Question: Question 1 to 4, 7, 12, 13 Questions and Problems connect 1 Accounting and Cash Flows Why might the revenue and cost figures shown on

Question 1 to 4, 7, 12, 13

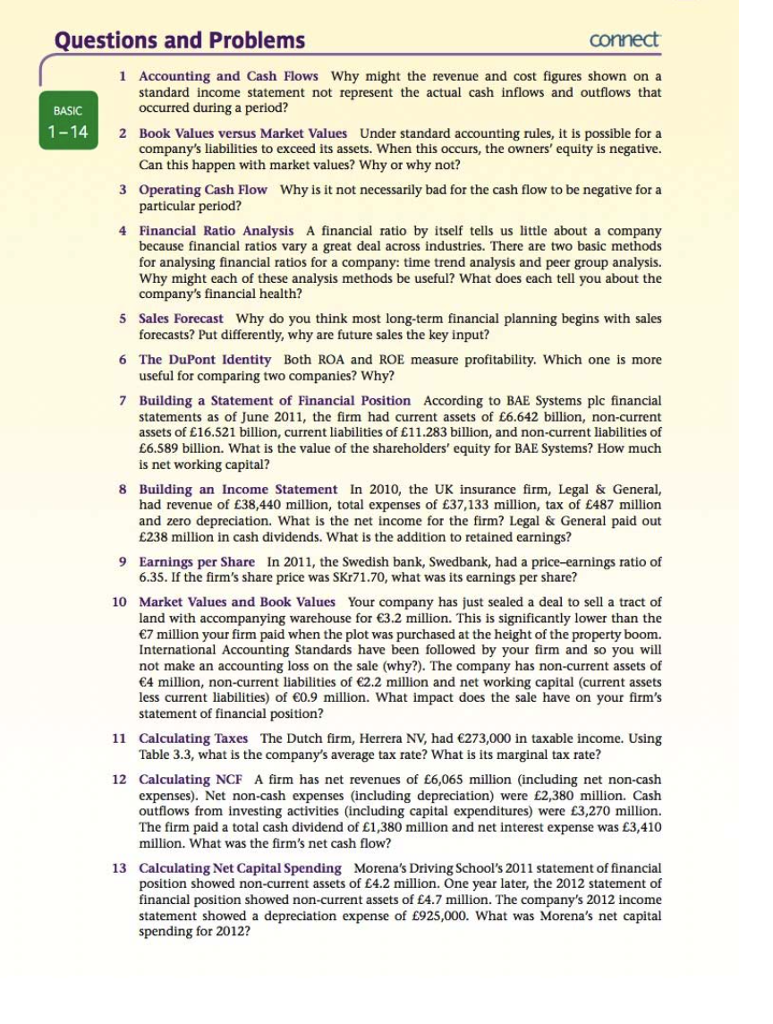

Questions and Problems connect 1 Accounting and Cash Flows Why might the revenue and cost figures shown on a standard income statement not represent the actual cash inflows and outflows that occurred during a period? BASIC 1-14 Book Values versus Market Values company's liabilities to exceed its assets. When this occurs, the owners' equity is negative. Can this happen with market values? Why or why not? 2 Under standard accounting rules, it is possible for a 3 Operating Cash Flow particular period? Why is it not necessarily bad for the cash flow to be negative for a 4 Financial Ratio Analysis A financial ratio by itself tells us ittle about a company because financial ratios vary a great deal across industries. There are two basic methods for analysing financial ratios for a company: time trend analysis and peer group analysis. Why might each of these analysis methods be useful? What does each tell you about the company's financial health? Sales Forecast Why do you think most long-term financial planning begins with sales forecasts? Put differently, why are future sales the key input? 6 The DuPont Identity Both ROA and ROE measure profitability. Which one is more useful for comparing two companies? Why? 7 Building a Statement of Financial Position According to BAE Systems plc financial statements as of June 2011, the firm had current assets of 6.642 billion, non-current assets of E16.521 billion, current liabilities of 11.283 billion, and non-current liabilities of 6.589 billion. What is the value of the shareholders' equity for BAE Systems? How much is net working capital? 8 Building an Income Statement In 2010, the UK insurance firm, Legal & General, had revenue of 38,440 million, total expenses of 37,133 million, tax of 487 million and zero depreciation. What is the net income for the firm? Legal & General paid out E238 million in cash dividends. What is the addition to retained earnings? 9 Earnings per Share 6.35. If the firm's share price was SKr71.70, what was its earnings per share? In 2011, the Swedish bank, Swedbank, had a price-earnings ratio of Market Values and Book Values land with accompanying warehouse for 3.2 million. This is significantly lower than the 7 million your firm paid when the plot was purchased at the height of the property boom. International Accounting Standards have been followed by your firm and so you will not make an accounting loss on the sale (why?). The company has non-current assets of 4 million, non-current liabilities of 2.2 million and net working capital (current assets less current liabilities) of 0.9 million. What impact does the sale have on your firm's statement of financial position? 10 Your company has just sealed a deal to sell a tract of 11 Calculating Taxes The Dutch firm, Herrera NV, had 273,000 in taxable income. Using Table 3.3, what is the company's average tax rate? What is its marginal tax rate? 12 Calculating NCF A firm has net revenues of 6,065 million (including net non-cash expenses). Net non-cash expenses (including depreciation) were 2,380 million. Caslh outflows from investing activities (including capital expenditures) were 3,270 million. The firm paid a total cash dividend of 1,380 million and net interest expense was 3,410 million. What was the firm's net cash flow? 13 Calculating Net Capital Spending position showed non-current assets of 4.2 million. One year later, the 2012 statement of financial position showed non-current assets of A.7 million. The company's 2012 income statement showed a depreciation expense of 925,000. What was Morena's net capital spending for 2012? Morena's Driving School's 2011 statement of financial

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts