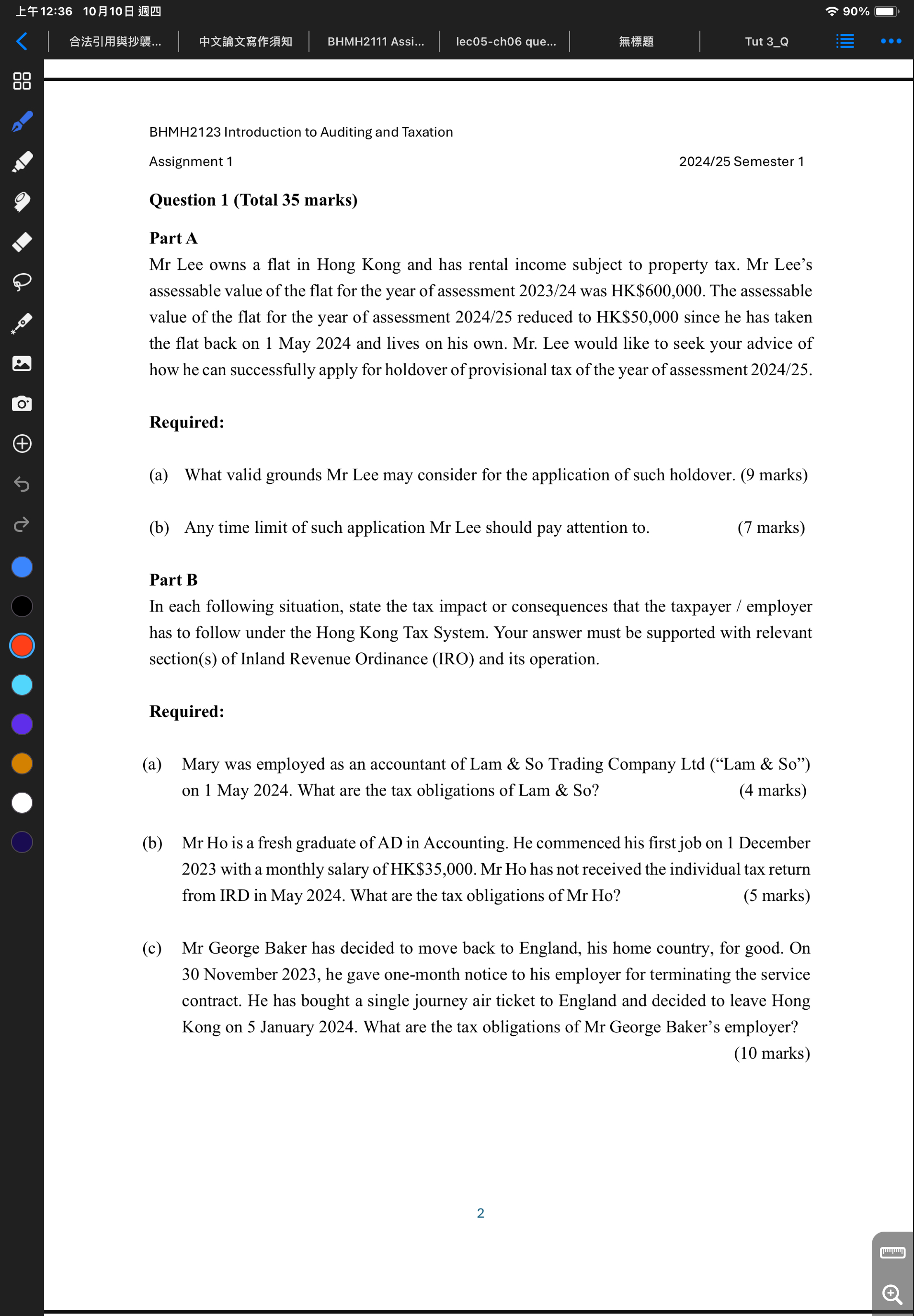

Question: Question 1 ( Total 3 5 marks ) Part A Mr Lee owns a flat in Hong Kong and has rental income subject to property

Question Total marks

Part A

Mr Lee owns a flat in Hong Kong and has rental income subject to property tax. Mr Lee's

assessable value of the flat for the year of assessment was HK $ The assessable

value of the flat for the year of assessment reduced to HK$ since he has taken

the flat back on May and lives on his own. Mr Lee would like to seek your advice of

how he can successfully apply for holdover of provisional tax of the year of assessment

Required:

a What valid grounds Mr Lee may consider for the application of such holdover. marks

b Any time limit of such application Mr Lee should pay attention to

Part B

In each following situation, state the tax impact or consequences that the taxpayer employer

has to follow under the Hong Kong Tax System. Your answer must be supported with relevant

sections of Inland Revenue Ordinance IRO and its operation.

Required:

a Mary was employed as an accountant of Lam & So Trading Company Ltd Lam & So

on May What are the tax obligations of Lam & So

b Mr Ho is a fresh graduate of AD in Accounting. He commenced his first job on December

with a monthly salary of $ Mr Ho has not received the individual tax return

from IRD in May What are the tax obligations of Mr Ho

c Mr George Baker has decided to move back to England, his home country, for good. On

November he gave onemonth notice to his employer for terminating the service

contract. He has bought a single journey air ticket to England and decided to leave Hong

Kong on January What are the tax obligations of Mr George Baker's employer?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock