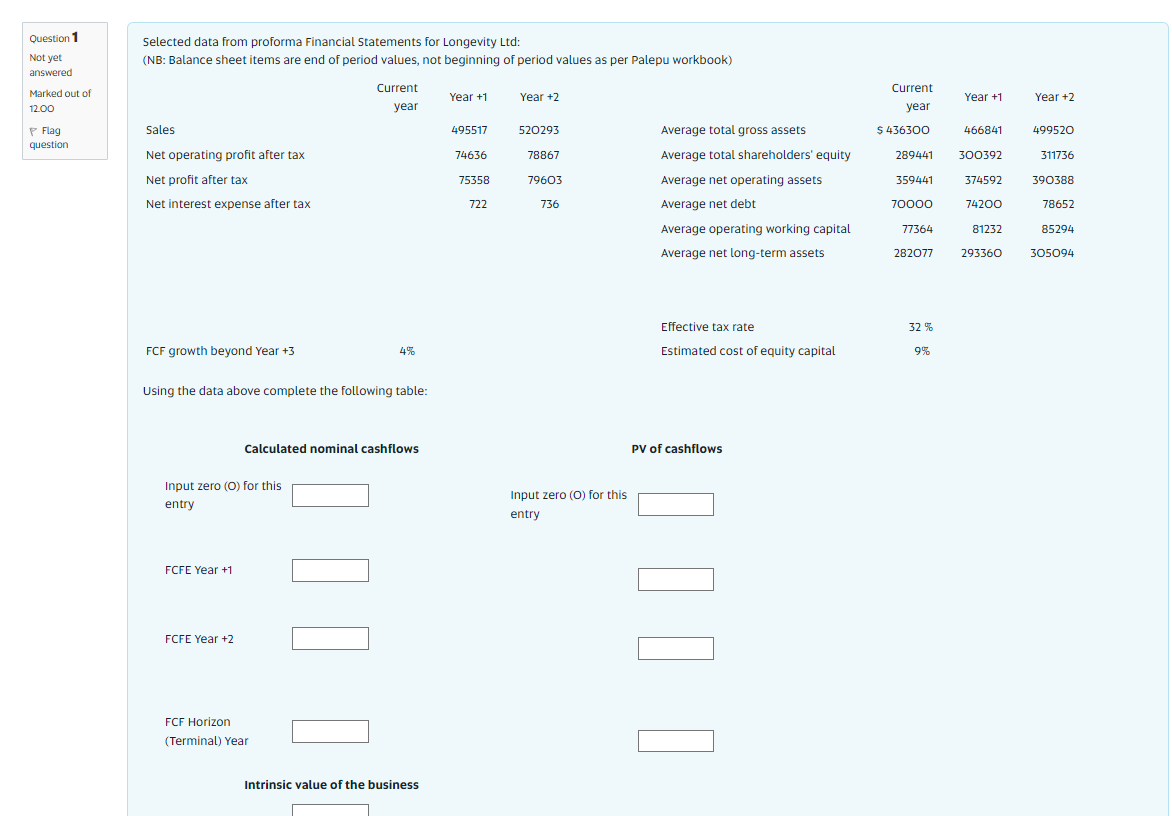

Question: Question 1 Selected data from proforma Financial Statements for Longevity Ltd: (NB: Balance sheet items are end of period values, not beginning of period values

Question 1 Selected data from proforma Financial Statements for Longevity Ltd: (NB: Balance sheet items are end of period values, not beginning of period values as per Palepu workbook) Not yet answered Marked out of 12.00 P Flag question Current year Year +1 Year +2 Current year Year +1 Year +2 Sales 495517 520293 $ 436300 466841 499520 Net operating profit after tax 74636 78867 Average total gross assets Average total shareholders' equity Average net operating assets 289441 300392 311736 Net profit after tax 75358 79603 359441 374592 390388 Net interest expense after tax 722 736 Average net debt 70000 74200 78652 77364 81232 85294 Average operating working capital Average net long-term assets 282077 293360 305094 Effective tax rate 32% FCF growth beyond Year +3 4% Estimated cost of equity capital 9% Using the data above complete the following table: Calculated nominal cashflows PV of cashflows Input zero (O) for this entry Input zero (O) for this entry FCFE Year +1 FCFE Year +2 II FCF Horizon (Terminal) Year Intrinsic value of the business Question 1 Selected data from proforma Financial Statements for Longevity Ltd: (NB: Balance sheet items are end of period values, not beginning of period values as per Palepu workbook) Not yet answered Marked out of 12.00 P Flag question Current year Year +1 Year +2 Current year Year +1 Year +2 Sales 495517 520293 $ 436300 466841 499520 Net operating profit after tax 74636 78867 Average total gross assets Average total shareholders' equity Average net operating assets 289441 300392 311736 Net profit after tax 75358 79603 359441 374592 390388 Net interest expense after tax 722 736 Average net debt 70000 74200 78652 77364 81232 85294 Average operating working capital Average net long-term assets 282077 293360 305094 Effective tax rate 32% FCF growth beyond Year +3 4% Estimated cost of equity capital 9% Using the data above complete the following table: Calculated nominal cashflows PV of cashflows Input zero (O) for this entry Input zero (O) for this entry FCFE Year +1 FCFE Year +2 II FCF Horizon (Terminal) Year Intrinsic value of the business

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts