Question: Question 1 (Similar to in-class example 4 on slide 46 from week 8) For your convenience, below is the summary on how to calculate unlevered

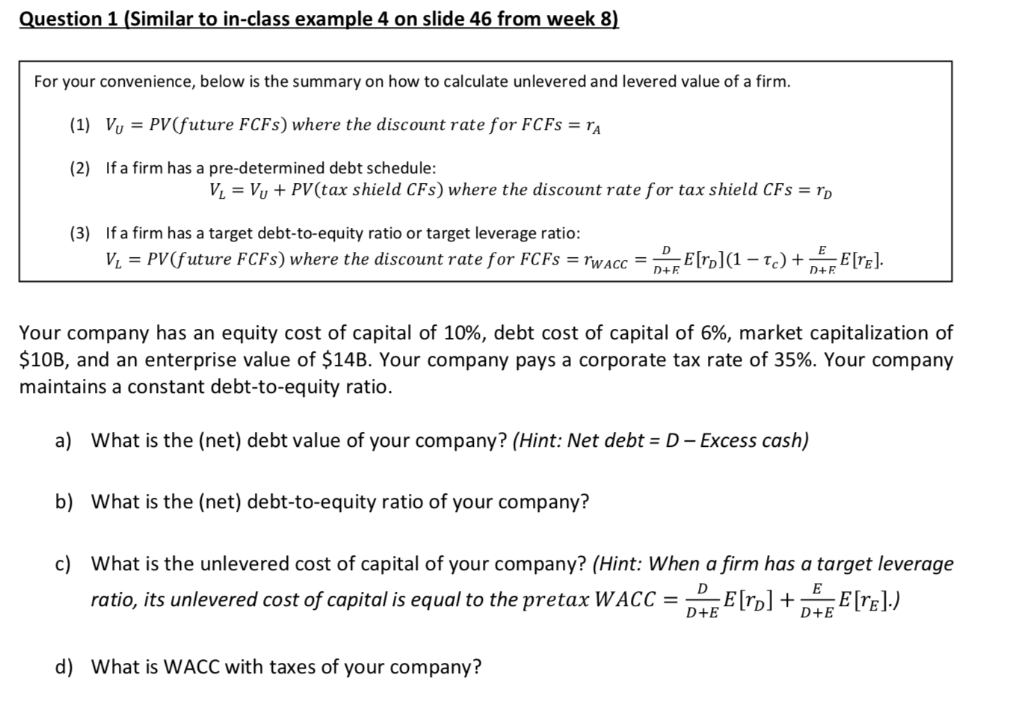

Question 1 (Similar to in-class example 4 on slide 46 from week 8) For your convenience, below is the summary on how to calculate unlevered and levered value of a firm. (1) Vu = PV(future FCFs) where the discount rate for FCFsrA (2) If a firm has a pre-determined debt schedule: Vi = Vu + PV(tax shield CFs) where the discount rate for tax shield CFs = rD If a firm has a target debt-to-equity ratio or target leverage ratio: Vi = PV(future FCFs) where the discount rate for FCFs = rwAcc = nDRE[ral(1-tJ + (3) E[rE]. D+R D+F Your company has an equity cost of capital of 10%, debt cost of capital of 6%, market capitalization of $10B, and an enterprise value of $149 Your company pays a corporate tax rate of 35%. Your company maintains a constant debt-to-equity ratio. a) What is the (net) debt value of your company? (Hint: Net debt D- Excess cash) b) What is the (net) debt-to-equity ratio of your company? c) What is the unlevered cost of capital of your company? (Hint: When a firm has a target leverage ratio, its unlevered cost of capital is equal to the pretax WACC =-EVo] + -E[rE].) D+E D+E d) What is WACC with taxes of your company

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts