Question: You are considering two investment options. In option A, you have to invest RM6000 now and RM1000 three years from now. In option B.

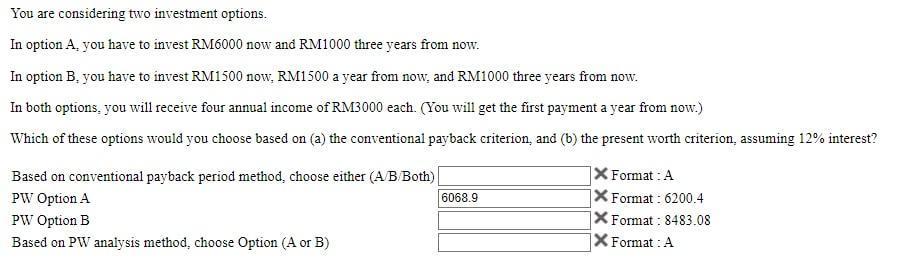

You are considering two investment options. In option A, you have to invest RM6000 now and RM1000 three years from now. In option B. you have to invest RM1500 now, RM1500 a year from now, and RM1000 three years from now. In both options, you will receive four annual income of RM3000 each. (You will get the first payment a year from now.) Which of these options would you choose based on (a) the conventional payback criterion, and (b) the present worth criterion, assuming 12% interest? Based on conventional payback period method, choose either (A/B/Both) PW Option A PW Option B Based on PW analysis method, choose Option (A or B) 6068.9 X Format : A X Format: 6200.4 X Format: 8483.08 X Format: A

Step by Step Solution

3.33 Rating (168 Votes )

There are 3 Steps involved in it

Conventional Payback Method In Option A the total investment is RM7000 and you will receive income o... View full answer

Get step-by-step solutions from verified subject matter experts