Question: Question 1 : The Multiply company makes two products , Volume and Specialized . Volume is a high -volume product that accounts for most

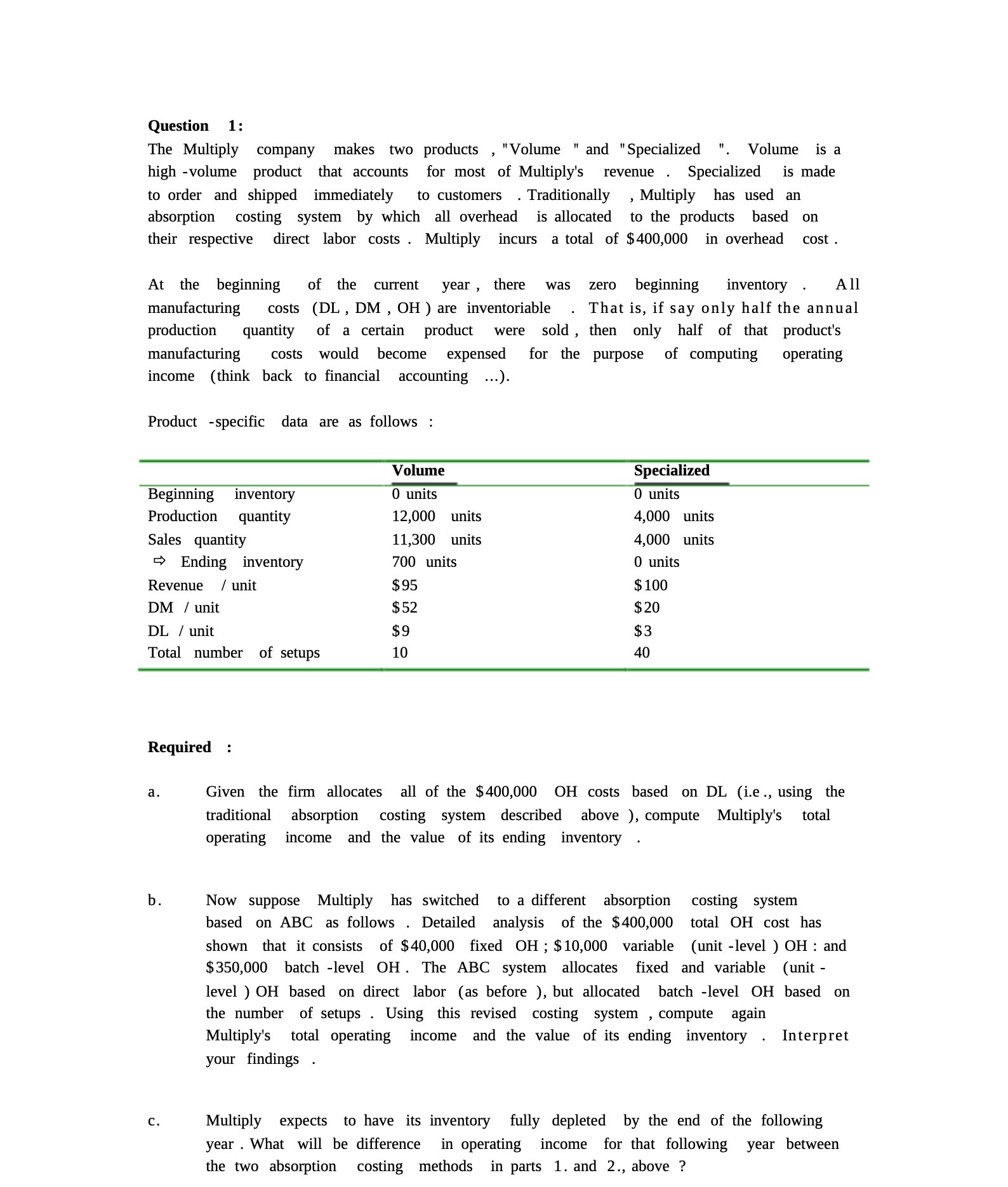

Question 1 : The Multiply company makes two products , "Volume " and "Specialized ". Volume is a high -volume product that accounts for most of Multiply's revenue . Specialized is made to order and shipped immediately to customers . Traditionally , Multiply has used an absorption costing system by which all overhead is allocated to the products based on their respective direct labor costs . Multiply incurs a total of $400,000 in overhead cost. At the beginning of the current year , there was zero beginning inventory . All manufacturing costs (DL , DM , 0H ) are inventoriable . That is, if say only half the annual production quantity of a certain product were sold , then only half of that product's manufacturing costs would become expensed for the purpose of computing operating income (think back to nancial accounting ...). Product -specific data are as follows 2 Volume Specialized Beginning inventory 0 units 0 units Production quantity 12,000 units 4,000 units Sales quantity 11,300 units 4,000 units '1} Ending inventory 700 units 0 units Revenue [unit $95 $100 DM / unit $52 $20 DL I unit $9 $3 Total number of setups 10 40 Required a. Given the firm allocates all of the $400,000 0H costs based on DL (i.e., using the traditional absorption costing system described above), compute Multiply's total operating income and the value of its ending inventory b. Now suppose Multiply has switched to a different absorption costing system based on ABC as follows . Detailed analysis of the $400,000 total OH cost has shown that it consists of $40,000 fixed 0H ; $10,000 variable (unit -level ) OH : and $350,000 batch -level OH. The ABC system allocates fixed and variable (unit - level ) OH based on direct labor (as before ), but allocated batch -level OH based on the number of setups . Using this revised costing system , compute again Multiply's total operating income and the value of its ending inventory . Interpret your findings . c. Multiply expects to have its inventory fully depleted by the end of the following year . What will be difference in operating income for that following year between the two absorption costing methods in parts 1. and 2., above