Question: Question 1 See below for my answer; I am unsure if it's correct or not. Please do it in a spreadsheet if possible. I got

Question 1 See below for my answer; I am unsure if it's correct or not. Please do it in a spreadsheet if possible.

I got this is this correct?

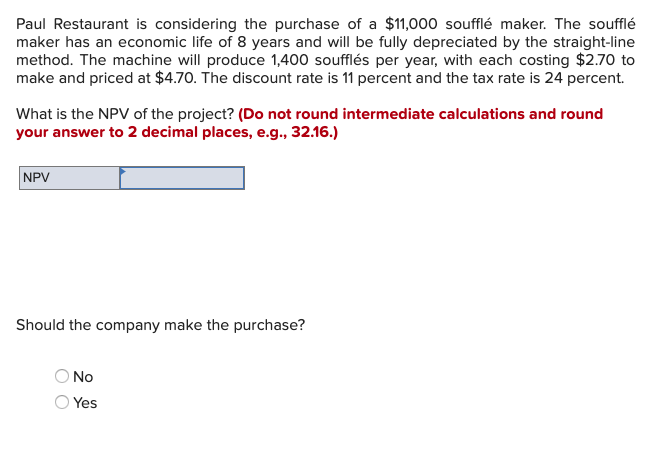

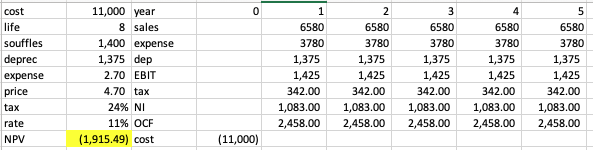

Paul Restaurant is considering the purchase of a $11,000 souffl maker. The souffl maker has an economic life of 8 years and will be fully depreciated by the straight-line method. The machine will produce 1,400 souffls per year, with each costing $2.70 to make and priced at $4.70. The discount rate is 11 percent and the tax rate is 24 percent What is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) NPV Should the company make the purchase? No Yes 11,000 year cost 0 1 2 3 6580 life 8 sales 6580 6580 6580 6580 1,400 expense souffles 3780 3780 3780 3780 3780 1,375 1,425 deprec 1,375 dep 1,375 1,375 1,375 1,375 1,425 2.70 EBIT 1,425 1,425 342.00 1,425 342.00 expense 4.70 tax price 342.00 342.00 342.00 1,083.00 2,458.00 1,083.00 1,083.00 1,083.00 24% NI 1,083.00 tax 11% OCF 2,458.00 2,458.00 2,458.00 2,458.00 rate (1,915.49) cost (11,000) NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts