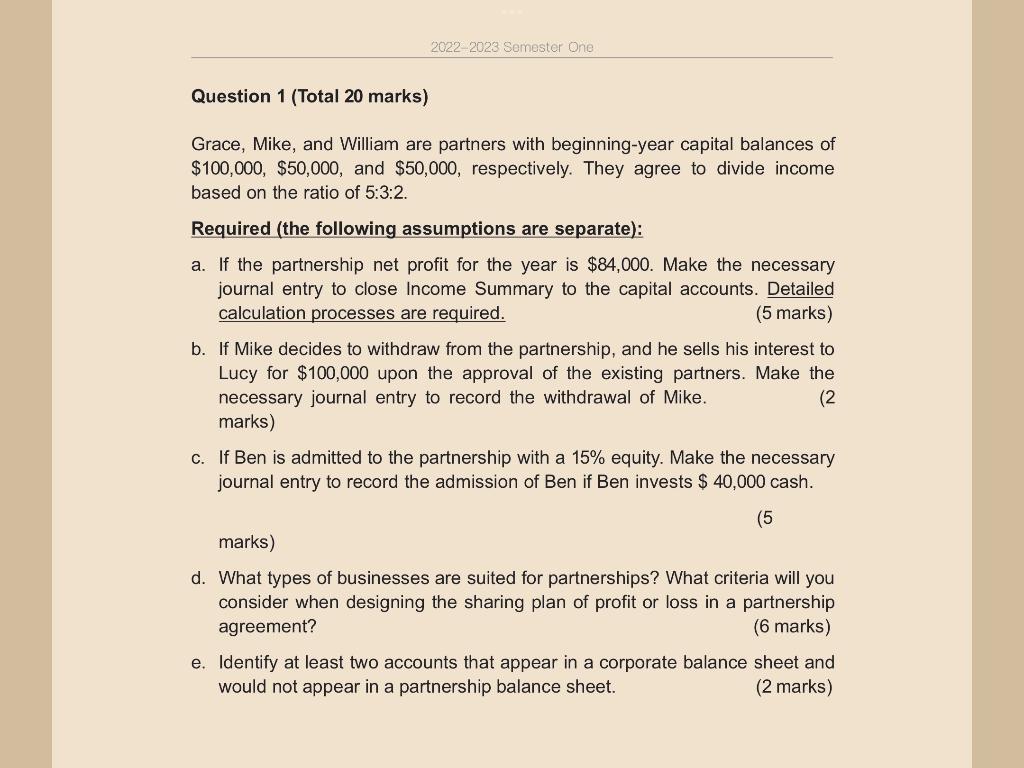

Question: Question 1 (Total 20 marks) Grace, Mike, and William are partners with beginning-year capital balances of $100,000,$50,000, and $50,000, respectively. They agree to divide income

Question 1 (Total 20 marks) Grace, Mike, and William are partners with beginning-year capital balances of $100,000,$50,000, and $50,000, respectively. They agree to divide income based on the ratio of 5:3:2. Required (the following assumptions are separate): a. If the partnership net profit for the year is $84,000. Make the necessary journal entry to close Income Summary to the capital accounts. Detailed calculation processes are required. (5 marks) b. If Mike decides to withdraw from the partnership, and he sells his interest to Lucy for $100,000 upon the approval of the existing partners. Make the necessary journal entry to record the withdrawal of Mike. marks) c. If Ben is admitted to the partnership with a 15% equity. Make the necessary journal entry to record the admission of Ben if Ben invests $40,000 cash. (5 marks) d. What types of businesses are suited for partnerships? What criteria will you consider when designing the sharing plan of profit or loss in a partnership agreement? (6 marks) e. Identify at least two accounts that appear in a corporate balance sheet and would not appear in a partnership balance sheet. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts