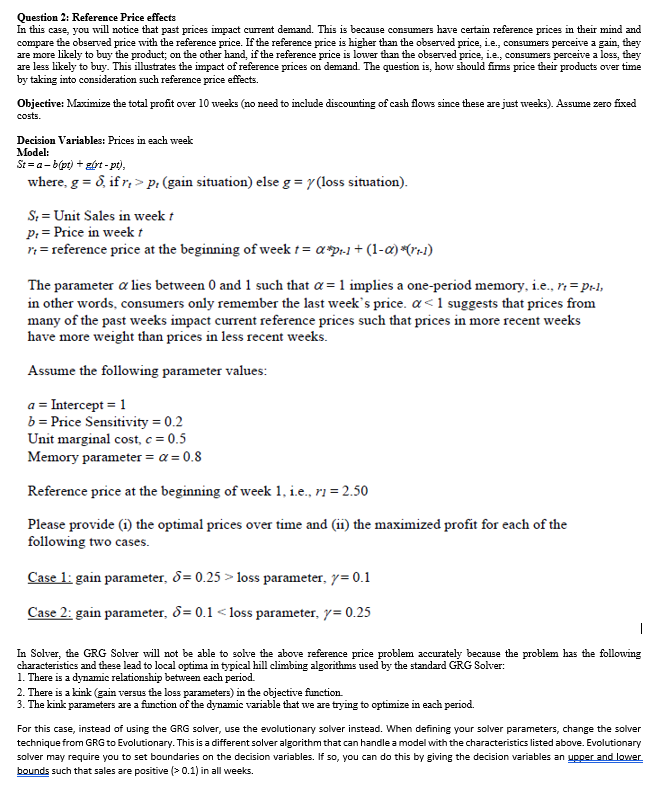

Question 1: Reference Price effects In this case, you will notice that past prices impact current demand. This is because consumers have certain reference prices in their mind and compare the observed price with the reference price. If the reference price is higher than the observed price, Le., consumers perceive a gain, they are more likely to buy the product; on the other hand, if the reference price is lower than the observed price, i.e., consumers perceive a loss, they are less likely to buy. This illustrates the impact of reference prices on demand The question is, how should firms price their products over time by taking into consideration such reference price effects. Objective: Maximize the total profit over 10 weeks (no need to include discounting of cash flows since these are just weeks). Assume zero fixed costs. Decision Variables: Prices in each week Model: St = a - b(pt) + 201 - pt), where, g = 6, if n, > pr (gain situation) else g = y (loss situation). S, = Unit Sales in week P: = Price in week t 1 = reference price at the beginning of week r = a*pu + (1-@) *(rul) The parameter loss parameter, y= 0.1 Case 2: gain parameter, 6= 0.1 0.1) in all weeks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts