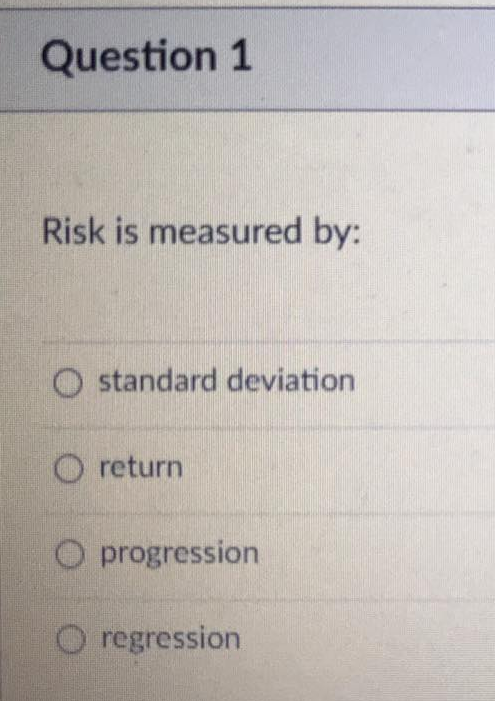

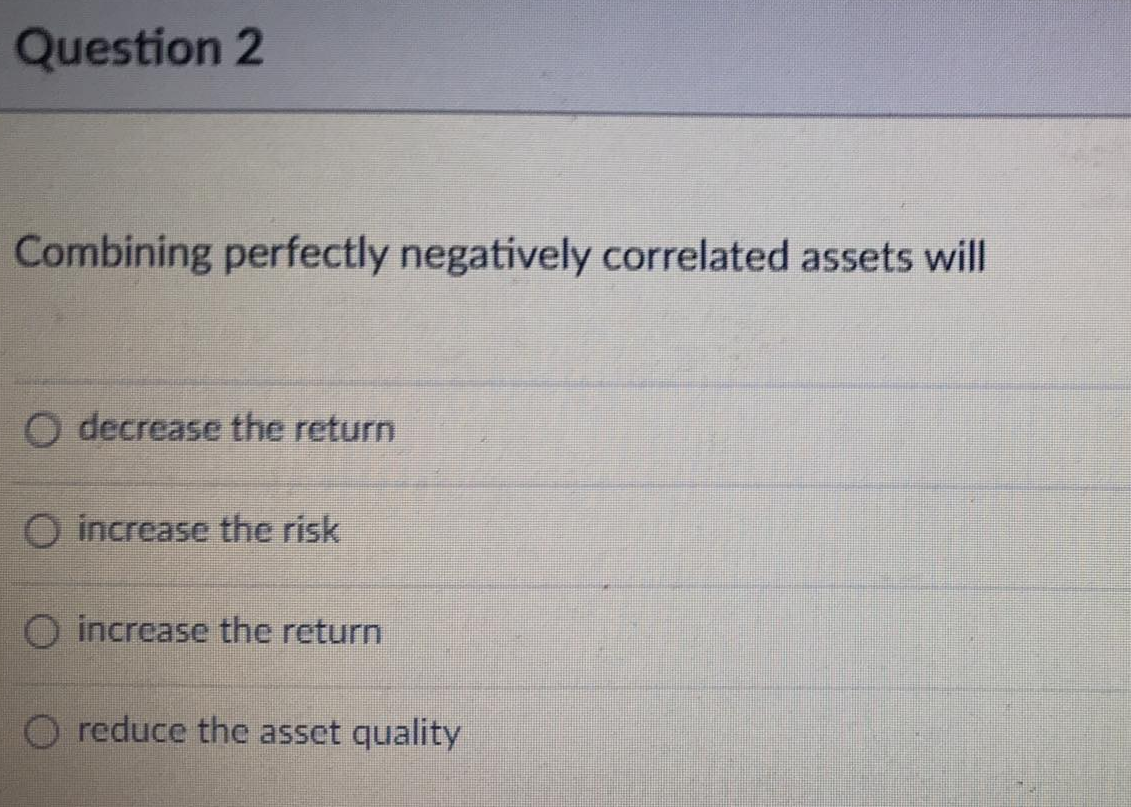

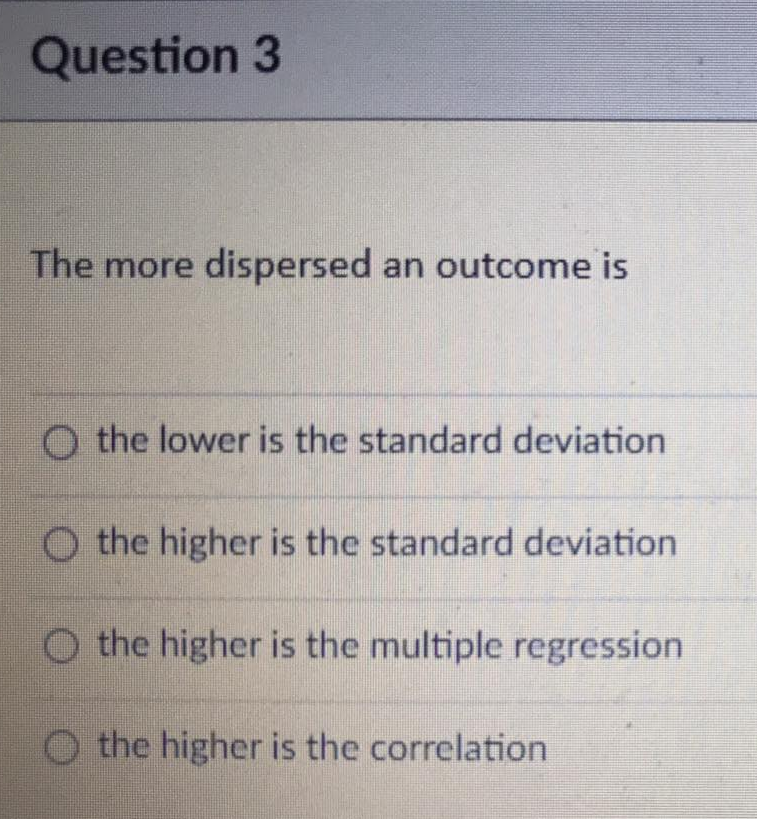

Question: Question 1 Risk is measured by: O standard deviation return progression OregressionQuestion 2 Combining perfectly negatively correlated assets will O decrease the return O increase

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts