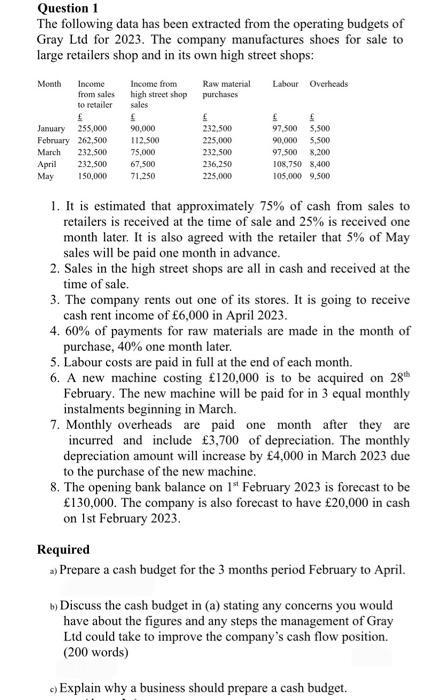

Question: Question 1 The following data has been extracted from the operating budgets of Gray Ltd for 2023. The company manufactures shoes for sale to

Question 1 The following data has been extracted from the operating budgets of Gray Ltd for 2023. The company manufactures shoes for sale to large retailers shop and in its own high street shops: Month Income from sales to retailer Income from high street shop sales January 255,000 90,000 February 262,500 112,500 75,000 March 232,500 April 232,500 67,500 May 150,000 71,250 Raw material Labour Overheads purchases 232,500 225,000 232,500 236,250 225,000 97,500 5,500 90,000 5,500 97,500 8,200 108,750 8,400 105,000 9.500 1. It is estimated that approximately 75% of cash from sales to retailers is received at the time of sale and 25% is received one month later. It is also agreed with the retailer that 5% of May sales will be paid one month in advance. 2. Sales in the high street shops are all in cash and received at the time of sale. 3. The company rents out one of its stores. It is going to receive cash rent income of 6,000 in April 2023. 4. 60% of payments for raw materials are made in the month of purchase, 40% one month later. 5. Labour costs are paid in full at the end of each month. 6. A new machine costing 120,000 is to be acquired on 28th February. The new machine will be paid for in 3 equal monthly instalments beginning in March. 7. Monthly overheads are paid one month after they are incurred and include 3,700 of depreciation. The monthly depreciation amount will increase by 4,000 in March 2023 due to the purchase of the new machine. 8. The opening bank balance on 1s February 2023 is forecast to be 130,000. The company is also forecast to have 20,000 in cash on 1st February 2023. Required a) Prepare a cash budget for the 3 months period February to April. b) Discuss the cash budget in (a) stating any concerns you would have about the figures and any steps the management of Gray Ltd could take to improve the company's cash flow position. (200 words) c) Explain why a business should prepare a cash budget.

Step by Step Solution

3.58 Rating (158 Votes )

There are 3 Steps involved in it

Gray Sales budget January February March April May Note Income from high street sales 11250000 7500000 6750000 A Income from sales to retailer 2550000... View full answer

Get step-by-step solutions from verified subject matter experts