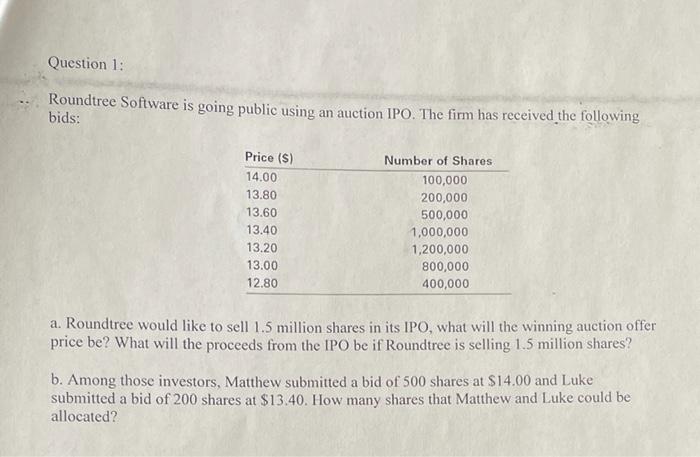

Question: Question 1: Roundtree Software is going public using an auction IPO. The firm has received the following bids: Price ($) 14.00 13.80 13.60 13.40 13.20

Question 1: Roundtree Software is going public using an auction IPO. The firm has received the following bids: Price ($) 14.00 13.80 13.60 13.40 13.20 13.00 12.80 Number of Shares 100,000 200,000 500,000 1,000,000 1,200,000 800,000 400,000 a. Roundtree would like to sell 1.5 million shares in its IPO, what will the winning auction offer price be? What will the proceeds from the IPO be if Roundtree is selling 1.5 million shares? b. Among those investors, Matthew submitted a bid of 500 shares at $14.00 and Luke submitted a bid of 200 shares at $13.40. How many shares that Matthew and Luke could be allocated

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts