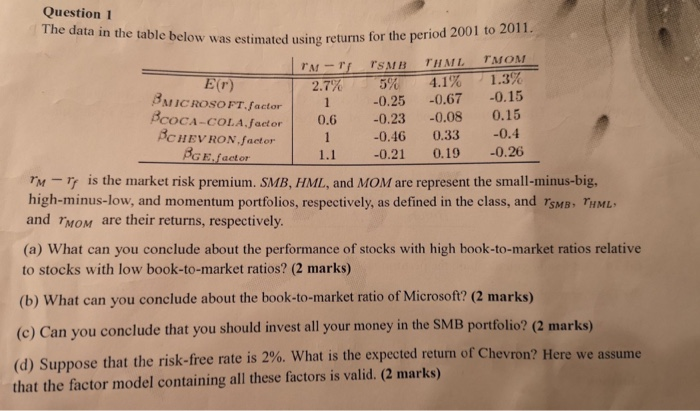

Question: Question 1 The data in the table below w was estimated using returns for the period 2001 to 2011 retums to E(r) 8MICROSOFT factor -0.25

Question 1 The data in the table below w was estimated using returns for the period 2001 to 2011 retums to E(r) 8MICROSOFT factor -0.25 -0.67 -0.15 CA-COLA.factor 0.6 -0.23 -0.08 0.15 1-0.46 0.33 -0.4 1.1 -0.21 0.19 -0.26 oci BCHEVRON factor BGE facto , 'r is the market risk premium, SMB, HML, and MOM are represent the small-minus-big, high-minus-low, and momentum portfolios, respectively, as defined in the class, and rSMB, 1ML, and TMOM are their returns, respectively (a) What can you conclude about the performance of stocks with high book-to-market ratios relative to stocks with low book-to-market ratios? (2 marks) (b) What can you conclude about the book-to-market ratio of Microsoft? (2 marks) (C) Can you conclude that you should invest all your money in the SMB portfolio? (2 marks) (d) Suppos e that the risk-free rate is 2%. What is the expected return of Chevron? Here we assume that the factor model containing all these factors is valid. (2 marks) Question 1 The data in the table below w was estimated using returns for the period 2001 to 2011 retums to E(r) 8MICROSOFT factor -0.25 -0.67 -0.15 CA-COLA.factor 0.6 -0.23 -0.08 0.15 1-0.46 0.33 -0.4 1.1 -0.21 0.19 -0.26 oci BCHEVRON factor BGE facto , 'r is the market risk premium, SMB, HML, and MOM are represent the small-minus-big, high-minus-low, and momentum portfolios, respectively, as defined in the class, and rSMB, 1ML, and TMOM are their returns, respectively (a) What can you conclude about the performance of stocks with high book-to-market ratios relative to stocks with low book-to-market ratios? (2 marks) (b) What can you conclude about the book-to-market ratio of Microsoft? (2 marks) (C) Can you conclude that you should invest all your money in the SMB portfolio? (2 marks) (d) Suppos e that the risk-free rate is 2%. What is the expected return of Chevron? Here we assume that the factor model containing all these factors is valid. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts