Question: QUESTION 1: [This question asks you to develop - within a very simple setting the risk properties of a credit derivative instrument backed by unsecured

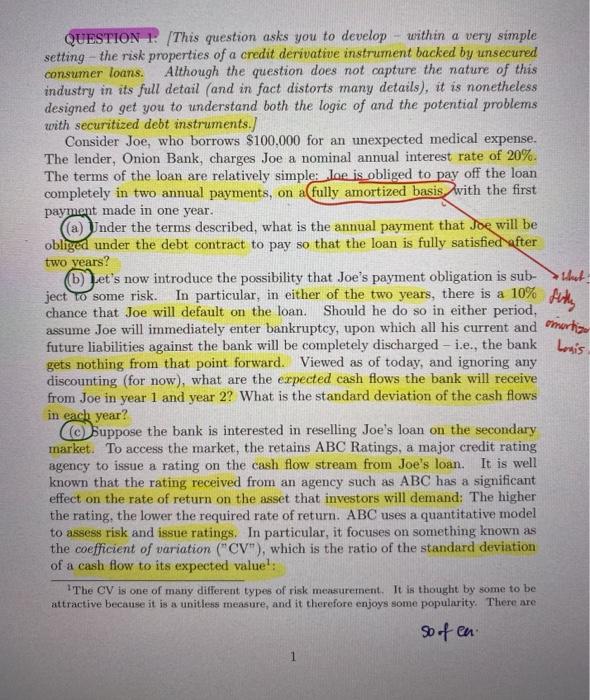

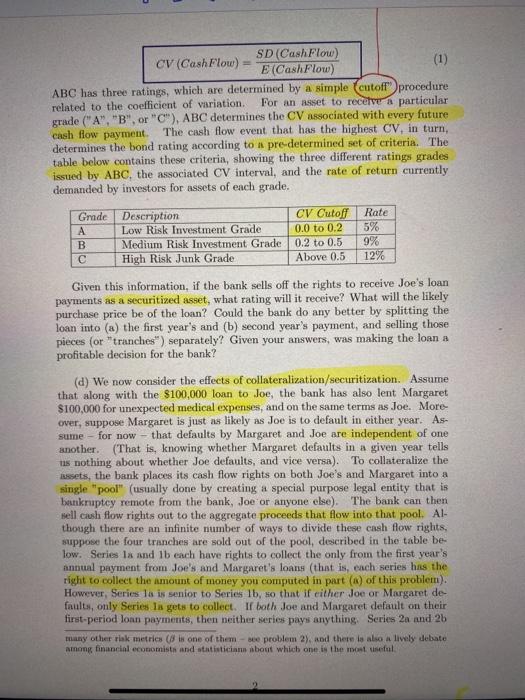

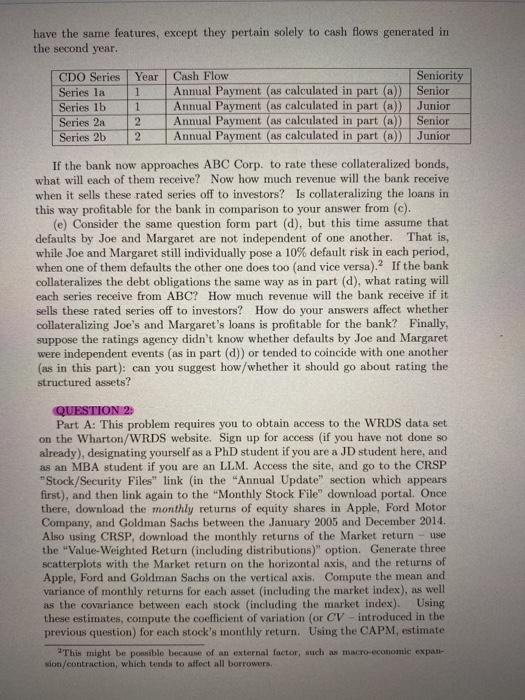

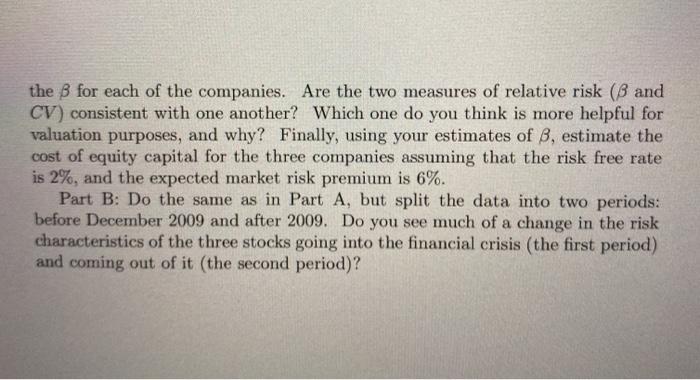

QUESTION 1: [This question asks you to develop - within a very simple setting the risk properties of a credit derivative instrument backed by unsecured consumer loans. Although the question does not capture the nature of this industry in its full detail (and in fact distorts many details), it is nonetheless designed to get you to understand both the logic of and the potential problems with securitized debt instruments. Consider Joe, who borrows $100.000 for an unexpected medical expense. The lender, Onion Bank, charges Joe a nominal annual interest rate of 20%. The terms of the loan are relatively simple: Joe is obliged to pay off the loan completely in two annual payments, on a fully amortized basis with the first payment made in one year. Under the terms described, what is the annual payment that Joe will be obliged under the debt contract to pay so that the loan is fully satisfied after two years? (b) Let's now introduce the possibility that Joe's payment obligation is sub- ject to some risk. In particular, in either of the two years, there is a 10% berthy chance that Joe will default on the loan. Should he do so in either period, assume Joe will immediately enter bankruptcy, upon which all his current and mortis future liabilities against the bank will be completely discharged - i.e., the bank Louis gets nothing from that point forward. Viewed as of today, and ignoring any discounting (for now), what are the expected cash flows the bank will receive from Joe in year 1 and year 2? What is the standard deviation of the cash flows in each year? (c) Suppose the bank is interested in reselling Joe's loan on the secondary market. To access the market, the retains ABC Ratings, a major credit rating agency to issue a rating on the cash flow stream from Joe's loan. It is well known that the rating received from an agency such as ABC has a significant effect on the rate of return on the asset that investors will demand: The higher the rating, the lower the required rate of return. ABC uses a quantitative model to assess risk and issue ratings. In particular, it focuses on something known as the coefficient of variation ("CV"), which is the ratio of the standard deviation of a cash flow to its expected value: The CV is one of many different types of risk measurement. It is thought by some to be attractive because it is a unitless measure, and it therefore enjoys some popularity. There are so of en 1 SD (Cash Flow) CV (Cash Flow) (1) E (Cash Flow) ABC has three ratings, which are determined by a simple cutoff" procedure related to the coefficient of variation. For an asset to receive a particular grade ("A", "B", or "C"), ABC determines the CV associated with every future cash flow payment The cash flow event that has the highest CV, in turn, determines the bond rating according to a pre determined set of criteria. The table below contains these criteria, showing the three different ratings grades issued by ABC, the associated CV interval, and the rate of return currently demanded by investors for assets of each grade. Grade Description CV Cutof A Low Risk Investment Grade 0.0 to 0.2 B Medium Risk Investment Grade 0.2 to 0.5 High Risk Junk Grade Above 0.5 Rate 5% 9% 12% Given this information, if the bank sells off the rights to receive Joe's loan payments as a securitized asset, what rating will it receive? What will the likely purchase price be of the loan? Could the bank do any better by splitting the loan into (a) the first year's and (b) second year's payment, and selling those pieces (or "tranches") separately? Given your answers, was making the loan a profitable decision for the bank? (d) We now consider the effects of collateralization/securitization. Assume that along with the $100,000 loan to Joe, the bank has also lent Margaret $100,000 for unexpected medical expenses, and on the same terms as Joe. More over, suppose Margaret is just as likely as Joe is to default in either year. As- sume - for now - that defaults by Margaret and Joe are independent of one another. (That is, knowing whether Margaret defaults in a given year tells is nothing about whether Joe defaults, and vice versa). To collateralize the assets, the bank places its cash flow rights on both Joe's and Margaret into a single "pool" (usually done by creating a special purpose legal entity that is bankruptcy remote from the bank, Joe or anyone else). The bank can then sell cash flow rights out to the aggregate proceeds that flow into that pool. Al- though there are an infinite number of ways to divide these cash flow rights, suppose the four tranches are sold out of the pool, described in the table be low. Series 1x and lb each have rights to collect the only from the first year's annual payment from Joe's and Margaret's loans (that is, each series has the right to collect the amount of money you computed in part (a) of this problem). However, Series la is senior to Series 1b, so that if either Joe or Margaret de faults, only Series la gets to collect. If both Joe and Margaret default on their first-period loan payments, then neither series pays anything Series 20 and 25 many other risk metries is one of them - see problem 2), and there is also a lively debate among financial economists and statisticians about which one is the most useful have the same features, except they pertain solely to cash flows generated in the second year. CDO Series Series la Series lb Series 2a Series 2b Year 1 1 2 2 Cash Flow Seniority Annual Payment (as calculated in part (8)) Senior Annual Payment (as calculated in part (a)) Junior Annual Payment (as calculated in part (a) Senior Annual Payment (as calculated in part (a))Junior If the bank now approaches ABC Corp. to rate these collateralized bonds, what will each of them receive? Now how much revenue will the bank receive when it sells these rated series off to investors? Is collateralizing the loans in this way profitable for the bank in comparison to your answer from (c). (e) Consider the same question form part (d), but this time assume that defaults by Joe and Margaret are not independent of one another. That is, while Joe and Margaret still individually pose a 10% default risk in each period, when one of them defaults the other one does too (and vice versa). If the bank collateralizes the debt obligations the same way as in part (d), what rating will each series receive from ABC? How much revenue will the bank receive if it sells these rated series off to investors? How do your answers affect whether collateralizing Joe's and Margaret's loans is profitable for the bank? Finally, suppose the ratings agency didn't know whether defaults by Joe and Margaret were independent events (as in part (a)) or tended to coincide with one another (as in this part): can you suggest how/whether it should go about rating the structured assets? QUESTION 2 Part A: This problem requires you to obtain access to the WRDS data set on the Wharton/WRDS website. Sign up for access (if you have not done so already), designating yourself as a PhD student if you are a JD student here, and as an MBA student if you are an LLM. Access the site, and go to the CRSP *Stock/Security Files" link (in the "Annual Update" section which appears first), and then link again to the "Monthly Stock File" download portal. Once there, download the monthly returns of equity shares in Apple, Ford Motor Company, and Goldman Sachs between the January 2005 and December 2014 Also using CRSP, download the monthly returns of the Market return - use the "Value-Weighted Return (including distributions)" option. Generate three scatterplots with the Market return on the horizontal axis, and the returns of Apple, Ford and Goldman Sachs on the vertical axis. Compute the mean and variance of monthly returns for each asset (including the market index), as well as the covariance between each stock (including the market index). Using these estimates, compute the coefficient of variation (or CV - introduced in the previous question) for each stock's monthly return. Using the CAPM, estimate This might be posible because of an external factor, such as macro-economie expan sion/contraction, which tends to affect all borrowers the B for each of the companies. Are the two measures of relative risk (B and CV) consistent with one another? Which one do you think is more helpful for valuation purposes, and why? Finally, using your estimates of B, estimate the cost of equity capital for the three companies assuming that the risk free rate is 2%, and the expected market risk premium is 6%. Part B: Do the same as in Part A, but split the data into two periods: before December 2009 and after 2009. Do you see much of a change in the risk characteristics of the three stocks going into the financial crisis (the first period) and coming out of it (the second period)? QUESTION 1: [This question asks you to develop - within a very simple setting the risk properties of a credit derivative instrument backed by unsecured consumer loans. Although the question does not capture the nature of this industry in its full detail (and in fact distorts many details), it is nonetheless designed to get you to understand both the logic of and the potential problems with securitized debt instruments. Consider Joe, who borrows $100.000 for an unexpected medical expense. The lender, Onion Bank, charges Joe a nominal annual interest rate of 20%. The terms of the loan are relatively simple: Joe is obliged to pay off the loan completely in two annual payments, on a fully amortized basis with the first payment made in one year. Under the terms described, what is the annual payment that Joe will be obliged under the debt contract to pay so that the loan is fully satisfied after two years? (b) Let's now introduce the possibility that Joe's payment obligation is sub- ject to some risk. In particular, in either of the two years, there is a 10% berthy chance that Joe will default on the loan. Should he do so in either period, assume Joe will immediately enter bankruptcy, upon which all his current and mortis future liabilities against the bank will be completely discharged - i.e., the bank Louis gets nothing from that point forward. Viewed as of today, and ignoring any discounting (for now), what are the expected cash flows the bank will receive from Joe in year 1 and year 2? What is the standard deviation of the cash flows in each year? (c) Suppose the bank is interested in reselling Joe's loan on the secondary market. To access the market, the retains ABC Ratings, a major credit rating agency to issue a rating on the cash flow stream from Joe's loan. It is well known that the rating received from an agency such as ABC has a significant effect on the rate of return on the asset that investors will demand: The higher the rating, the lower the required rate of return. ABC uses a quantitative model to assess risk and issue ratings. In particular, it focuses on something known as the coefficient of variation ("CV"), which is the ratio of the standard deviation of a cash flow to its expected value: The CV is one of many different types of risk measurement. It is thought by some to be attractive because it is a unitless measure, and it therefore enjoys some popularity. There are so of en 1 SD (Cash Flow) CV (Cash Flow) (1) E (Cash Flow) ABC has three ratings, which are determined by a simple cutoff" procedure related to the coefficient of variation. For an asset to receive a particular grade ("A", "B", or "C"), ABC determines the CV associated with every future cash flow payment The cash flow event that has the highest CV, in turn, determines the bond rating according to a pre determined set of criteria. The table below contains these criteria, showing the three different ratings grades issued by ABC, the associated CV interval, and the rate of return currently demanded by investors for assets of each grade. Grade Description CV Cutof A Low Risk Investment Grade 0.0 to 0.2 B Medium Risk Investment Grade 0.2 to 0.5 High Risk Junk Grade Above 0.5 Rate 5% 9% 12% Given this information, if the bank sells off the rights to receive Joe's loan payments as a securitized asset, what rating will it receive? What will the likely purchase price be of the loan? Could the bank do any better by splitting the loan into (a) the first year's and (b) second year's payment, and selling those pieces (or "tranches") separately? Given your answers, was making the loan a profitable decision for the bank? (d) We now consider the effects of collateralization/securitization. Assume that along with the $100,000 loan to Joe, the bank has also lent Margaret $100,000 for unexpected medical expenses, and on the same terms as Joe. More over, suppose Margaret is just as likely as Joe is to default in either year. As- sume - for now - that defaults by Margaret and Joe are independent of one another. (That is, knowing whether Margaret defaults in a given year tells is nothing about whether Joe defaults, and vice versa). To collateralize the assets, the bank places its cash flow rights on both Joe's and Margaret into a single "pool" (usually done by creating a special purpose legal entity that is bankruptcy remote from the bank, Joe or anyone else). The bank can then sell cash flow rights out to the aggregate proceeds that flow into that pool. Al- though there are an infinite number of ways to divide these cash flow rights, suppose the four tranches are sold out of the pool, described in the table be low. Series 1x and lb each have rights to collect the only from the first year's annual payment from Joe's and Margaret's loans (that is, each series has the right to collect the amount of money you computed in part (a) of this problem). However, Series la is senior to Series 1b, so that if either Joe or Margaret de faults, only Series la gets to collect. If both Joe and Margaret default on their first-period loan payments, then neither series pays anything Series 20 and 25 many other risk metries is one of them - see problem 2), and there is also a lively debate among financial economists and statisticians about which one is the most useful have the same features, except they pertain solely to cash flows generated in the second year. CDO Series Series la Series lb Series 2a Series 2b Year 1 1 2 2 Cash Flow Seniority Annual Payment (as calculated in part (8)) Senior Annual Payment (as calculated in part (a)) Junior Annual Payment (as calculated in part (a) Senior Annual Payment (as calculated in part (a))Junior If the bank now approaches ABC Corp. to rate these collateralized bonds, what will each of them receive? Now how much revenue will the bank receive when it sells these rated series off to investors? Is collateralizing the loans in this way profitable for the bank in comparison to your answer from (c). (e) Consider the same question form part (d), but this time assume that defaults by Joe and Margaret are not independent of one another. That is, while Joe and Margaret still individually pose a 10% default risk in each period, when one of them defaults the other one does too (and vice versa). If the bank collateralizes the debt obligations the same way as in part (d), what rating will each series receive from ABC? How much revenue will the bank receive if it sells these rated series off to investors? How do your answers affect whether collateralizing Joe's and Margaret's loans is profitable for the bank? Finally, suppose the ratings agency didn't know whether defaults by Joe and Margaret were independent events (as in part (a)) or tended to coincide with one another (as in this part): can you suggest how/whether it should go about rating the structured assets? QUESTION 2 Part A: This problem requires you to obtain access to the WRDS data set on the Wharton/WRDS website. Sign up for access (if you have not done so already), designating yourself as a PhD student if you are a JD student here, and as an MBA student if you are an LLM. Access the site, and go to the CRSP *Stock/Security Files" link (in the "Annual Update" section which appears first), and then link again to the "Monthly Stock File" download portal. Once there, download the monthly returns of equity shares in Apple, Ford Motor Company, and Goldman Sachs between the January 2005 and December 2014 Also using CRSP, download the monthly returns of the Market return - use the "Value-Weighted Return (including distributions)" option. Generate three scatterplots with the Market return on the horizontal axis, and the returns of Apple, Ford and Goldman Sachs on the vertical axis. Compute the mean and variance of monthly returns for each asset (including the market index), as well as the covariance between each stock (including the market index). Using these estimates, compute the coefficient of variation (or CV - introduced in the previous question) for each stock's monthly return. Using the CAPM, estimate This might be posible because of an external factor, such as macro-economie expan sion/contraction, which tends to affect all borrowers the B for each of the companies. Are the two measures of relative risk (B and CV) consistent with one another? Which one do you think is more helpful for valuation purposes, and why? Finally, using your estimates of B, estimate the cost of equity capital for the three companies assuming that the risk free rate is 2%, and the expected market risk premium is 6%. Part B: Do the same as in Part A, but split the data into two periods: before December 2009 and after 2009. Do you see much of a change in the risk characteristics of the three stocks going into the financial crisis (the first period) and coming out of it (the second period)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts