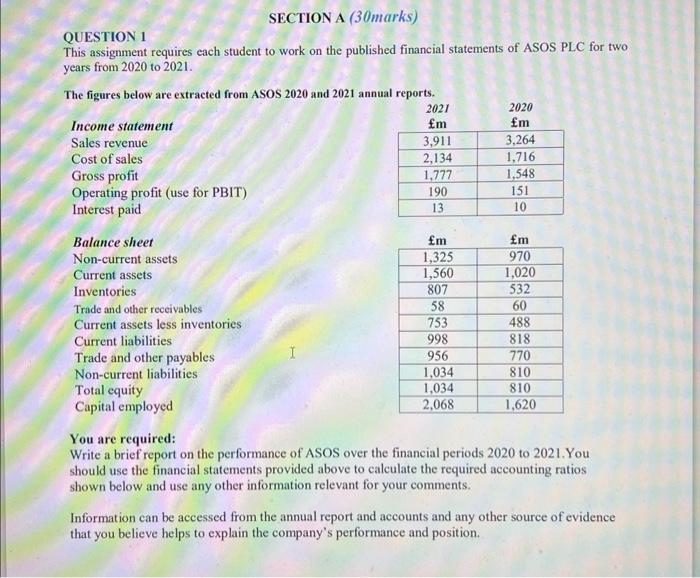

Question: QUESTION 1 This assignment requires each student to work on the published financial statements of ASOS PLC for two years from 2020 to 2021 .

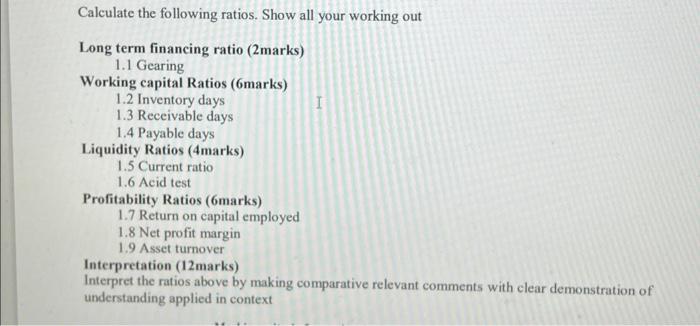

QUESTION 1 This assignment requires each student to work on the published financial statements of ASOS PLC for two years from 2020 to 2021 . The figures below are extracted from ASOS 2020 and 2021 annual rennrts. You are required: Write a brief report on the performance of ASOS over the financial periods 2020 to 2021.You should use the financial statements provided above to calculate the required accounting ratios shown below and use any other information relevant for your comments. Information can be accessed from the annual report and accounts and any other source of evidence that you believe helps to explain the company's performance and position. Calculate the following ratios. Show all your working out Long term financing ratio ( 2 marks) 1.1 Gearing Working capital Ratios (6marks) 1.2 Inventory days 1.3 Receivable days 1.4 Payable days Liquidity Ratios (4marks) 1.5 Current ratio 1.6 Acid test Profitability Ratios (6marks) 1.7 Return on capital employed 1.8 Net profit margin 1.9 Asset turnover Interpretation (12marks) Interpret the ratios above by making comparative relevant comments with clear demonstration of understanding applied in context INSTRUCTIONS This coursework has three sections questions. 1. Answer all question 2. Show all working out. 3. You must show all working out. You may use Excel, but you must show the formula for the excel calculations 4. Do not include the assessment questions

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts