Question: Question 1 (Total: 20 marks) (a) Let S(T) be the stock's price at time T that follows a lognormal model. A Monte Carlo simulation of

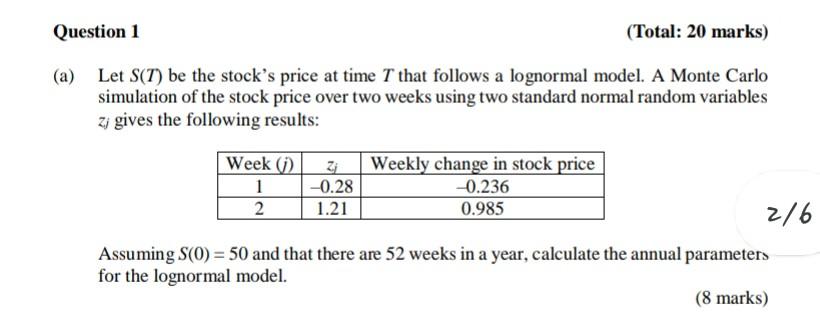

Question 1 (Total: 20 marks) (a) Let S(T) be the stock's price at time T that follows a lognormal model. A Monte Carlo simulation of the stock price over two weeks using two standard normal random variables Z gives the following results: Week (1) Weekly change in stock price 1 -0.28 -0.236 2 1.21 0.985 2/6 Assuming S(0) = 50 and that there are 52 weeks in a year, calculate the annual parameters for the lognormal model. (8 marks) Question 1 (Total: 20 marks) (a) Let S(T) be the stock's price at time T that follows a lognormal model. A Monte Carlo simulation of the stock price over two weeks using two standard normal random variables Z gives the following results: Week (1) Weekly change in stock price 1 -0.28 -0.236 2 1.21 0.985 2/6 Assuming S(0) = 50 and that there are 52 weeks in a year, calculate the annual parameters for the lognormal model. (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts