Question: Question 1 : Susan is considering having her bank process an SBA Microloan loan for her business and she is requesting a $ 6 0

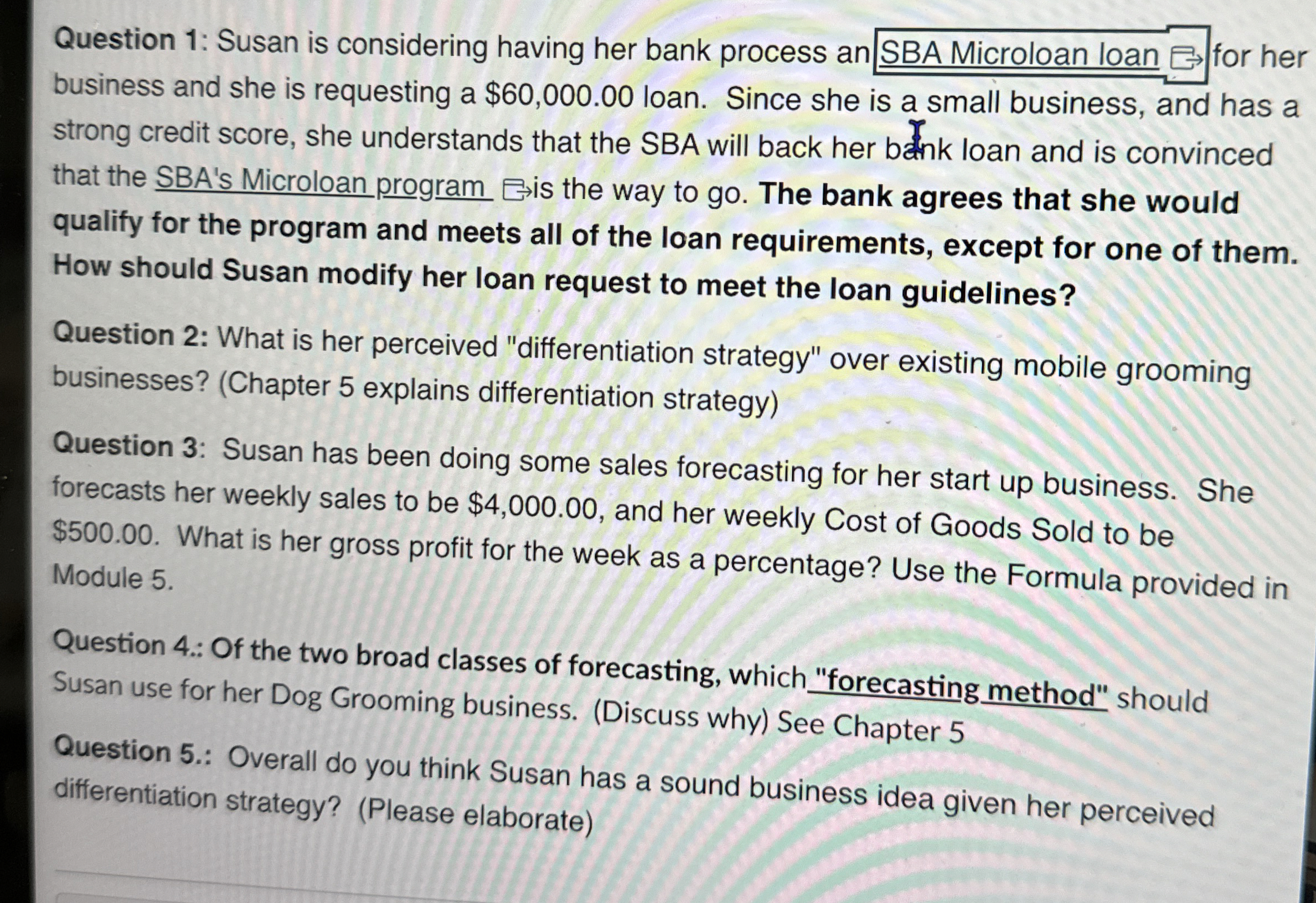

Question : Susan is considering having her bank process an SBA Microloan loan for her

business and she is requesting a $ loan. Since she is a small business, and has a

strong credit score, she understands that the SBA will back her barnk loan and is convinced

that the SBA's Microloan program eis the way to go The bank agrees that she would

qualify for the program and meets all of the loan requirements, except for one of them.

How should Susan modify her loan request to meet the loan guidelines?

Question : What is her perceived "differentiation strategy" over existing mobile grooming

businesses? Chapter explains differentiation strategy

Question : Susan has been doing some sales forecasting for her start up business. She

forecasts her weekly sales to be $ and her weekly Cost of Goods Sold to be

$ What is her gross profit for the week as a percentage? Use the Formula provided in

Module

Question : Of the two broad classes of forecasting, which "forecasting method" should

Susan use for her Dog Grooming business. Discuss why See Chapter

Question : Overall do you think Susan has a sound business idea given her perceived

differentiation strategy? Please elaborate

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock