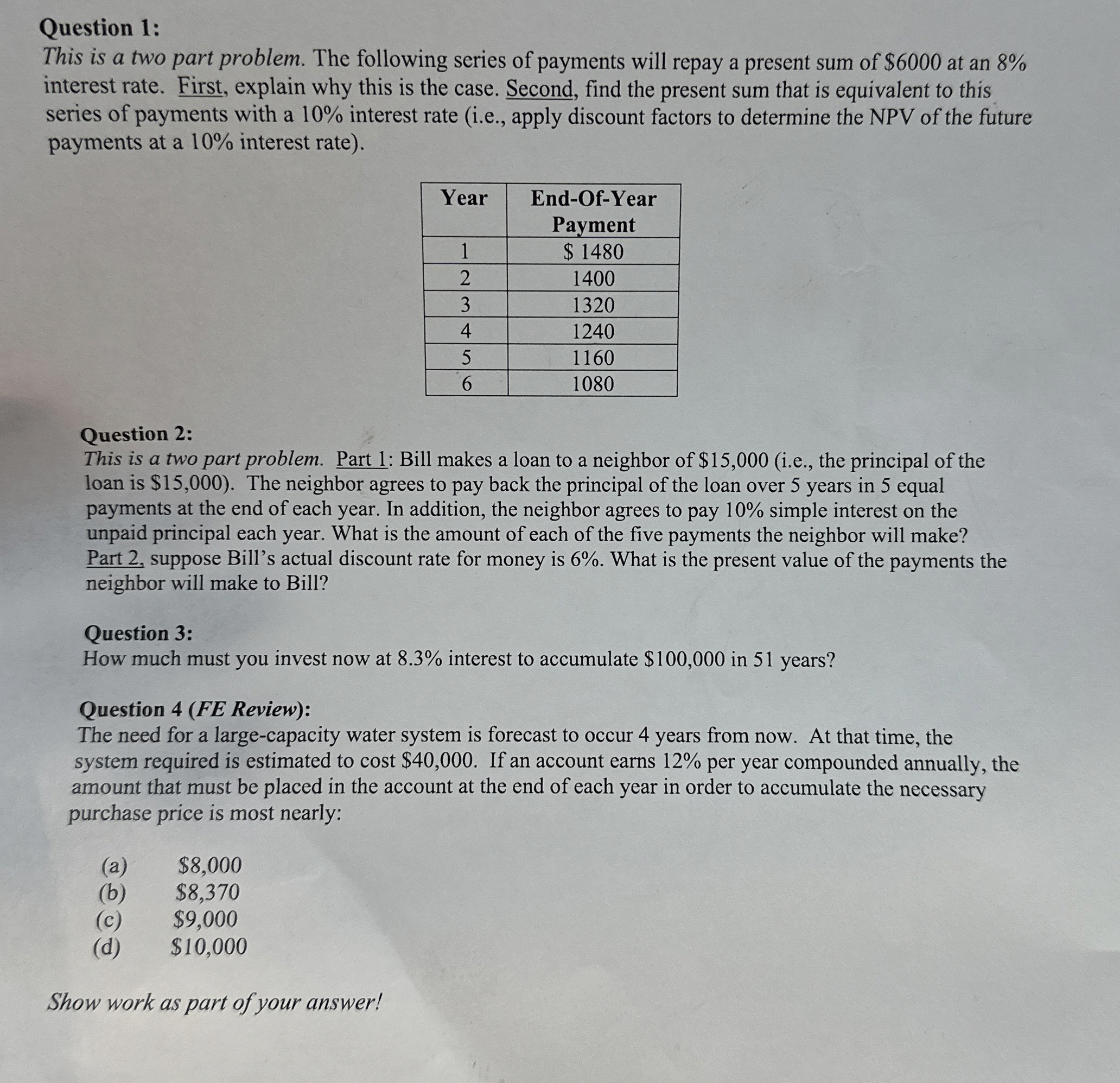

Question: Question 1 : This is a two part problem. The following series of payments will repay a present sum of $ 6 0 0 0

Question :

This is a two part problem. The following series of payments will repay a present sum of $ at an

interest rate. First, explain why this is the case. Second, find the present sum that is equivalent to this,

series of payments with a interest rate ie apply discount factors to determine the NPV of the future

payments at a interest rate

Question :

This is a two part problem. Part : Bill makes a loan to a neighbor of $ie the principal of the

loan is $ The neighbor agrees to pay back the principal of the loan over years in equal

payments at the end of each year. In addition, the neighbor agrees to pay simple interest on the

unpaid principal each year. What is the amount of each of the five payments the neighbor will make?

Part suppose Bill's actual discount rate for money is What is the present value of the payments the

neighbor will make to Bill?

Question :

How much must you invest now at interest to accumulate $ in years?

Question FE Review:

The need for a largecapacity water system is forecast to occur years from now. At that time, the

system required is estimated to cost $ If an account earns per year compounded annually, the

amount that must be placed in the account at the end of each year in order to accumulate the necessary

purchase price is most nearly:

a $

b $

c $

d $

Show work as part of your answer!

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock