Question: Question 1 Total 15 marks The data below describe a portfolio that consists of three stocks and each stock satisfies a single-index model. Stock code

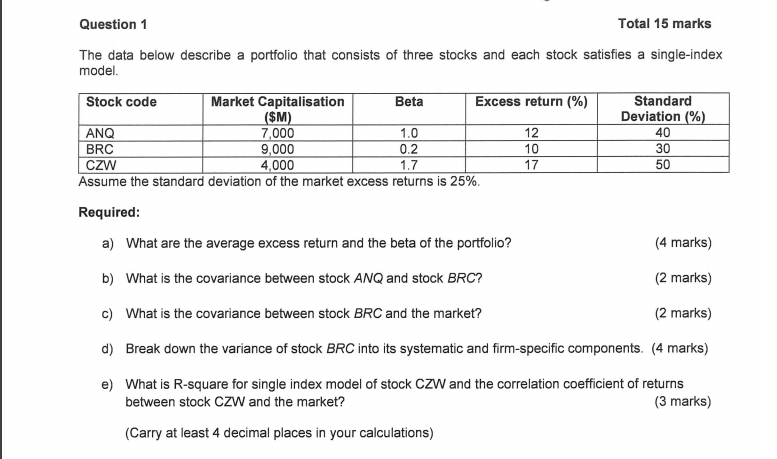

Question 1 Total 15 marks The data below describe a portfolio that consists of three stocks and each stock satisfies a single-index model. Stock code Market Capitalisation Beta Excess return (%) Standard ($M) Deviation (%) ANQ 7,000 1.0 12 40 BRC 9,000 0.2 10 30 CZW 4,000 1.7 17 50 Assume the standard deviation of the market excess returns is 25%. Required: a) What are the average excess return and the beta of the portfolio? (4 marks) b) What is the covariance between stock ANQ and stock BRC? (2 marks) c) What is the covariance between stock BRC and the market? (2 marks) d) Break down the variance of stock BRC into its systematic and firm-specific components. (4 marks) e) What is R-square for single index model of stock CZW and the correlation coefficient of returns between stock CZW and the market? (3 marks) (Carry at least 4 decimal places in your calculations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts