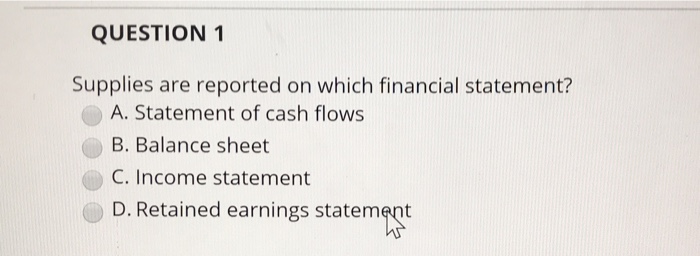

Question: QUESTION 1 Supplies are reported on which financial statement? A. Statement of cash flows B. Balance sheet C. Income statement D. Retained earnings statement If

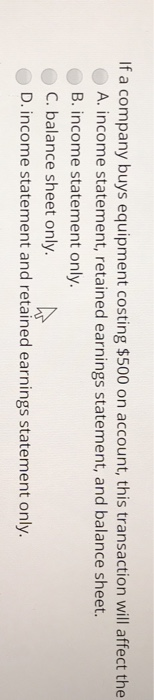

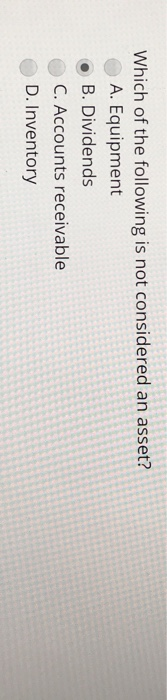

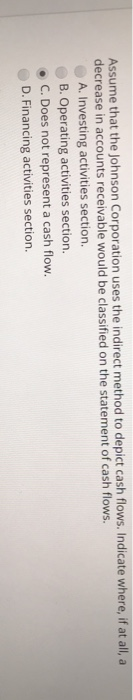

QUESTION 1 Supplies are reported on which financial statement? A. Statement of cash flows B. Balance sheet C. Income statement D. Retained earnings statement If a company buys equipment costing $500 on account, this transaction will affect the A. income statement, retained earnings statement, and balance sheet. B. income statement only. C. balance sheet only. D. income statement and retained earnings statement only. Which of the following is not considered an asset? A. Equipment B. Dividends C. Accounts receivable D. Inventory Assume that the Johnson Corporation uses the indirect method to depict cash flows. Indicate where, if at all, a decrease in accounts receivable would be classified on the statement of cash flows. A. Investing activities section. B. Operating activities section. C. Does not represent a cash flow. D. Financing activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts