Question: Question 1 Total 12 marks As a financial analyst, you either apply Alpha calculated by using Securities Market Line (SML) or Sharpe ratio for making

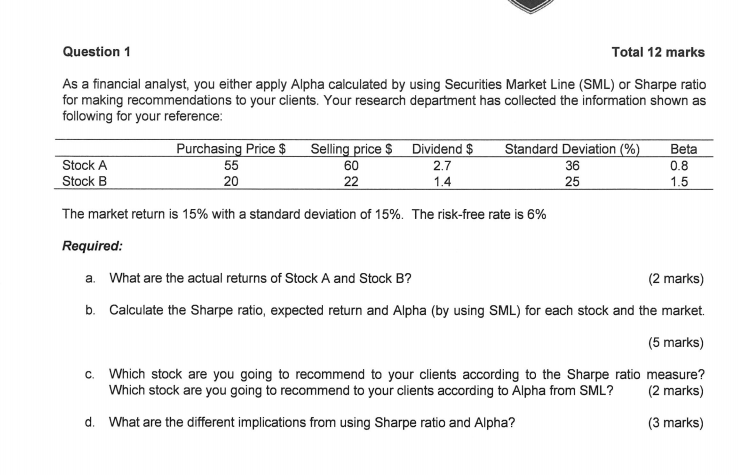

Question 1 Total 12 marks As a financial analyst, you either apply Alpha calculated by using Securities Market Line (SML) or Sharpe ratio for making recommendations to your clients. Your research department has collected the information shown as following for your reference: Purchasing Price $ Selling price $ Dividend $ Standard Deviation (%) Beta Stock A 55 60 2.7 36 0.8 Stock B 20 22 1.4 25 1.5 The market return is 15% with a standard deviation of 15%. The risk-free rate is 6% Required: a. What are the actual returns of Stock A and Stock B? (2 marks) b. Calculate the Sharpe ratio, expected return and Alpha (by using SML) for each stock and the market. (5 marks) C. Which stock are you going to recommend to your clients according to the Sharpe ratio measure? Which stock are you going to recommend to your clients according to Alpha from SML? (2 marks) d. What are the different implications from using Sharpe ratio and Alpha

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts