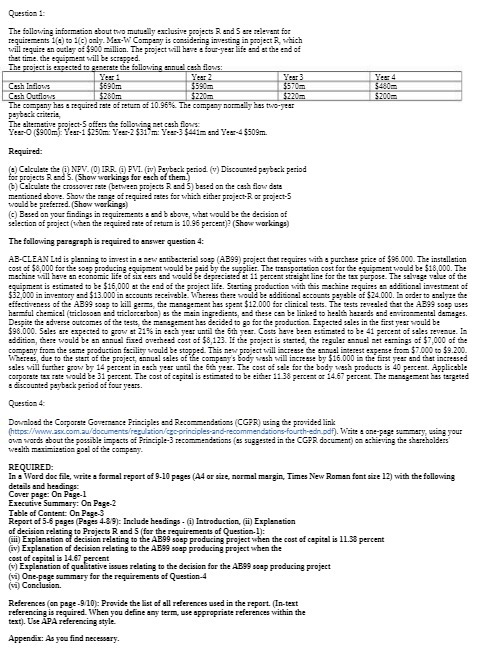

Question: Question 1: The following information about two mutually exclusive projects R. end S are relevant for requirements 1(8) to 1(c) only. Mox-W Company is considering

Question 1: The following information about two mutually exclusive projects R. end S are relevant for requirements 1(8) to 1(c) only. Mox-W Company is considering investing in project R, which will require on ourley of $900 million. The project will have a four-year life and at the end of that time. the equipment will be scrapped. The project is expected to generate the following ennuel cash flows: Yard Your 2 Your 3 Cash Inflows $690m $590m $570m $480 Cash Outflows $260m $220mm $200 The company has a required rate of return of 10.9636. The company normally has two-jeer payback criteria The altemotive project-5 offers the following net cash flows: Year-0 ($900m): Year-1 $250m: Yew-2 $317m: Year-3 $441m and Year-4 $509m. Required: (@ Calculate the (i) NOV. (0) IRR. () BVI. (iv) Boybeck period (v) Discounted payback period for projects Rend 5. (Show workings for each of them.) () Calculate the crossover rate (between projects R. and 5) based on the cash flow data mentioned above. Show the range of required mates for which either project-R. on project-5 would be preferred. (Show workings) (c) Based on your findings in requirements : and b above, what would be the decision of selection of project (when the required rate of return is 10.96 percent)? (Show workings) The following paragraph is required to answer question 4: AB-CLEAN Lid is planning to invest in a new antibacterial soup (AB99) project that requires with a purchase price of $96 000. The installation cost of $8,000 for the soup producing equipment would be paid by the supplier. The transportation cost for the equipment would be $18,000. The machine will have an economic life of six ears and would be depreciated at 11 percent straight line for the fox purpose. The solvege value of the equipment is estimated to be $16,000 at the end of the project life. Starting production with this machine requires an additional investment of $32,000 in inventory and $13.000 in accounts receivable. Whereas there would be additional accounts payable of $24.000. In order to analyze the effectiveness of the AB99 soup to kill germs, the management has spent $12.000 for clinical tests. The tests revealed that the AB99 comp uses harmful chemical (triclosoon and triclorcarbon) as the main ingredients, and these can be linked to health hazards and environmental damages. Despite the edverse outcomes of the tests, the management has decided to go for the production. Expected sales in the first year would be $96.000. Sales are expected to grow at 21%% in each year until the 6th year. Costs have been estimated to be 41 percent of sales revenue. In addition, there would be an annual fixed overhead cost of $8,123. If the project is started, the regular annual net commings of $7,000 of the company from the some production facility would be stopped. This new project will increase the annual interest expense from $7.000 to $9.200. Whereus, due to the store of the project, annual sales of the company's body wash will increase by $16.000 in the first year and that increased sales will further grow by 14 percent in each year until the 6ch year. The cost of sells for the body wash products is 40 percent. Applicable comporate tax rate would be 31 percent. The cost of capital is estimated to be either 11 38 percent or 14.67 percent. The management has targeted : discounted peybeck period of four years. Question 4: Download the Comporate Governance Principles and Recommendations (CGPR) using the provided link (http:://www.ask. com.aw/documents/regulation/cgc-principles-and-recommendations-fourth-edh.pdf). Write : one-page summary, using your own words about the possible impacts of Principle-3 recommendations (as suggested in the OGPR document) on achieving the shareholders wealth maximization goel of the company. REQUIRED: In a Word doc file, write a formal report of 9-10 pages (A4 or size, normal margin, Times New Roman font size 12) with the following details and heedings: Cover page: On Page-1 Executive Summary: On Page-2 Table of Content: On Page-3 Report of 5-6 pages (Pages 4-8 9): Include headings - (i) Introduction, (ii) Explanation of decision relating to Projects R and 5 (for the requirements of Question-1): (mii) Explanation of decision relating to the AB99 soup producing project when the cost of capital is 11.38 percent (iv) Explanation of decision relating to the AB99 soup producing project when the cost of capital is 14.67 percent (v) Explanation of qualitative issues relating to the decision for the AB99 soap producing project (3i) One-page summary for the requirements of Question-4 (vi) Conclusion. References (on page -9/10): Provide the list of all references used in the report. (In-text referencing is required. When you define any term, use appropriate references within the text). Use APA referencing style. Appendix: As you find necessary