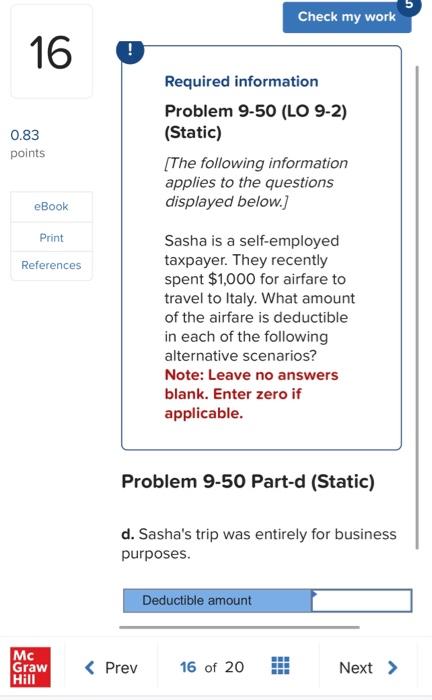

Question: Question 1: Required information Problem 9-50 (LO 9-2) (Static) [The following information applies to the questions displayed below.] Sasha is a self-employed taxpayer. They recently

![applies to the questions displayed below.] Sasha is a self-employed taxpayer. They](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ebdabc5a3b7_98866ebdabc38d0b.jpg)

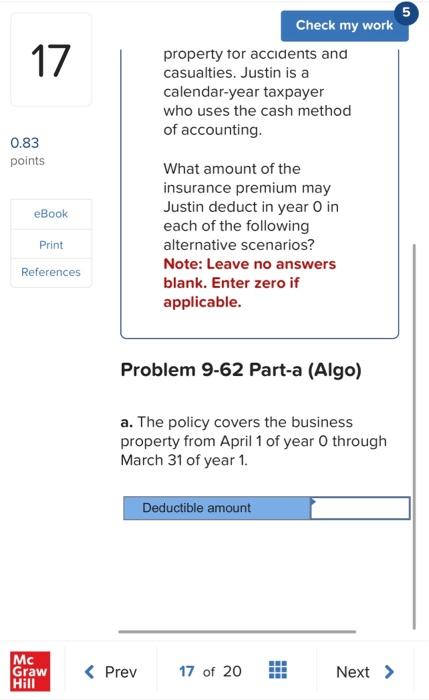

Required information Problem 9-50 (LO 9-2) (Static) [The following information applies to the questions displayed below.] Sasha is a self-employed taxpayer. They recently spent $1,000 for airfare to travel to Italy. What amount of the airfare is deductible in each of the following alternative scenarios? Note: Leave no answers blank. Enter zero if applicable. Problem 9-50 Part-d (Static) d. Sasha's trip was entirely for business purposes. Problem 9-62 (LO 9-4) (Algo) [The following information applies to the questions displayed below.] In January of year 0, Justin paid $9,000 for an insurance policy that covers his business property for accidents and casualties. Justin is a calendar-year taxpayer who uses the cash method of accounting. What amount of the insurance premium may Justin deduct in year 0 in each of the following alternative scenarios? Note: Leave no answers blank. Enter zero if applicable. Problem 9-62 Part-a (Algo) property tor accidents and casualties. Justin is a calendar-year taxpayer who uses the cash method of accounting. What amount of the insurance premium may Justin deduct in year 0 in each of the following alternative scenarios? Note: Leave no answers blank. Enter zero if applicable. Problem 9-62 Part-a (Algo) a. The policy covers the business property from April 1 of year 0 through March 31 of year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts