Question: Question 1 Section A - ALL 15 questions are compulsory and MUST be attempted Please use Candidate Answer Booklet to record your answers to each

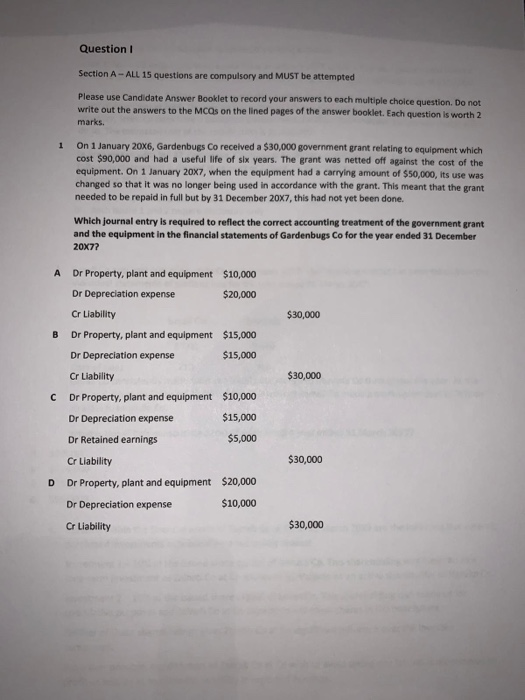

Question 1 Section A - ALL 15 questions are compulsory and MUST be attempted Please use Candidate Answer Booklet to record your answers to each multiple choice question. Do not write out the answers to the MCs on the lined pages of the answer booklet. Each question is worth 2 marks. On 1 January 20X6, Gardenbugs Co received a $30,000 government grant relating to equipment which cost $90,000 and had a useful life of six years. The grant was netted off against the cost of the equipment. On 1 January 20X7, when the equipment had a carrying amount of $50,000, its use was changed so that it was no longer being used in accordance with the grant. This meant that the grant needed to be repaid in full but by 31 December 20X7, this had not yet been done. Which journal entry is required to reflect the correct accounting treatment of the government grant and the equipment in the financial statements of Gardenbugs Co for the year ended 31 December 20x7? $30,000 B Dr Property, plant and equipment $10,000 Dr Depreciation expense $20,000 Cr Liability Dr Property, plant and equipment $15,000 Dr Depreciation expense $15,000 Cr Liability Dr Property, plant and equipment $10,000 Dr Depreciation expense $15,000 Dr Retained earnings $5,000 $30,000 C $30,000 D Cr Liability Dr Property, plant and equipment $20,000 Dr Depreciation expense $10,000 Cr Liability $30,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts