Question: Question 1 (Total: 20 marks) The USD LIBOR rates per annum with continuous compounding and the swap rates per annum for semi-annual pay swaps on

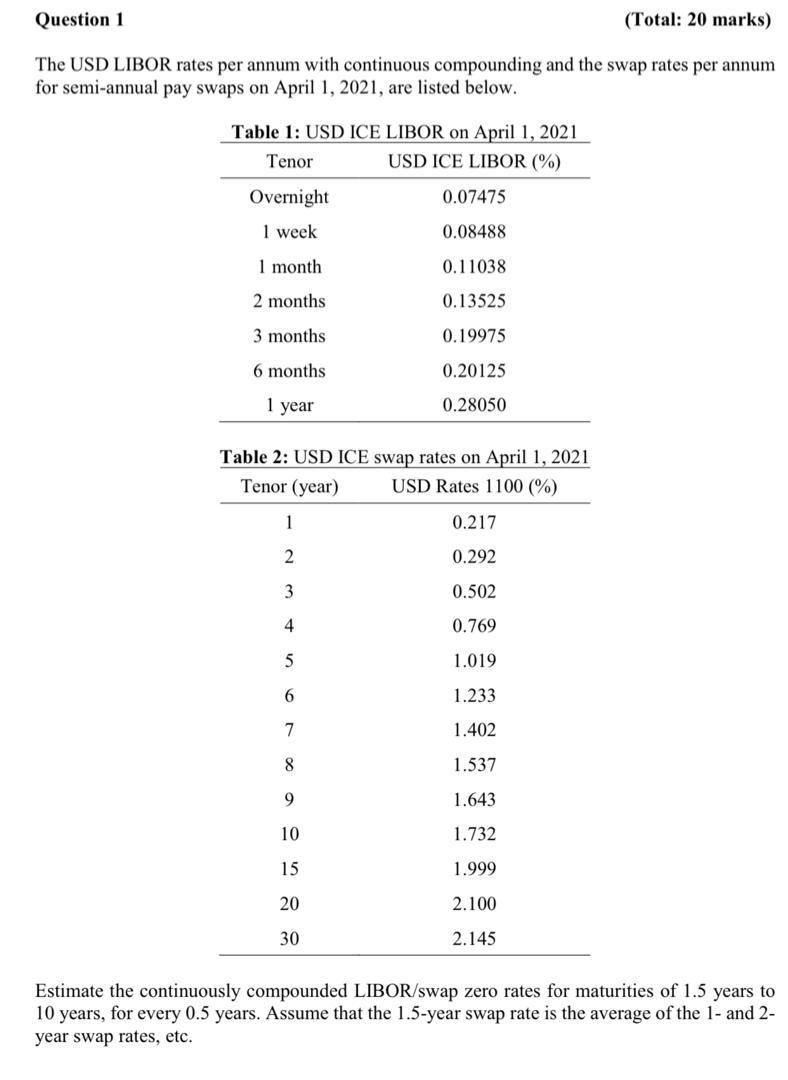

Question 1 (Total: 20 marks) The USD LIBOR rates per annum with continuous compounding and the swap rates per annum for semi-annual pay swaps on April 1, 2021, are listed below. Table 1: USD ICE LIBOR on April 1, 2021 Tenor USD ICE LIBOR (%) Overnight 0.07475 1 week 0.08488 1 month 0.11038 2 months 0.13525 3 months 0.19975 6 months 0.20125 1 year 0.28050 Table 2: USD ICE swap rates on April 1, 2021 Tenor (year) USD Rates 1100 %) 1 0.217 2 0.292 3 0.502 4 0.769 5 1.019 6 1.233 7 1.402 8 1.537 9 1.643 10 1.732 15 1.999 20 2.100 30 2.145 Estimate the continuously compounded LIBOR/swap zero rates for maturities of 1.5 years to 10 years, for every 0.5 years. Assume that the 1.5-year swap rate is the average of the 1- and 2- year swap rates, etc. Question 1 (Total: 20 marks) The USD LIBOR rates per annum with continuous compounding and the swap rates per annum for semi-annual pay swaps on April 1, 2021, are listed below. Table 1: USD ICE LIBOR on April 1, 2021 Tenor USD ICE LIBOR (%) Overnight 0.07475 1 week 0.08488 1 month 0.11038 2 months 0.13525 3 months 0.19975 6 months 0.20125 1 year 0.28050 Table 2: USD ICE swap rates on April 1, 2021 Tenor (year) USD Rates 1100 %) 1 0.217 2 0.292 3 0.502 4 0.769 5 1.019 6 1.233 7 1.402 8 1.537 9 1.643 10 1.732 15 1.999 20 2.100 30 2.145 Estimate the continuously compounded LIBOR/swap zero rates for maturities of 1.5 years to 10 years, for every 0.5 years. Assume that the 1.5-year swap rate is the average of the 1- and 2- year swap rates, etc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts