Question: Question 1 (Total: 20 marks) (a) Consider a special fully discrete whole life insurance on a life aged 55. The death benefit is 30,000 if

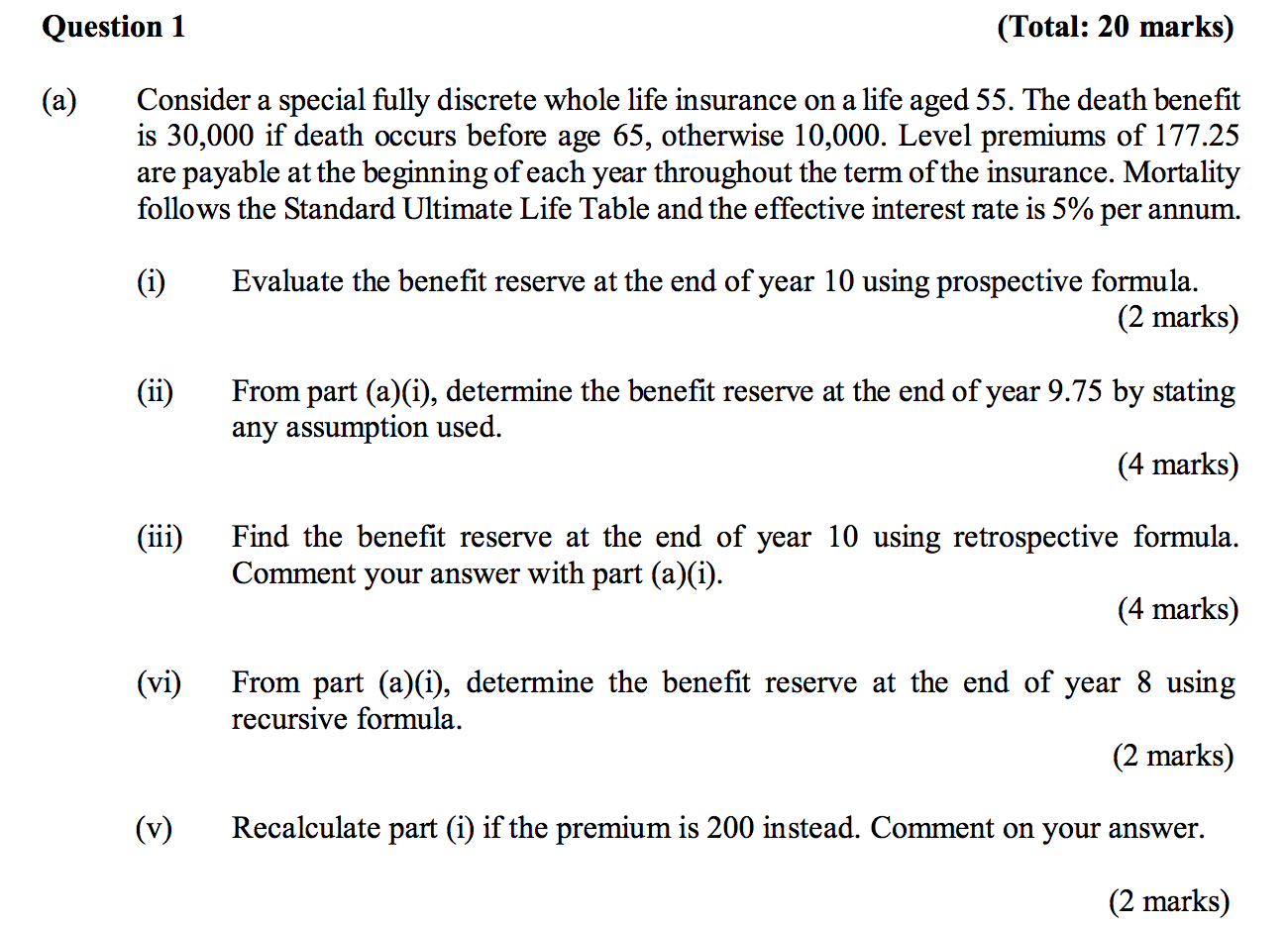

Question 1 (Total: 20 marks) (a) Consider a special fully discrete whole life insurance on a life aged 55. The death benefit is 30,000 if death occurs before age 65, otherwise 10,000. Level premiums of 177.25 are payable at the beginning of each year throughout the term of the insurance. Mortality follows the Standard Ultimate Life Table and the effective interest rate is 5% per annum. (i) Evaluate the benefit reserve at the end of year 10 using prospective formula. (2 marks) (ii) From part (a)(i), determine the benefit reserve at the end of year 9.75 by stating any assumption used. (4 marks) (iii) Find the benefit reserve at the end of year 10 using retrospective formula. Comment your answer with part (a)(i). (4 marks) (vi) From part (a)(i), determine the benefit reserve at the end of year 8 using recursive formula. (2 marks) (v ) Recalculate part (i) if the premium is 200 instead. Comment on your answer. (2 marks) Question 1 (Total: 20 marks) (a) Consider a special fully discrete whole life insurance on a life aged 55. The death benefit is 30,000 if death occurs before age 65, otherwise 10,000. Level premiums of 177.25 are payable at the beginning of each year throughout the term of the insurance. Mortality follows the Standard Ultimate Life Table and the effective interest rate is 5% per annum. (i) Evaluate the benefit reserve at the end of year 10 using prospective formula. (2 marks) (ii) From part (a)(i), determine the benefit reserve at the end of year 9.75 by stating any assumption used. (4 marks) (iii) Find the benefit reserve at the end of year 10 using retrospective formula. Comment your answer with part (a)(i). (4 marks) (vi) From part (a)(i), determine the benefit reserve at the end of year 8 using recursive formula. (2 marks) (v ) Recalculate part (i) if the premium is 200 instead. Comment on your answer. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts