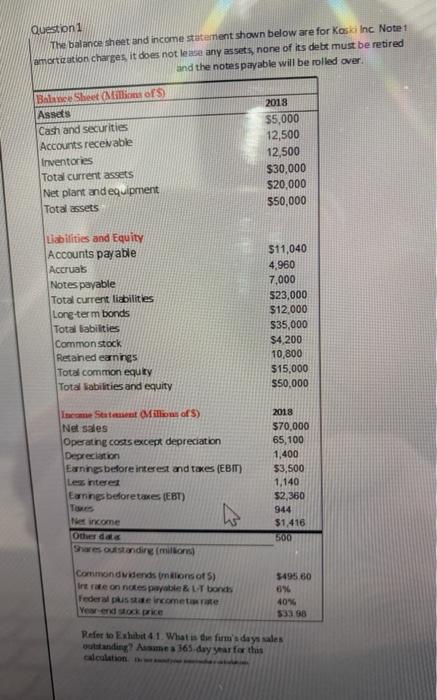

Question: Question 1 The balance sheet and income statement shown below are for Kosi Inc Note 1 amortization charges, it does not lease any assets, none

Question 1 The balance sheet and income statement shown below are for Kosi Inc Note 1 amortization charges, it does not lease any assets, none of its debt must be retired and the notespayable will be rolled over BIS ( Mor) Assets 2018 Cash and securities $5,000 Accounts recevable 12,500 Inventories 12,500 Total current assets $30,000 Net plant and equipment $20,000 Total assets 550,000 Liabilities and Equity Accounts payable Accruals Notes payable Total current liabilities Long-term bonds Total abilities Common stock Retained earnings Total common equky Total abilities and equity $11,040 4,960 7,000 $23,000 $12.000 S35,000 $4,200 10,800 $15,000 $50,000 Income Statement Millions of S) Net sales Operating costs except depreciation Depreciation Earnings before interest and taxes (EBIT) Les interest Earnings before taxes (EBT) 2018 $70,000 65,100 1,400 $3,500 1,140 $2,360 944 $1,416 500 hos Net income Other das Shares outstanding millions) Commondvidends lions of 5) Inteon notes payable & LT bonds Federal pus state cometrate $495 60 8% 40% 533 88 Refer to Exhibit 41. What is the firm's days sales unding? Amea 365 day year for this calculation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts