Question: Question 1. The investor has a mean-variance optimizer with A = 2. There are two risky assets with returns 71,72 and one risk-free asset with

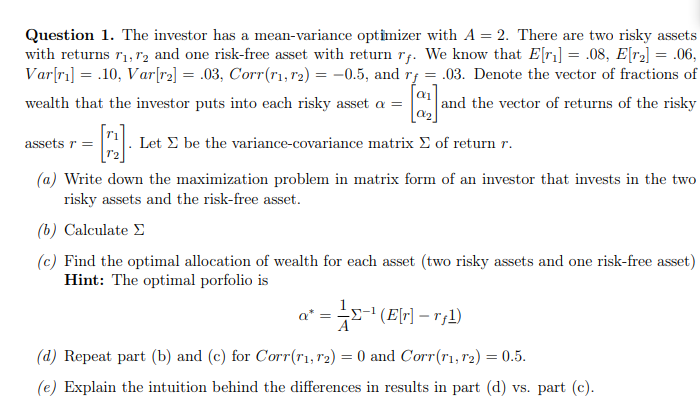

Question 1. The investor has a mean-variance optimizer with A = 2. There are two risky assets with returns 71,72 and one risk-free asset with return ry. We know that E[ru] = .08, E[r2] = .06, Var[ru] = .10, Var[r2] = .03, Corr(r1, r2) = -0.5, and r= .03. Denote the vector of fractions of wealth that the investor puts into each risky asset a = and the vector of returns of the risky Qi OL assets r = Let be the variance-covariance matrix of return r. (a) Write down the maximization problem in matrix form of an investor that invests in the two risky assets and the risk-free asset. (6) Calculate (c) Find the optimal allocation of wealth for each asset (two risky assets and one risk-free asset) Hint: The optimal porfolio is a* = - -9--(E[r] - r;1) (d) Repeat part (b) and (c) for Corr(r1, r2) = 0 and Corr(r1, r2) = 0.5. (e) Explain the intuition behind the differences in results in part (d) vs. part (c). Question 1. The investor has a mean-variance optimizer with A = 2. There are two risky assets with returns 71,72 and one risk-free asset with return ry. We know that E[ru] = .08, E[r2] = .06, Var[ru] = .10, Var[r2] = .03, Corr(r1, r2) = -0.5, and r= .03. Denote the vector of fractions of wealth that the investor puts into each risky asset a = and the vector of returns of the risky Qi OL assets r = Let be the variance-covariance matrix of return r. (a) Write down the maximization problem in matrix form of an investor that invests in the two risky assets and the risk-free asset. (6) Calculate (c) Find the optimal allocation of wealth for each asset (two risky assets and one risk-free asset) Hint: The optimal porfolio is a* = - -9--(E[r] - r;1) (d) Repeat part (b) and (c) for Corr(r1, r2) = 0 and Corr(r1, r2) = 0.5. (e) Explain the intuition behind the differences in results in part (d) vs. part (c)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts