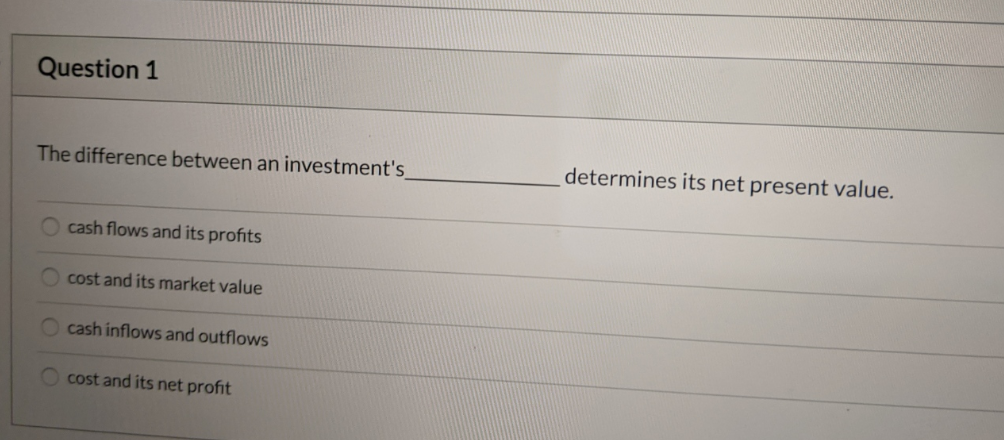

Question: Question 1 The difference between an investment's determines its net present value. cash flows and its profits cost and its market value cash inflows and

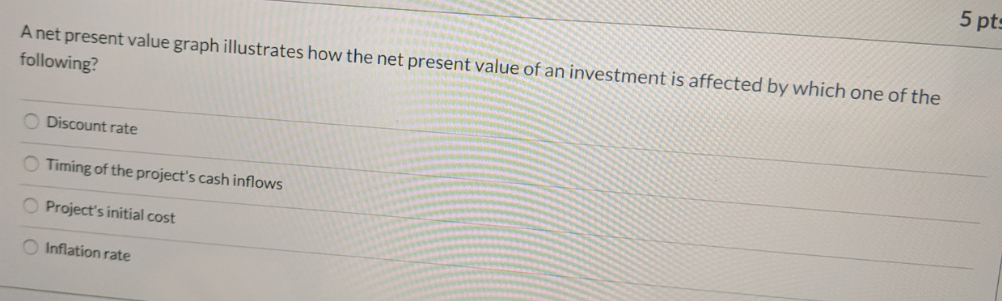

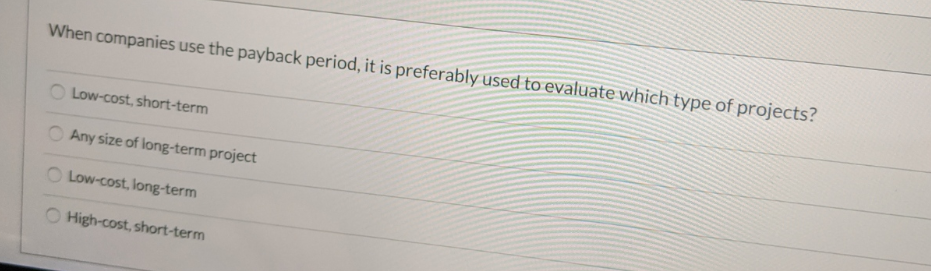

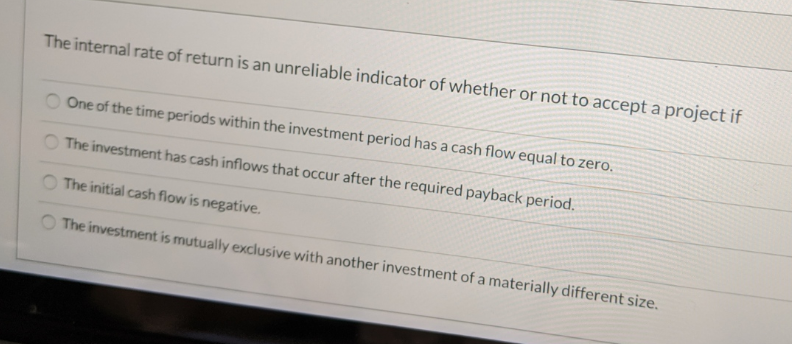

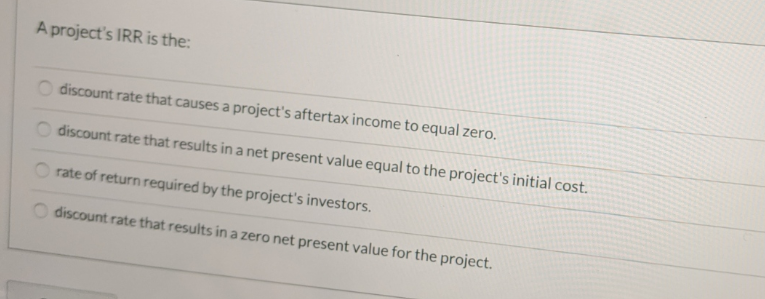

Question 1 The difference between an investment's determines its net present value. cash flows and its profits cost and its market value cash inflows and outflows cost and its net profit A net present value graph illustrates how the net present value of an investment is affected by which one of the following? Discount rate Timing of the project's cash inflows Project's initial cost Inflation rate When companies use the payback period, it is preferably used to evaluate which type of projects? Low-cost, short-term Any size of long-term project Low-cost, long-term High-cost, short-term The internal rate of return is an unreliable indicator of whether or not to accept a project if One of the time periods within the investment period has a cash flow equal to zero. The investment has cash inflows that occur after the required payback period. The initial cash flow is negative. The investment is mutually exclusive with another investment of a materially different size. A project's IRR is the: discount rate that causes a project's aftertax income to equal zero. Cdiscount rate that results in a net present value equal to the project's initial cost. rate of return required by the project's investors. discount rate that results in a zero net present value for the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts