Question: Question 1 (Total 20 marks) Part A (12 marks) The company Unlimited Gain issues $2,000,000 face value of seven-year bonds on January 1, 2022 when

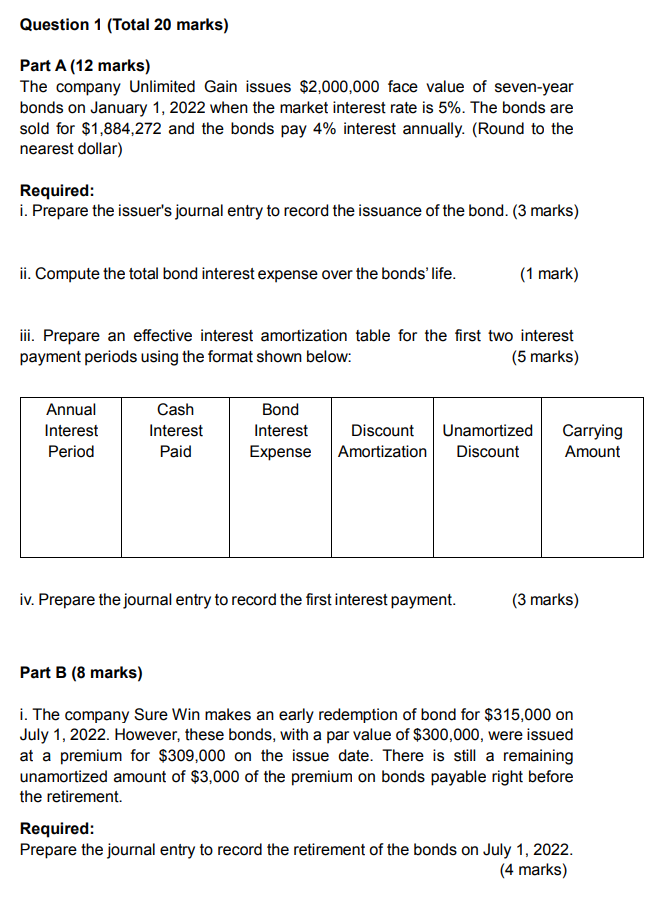

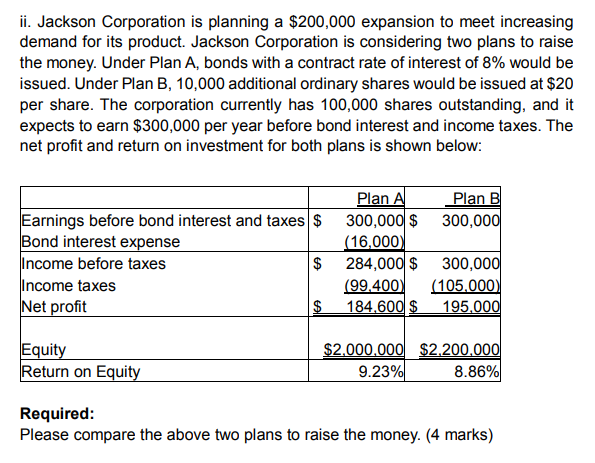

Question 1 (Total 20 marks) Part A (12 marks) The company Unlimited Gain issues $2,000,000 face value of seven-year bonds on January 1, 2022 when the market interest rate is 5%. The bonds are sold for $1,884,272 and the bonds pay 4% interest annually. (Round to the nearest dollar) Required: i. Prepare the issuer's journal entry to record the issuance of the bond. (3 marks) ii. Compute the total bond interest expense over the bonds' life. (1 mark) iii. Prepare an effective interest amortization table for the first two interest payment periods using the format shown below: (5 marks) Annual Interest Period Cash Interest Paid Bond Interest Discount Expense Amortization Unamortized Discount Carrying Amount iv. Prepare the journal entry to record the first interest payment. (3 marks) Part B (8 marks) i. The company Sure Win makes an early redemption of bond for $315,000 on July 1, 2022. However, these bonds, with a par value of $300,000, were issued at a premium for $309,000 on the issue date. There is still a remaining unamortized amount of $3,000 of the premium on bonds payable right before the retirement Required: Prepare the journal entry to record the retirement of the bonds on July 1, 2022. (4 marks) ii. Jackson Corporation is planning a $200,000 expansion to meet increasing demand for its product. Jackson Corporation is considering two plans to raise the money. Under Plan A, bonds with a contract rate of interest of 8% would be issued. Under Plan B, 10,000 additional ordinary shares would be issued at $20 per share. The corporation currently has 100,000 shares outstanding, and it expects to earn $300,000 per year before bond interest and income taxes. The net profit and return on investment for both plans is shown below: Earnings before bond interest and taxes $ Bond interest expense Income before taxes Income taxes Net profit Plan A Plan B 300,000 $ 300,000 (16,000) 284,000 $ 300,000 (99.400) (105,000 184.600 $ 195,000 $ $ Equity Return on Equity $2,000,000 $2,200,000 9.23% 8.86% Required: Please compare the above two plans to raise the money. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts