Question: Question 1 The following is data extracted from Burfi Pte Ltd's financial reports. All data are as of December 31, 2019. Current ratio 2 Beginning

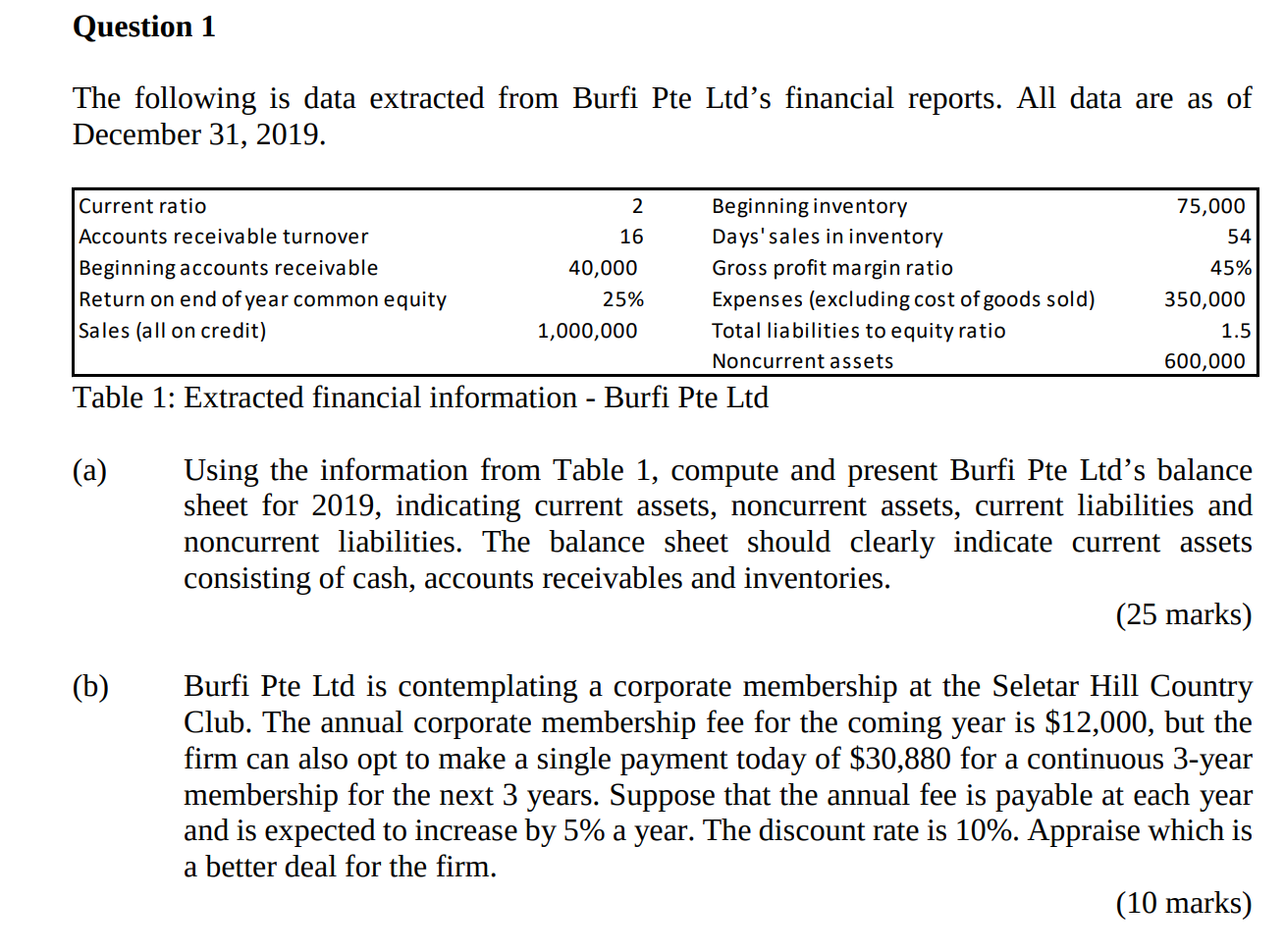

Question 1 The following is data extracted from Burfi Pte Ltd's financial reports. All data are as of December 31, 2019. Current ratio 2 Beginning inventory Accounts receivable turnover 16 Days' sales in inventory Beginning accounts receivable 40,000 Gross profit margin ratio Return on end of year common equity 25% Expenses (excluding cost of goods sold) Sales (all on credit) 1,000,000 Total liabilities to equity ratio Noncurrent assets Table 1: Extracted financial information - Burfi Pte Ltd 75,000 54 45% 350,000 1.5 600,000 (a) Using the information from Table 1, compute and present Burfi Pte Ltds balance sheet for 2019, indicating current assets, noncurrent assets, current liabilities and noncurrent liabilities. The balance sheet should clearly indicate current assets consisting of cash, accounts receivables and inventories. (25 marks) (b) Burfi Pte Ltd is contemplating a corporate membership at the Seletar Hill Country Club. The annual corporate membership fee for the coming year is $12,000, but the firm can also opt to make a single payment today of $30,880 for a continuous 3-year membership for the next 3 years. Suppose that the annual fee is payable at each year and is expected to increase by 5% a year. The discount rate is 10%. Appraise which is a better deal for the firm. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts