Question: Question 1 (Sortino ratio. (12 marks)). Consider a portfolio selection problem where R is the target return rate on the expected return of the portfolio.

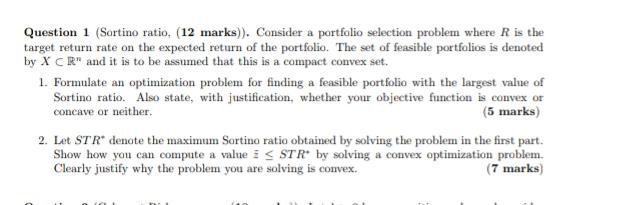

Question 1 (Sortino ratio. (12 marks)). Consider a portfolio selection problem where R is the target return rate on the expected return of the portfolio. The set of feasible portfolios is denoted by X CR" and it is to be assumed that this is a compact convex set. 1. Formulate an optimization problem for finding a feasible portfolio with the largest value of Sortino ratio. Also state, with justification, whether your objective function is convex or concave or neither (5 marks) 2. Let ST R* denote the maximum Sortino ratio obtained by solving the problem in the first part. Show how you can compute a value S STR* by solving a convex optimization problem. Clearly justify why the problem you are solving is convex. (7 marks) Question 1 (Sortino ratio. (12 marks)). Consider a portfolio selection problem where R is the target return rate on the expected return of the portfolio. The set of feasible portfolios is denoted by X CR" and it is to be assumed that this is a compact convex set. 1. Formulate an optimization problem for finding a feasible portfolio with the largest value of Sortino ratio. Also state, with justification, whether your objective function is convex or concave or neither (5 marks) 2. Let ST R* denote the maximum Sortino ratio obtained by solving the problem in the first part. Show how you can compute a value S STR* by solving a convex optimization problem. Clearly justify why the problem you are solving is convex. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts