Question: QUESTION 1 Replacement Project A Firm is considering the Replacement of the Existing Equipment. The Firm's Marginal Tax Rate is 40% - The Old Equipment

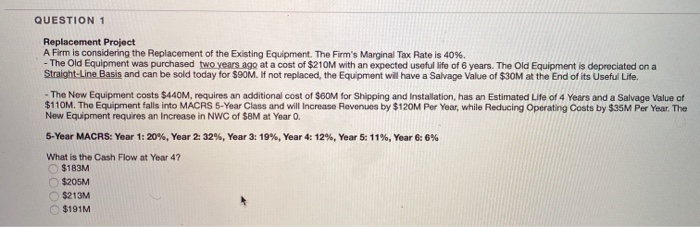

QUESTION 1 Replacement Project A Firm is considering the Replacement of the Existing Equipment. The Firm's Marginal Tax Rate is 40% - The Old Equipment was purchased two years ago at a cost of $210M with an expected useful life of 6 years. The Old Equipment is depreciated on a Straight-Line Basis and can be sold today for $90M. If not replaced, the Equipment will have a Salvage Value of $30M at the End of its Useful Life - The New Equipment costs $440M, requires an additional cost of $60M for Shipping and Installation, has an Estimated Life of 4 Years and a Salvage Value of $110M. The Equipment falls into MACRS 5-Year Class and will increase Revenue by $120M Por Year, while Reducing Operating costs by $35M Per Year. The New Equipment requires an increase in NWC of $8M at Year O. 5-Year MACRS: Year 1: 20%, Year 2: 32%, Year 3: 19%, Year 4: 12%, Year 5: 11%, Year 6: 6% What is the Cash Flow at Year 4? $183M $205M $213M $191M

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts