Question: QUESTION 1 The Thorn Co maintains a general checking account at the First Bank. First Bank provides a bank statement and canceled checks once a

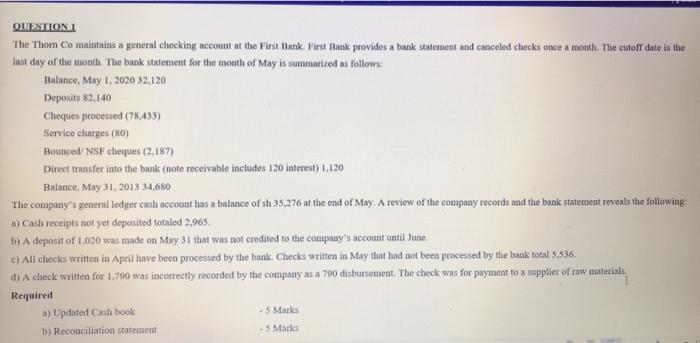

QUESTION 1

The Thorn Co maintains a general checking account at the First Bank. First Bank provides a bank statement and canceled checks once a month. The cutoff date is the last day of the month. The bank statement for the month of May is summarized as follows:

Balance, May 1, 2020 32,120

Deposits 82,140

Cheques processed (78,433)

Service charges (80)

Bounced/ NSF cheques (2,187)

Direct transfer into the bank (note receivable includes 120 interest) 1,120

Balance, May 31, 2013 34,680

The companys general ledger cash account has a balance of sh 35,276 at the end of May. A review of the company records and the bank statement reveals the following:

a) Cash receipts not yet deposited totaled 2,965.

b) A deposit of 1,020 was made on May 31 that was not credited to the companys account until June.

c) All checks written in April have been processed by the bank. Checks written in May that had not been processed by the bank total 5,536.

d) A check written for 1,790 was incorrectly recorded by the company as a 790 disbursement. The check was for payment to a supplier of raw materials.

Required

a) Updated Cash book

b) Reconciliation statement

QUESTIONI The Thom Co maintains a general checking account at the First Bank. First Bank provides a bank statement and canceled checks once a month. The cutoff date is the last day of the month. The bank statement for the month of May is summarized as follows: Balance, May 1, 2020 32,120 Deposits 82,140 Cheques processed (78,433) Service charges (80) Bounced NSF cheques (2,187) Direct transfer into the bank (note receivable includes 120 interest) 1.120 Balance, May 31, 2013 34,680 The company's general ledger cash account has a balance of sh 35,276 at the end of May. A review of the company records and the bank statement revents the following: #) Cash receipts not yet deposited totaled 2.965 b) A deposit of 1,020 was made on May 31 that was not credited to the company's account until June c) All checks written in April have been processed by the bank. Checks written in May that had not been processed by the bank total 5.536. d) A check written for 1.790 was incorrectly recorded by the company as a 790 disbursement. The check was for payment to a supplier of raw materials, Required a) Updated Cash book 5 Marks b) Reconciliation statement - 5 Mark

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts