Question: Question 1 ( Total 6 0 marks ) Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing an existing piece

Question Total marks

Degnan Dance Company, Inc., a manufacturer of dance and exercise apparel, is considering replacing

an existing piece of equipment with a more sophisticated machine. The following information is given.

FIGURE

Facts

Earnings Before Depreciation and Taxes

The firm pays percent taxes on ordinary income and capital gains.

a Given the information in Figure compute the initial investment.

marks

b Given the information in Figure compute the incremental annual cash flows.

marks

c Given the information in Figure compute the payback period.

marks

d Given the information in Figure and percent cost of capital,

i compute the net present value.

marks

ii Should the project be accepted?

marks Question Total marks

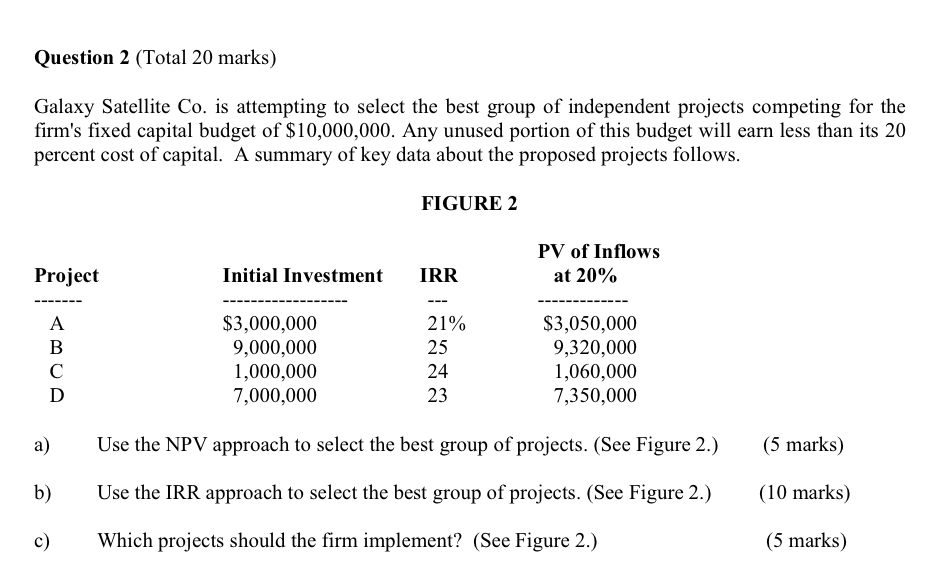

Galaxy Satellite Co is attempting to select the best group of independent projects competing for the

firm's fixed capital budget of $ Any unused portion of this budget will earn less than its

percent cost of capital. A summary of key data about the proposed projects follows.

FIGURE

a Use the NPV approach to select the best group of projects. See Figure

marks

b Use the IRR approach to select the best group of projects. See Figure

marks

c Which projects should the firm implement? See Figure

marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock