Question: Question 1: Solve manually, handwritten. (25 points) A company is planning to buy a machine. There are two alternatives. The initial costs, salvage values, useful

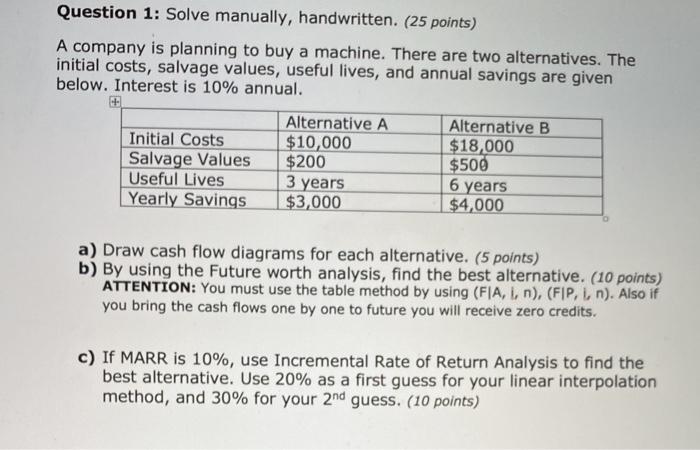

Question 1: Solve manually, handwritten. (25 points) A company is planning to buy a machine. There are two alternatives. The initial costs, salvage values, useful lives, and annual savings are given below. Interest is 10% annual. + Alternative A Alternative B Initial Costs $10,000 $18,000 Salvage Values $200 $500 Useful Lives 3 years 6 years Yearly Savings $3,000 $4,000 a) Draw cash flow diagrams for each alternative. (5 points) b) By using the Future worth analysis, find the best alternative. (10 points) ATTENTION: You must use the table method by using (FIA,1,n), (FIP, i, n). Also if you bring the cash flows one by one to future you will receive zero credits. c) If MARR is 10%, use Incremental Rate of Return Analysis to find the best alternative. Use 20% as a first guess for your linear interpolation method, and 30% for your 2nd guess. (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts