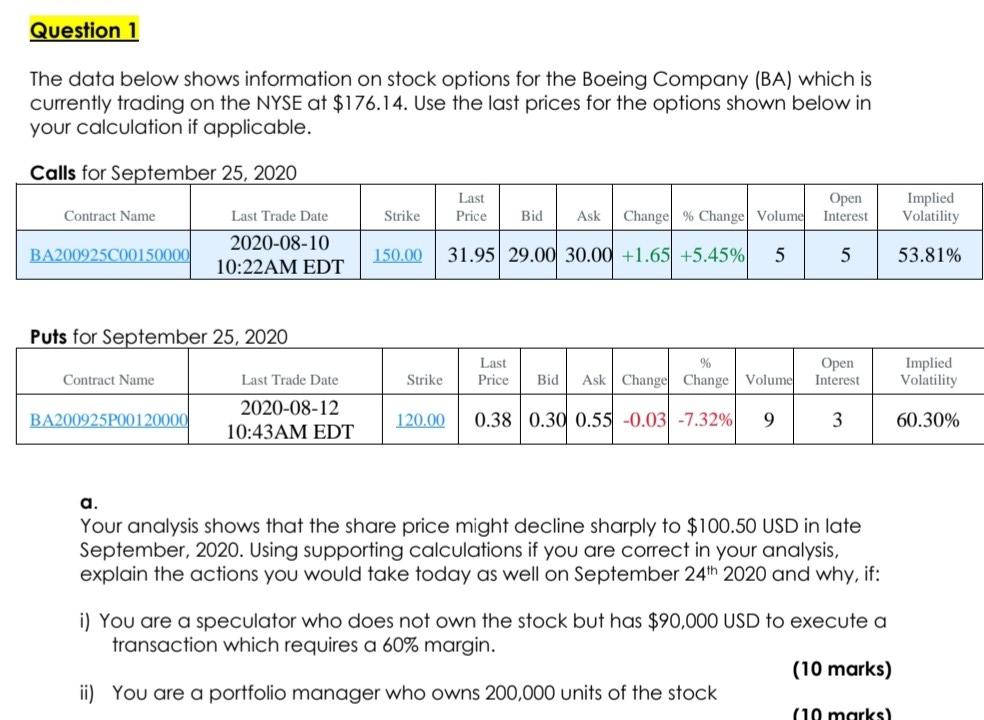

Question: Question 1 The data below shows information on stock options for the Boeing Company (BA) which is currently trading on the NYSE at $176.14. Use

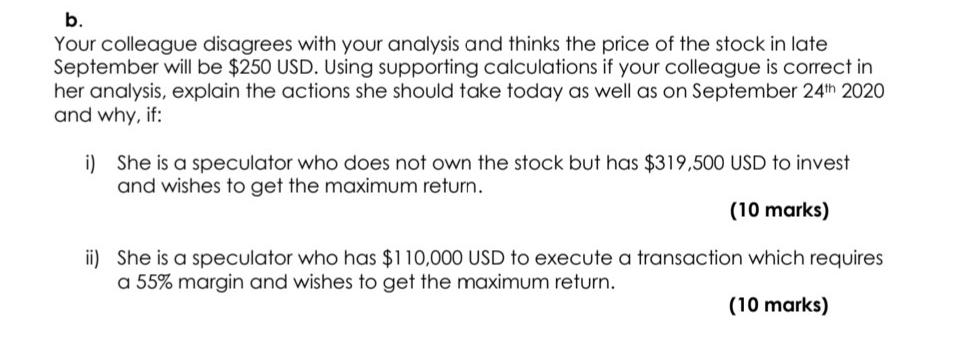

Question 1 The data below shows information on stock options for the Boeing Company (BA) which is currently trading on the NYSE at $176.14. Use the last prices for the options shown below in your calculation if applicable. Calls for September 25, 2020 Contract Name Last Trade Date Strike Last Price Open Interest Implied Volatility Bid Change % Change Volume Ask BA200925C00150000 2020-08-10 10:22AM EDT 150.00 31.95 29.00 30.00 +1.65 +5.45% 5 5 53.81% Puts for September 25, 2020 Last Price Strike Contract Name Bid % Ask Change Change Volume Open Interest Implied Volatility Last Trade Date 2020-08-12 10:43AM EDT BA200925P00120000 120.00 0.38 0.30 0.55 -0.03 -7.32% 9 3 60.30% a. Your analysis shows that the share price might decline sharply to $100.50 USD in late September, 2020. Using supporting calculations if you are correct in your analysis, explain the actions you would take today as well on September 24th 2020 and why, if: i) You are a speculator who does not own the stock but has $90,000 USD to execute a transaction which requires a 60% margin. (10 marks) ii) You are a portfolio manager who owns 200,000 units of the stock (10 marks) b. Your colleague disagrees with your analysis and thinks the price of the stock in late September will be $250 USD. Using supporting calculations if your colleague is correct in her analysis, explain the actions she should take today as well as on September 24th 2020 and why, if: i) She is a speculator who does not own the stock but has $319,500 USD to invest and wishes to get the maximum return. (10 marks) ii) She is a speculator who has $110,000 USD to execute a transaction which requires a 55% margin and wishes to get the maximum return. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts