Question: Question 1 (This question is going to guide you analyze the case that we briefly covered in class, in order to help you understand limits

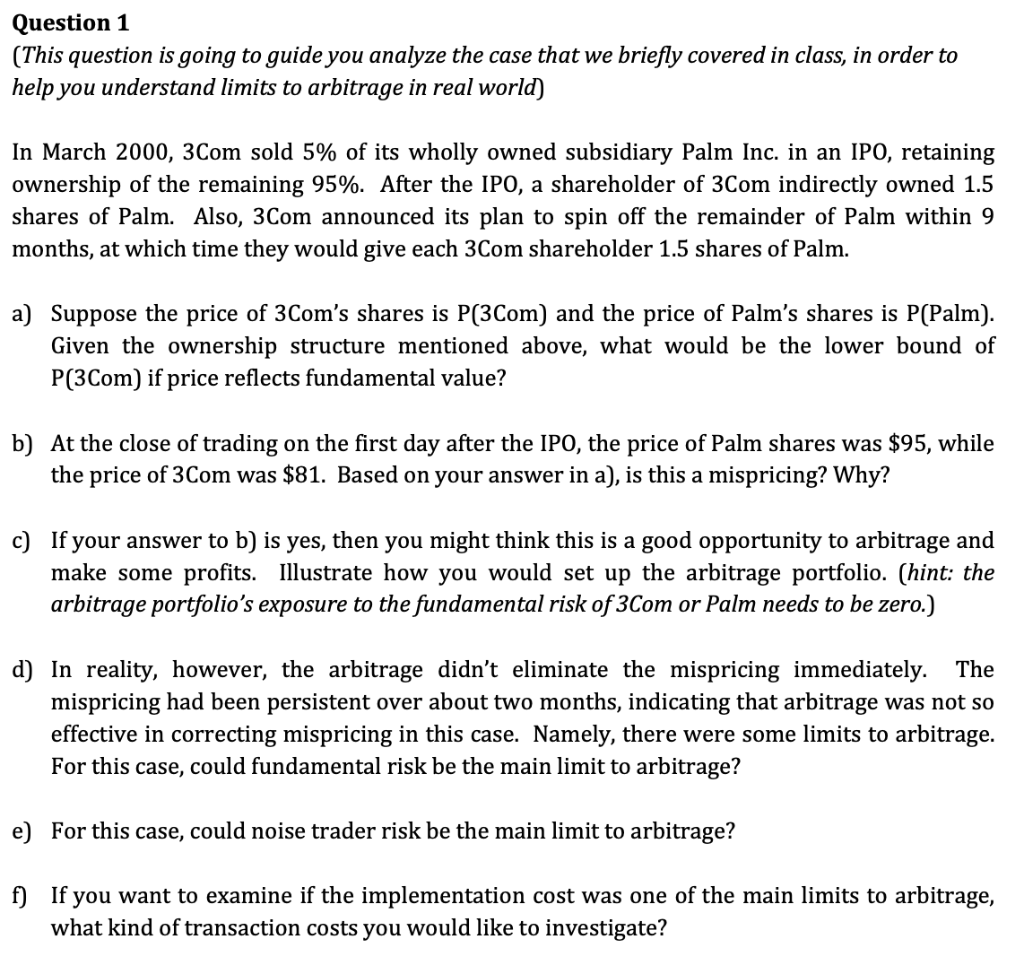

Question 1 (This question is going to guide you analyze the case that we briefly covered in class, in order to help you understand limits to arbitrage in real world) In March 2000, 3Com sold 5% of its wholly owned subsidiary Palm Inc. in an IPO, retaining ownership of the remaining 95%. After the IPO, a shareholder of 3Com indirectly owned 1.5 shares of Palm. Also, 3Com announced its plan to spin off the remainder of Palm within 9 months, at which time they would give each 3Com shareholder 1.5 shares of Palm. a) Suppose the price of 3Com's shares is P(3Com) and the price of Palm's shares is P(Palm). Given the ownership structure mentioned above, what would be the lower bound of P(3Com) if price reflects fundamental value? b) At the close of trading on the first day after the IPO, the price of Palm shares was $95, while the price of 3Com was $81. Based on your answer in a), is this a mispricing? Why? c) If your answer to b) is yes, then you might think this is a good opportunity to arbitrage and make some profits. Illustrate how you would set up the arbitrage portfolio. (hint: the arbitrage portfolio's exposure to the fundamental risk of 3Com or Palm needs to be zero.) d) In reality, however, the arbitrage didn't eliminate the mispricing immediately. The mispricing had been persistent over about two months, indicating that arbitrage was not so effective in correcting mispricing in this case. Namely, there were some limits to arbitrage. For this case, could fundamental risk be the main limit to arbitrage? e) For this case, could noise trader risk be the main limit to arbitrage? f) If you want to examine if the implementation cost was one of the main limits to arbitrage, what kind of transaction costs you would like to investigate? Question 1 (This question is going to guide you analyze the case that we briefly covered in class, in order to help you understand limits to arbitrage in real world) In March 2000, 3Com sold 5% of its wholly owned subsidiary Palm Inc. in an IPO, retaining ownership of the remaining 95%. After the IPO, a shareholder of 3Com indirectly owned 1.5 shares of Palm. Also, 3Com announced its plan to spin off the remainder of Palm within 9 months, at which time they would give each 3Com shareholder 1.5 shares of Palm. a) Suppose the price of 3Com's shares is P(3Com) and the price of Palm's shares is P(Palm). Given the ownership structure mentioned above, what would be the lower bound of P(3Com) if price reflects fundamental value? b) At the close of trading on the first day after the IPO, the price of Palm shares was $95, while the price of 3Com was $81. Based on your answer in a), is this a mispricing? Why? c) If your answer to b) is yes, then you might think this is a good opportunity to arbitrage and make some profits. Illustrate how you would set up the arbitrage portfolio. (hint: the arbitrage portfolio's exposure to the fundamental risk of 3Com or Palm needs to be zero.) d) In reality, however, the arbitrage didn't eliminate the mispricing immediately. The mispricing had been persistent over about two months, indicating that arbitrage was not so effective in correcting mispricing in this case. Namely, there were some limits to arbitrage. For this case, could fundamental risk be the main limit to arbitrage? e) For this case, could noise trader risk be the main limit to arbitrage? f) If you want to examine if the implementation cost was one of the main limits to arbitrage, what kind of transaction costs you would like to investigate

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts