Question: Question 1: True/False question: Decide whether the following statements are True or False. Explain your reasoning Vertical equity is the principle which mostly applied with

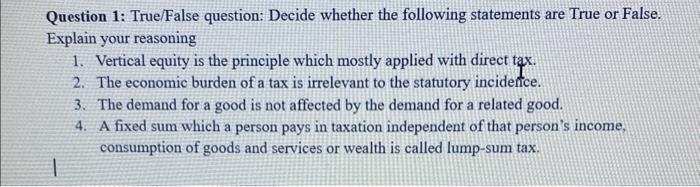

Question 1: True/False question: Decide whether the following statements are True or False. Explain your reasoning 1. Vertical equity is the principle which mostly applied with direct tax. 2. The economic burden of a tax is irrelevant to the statutory incidence. 3. The demand for a good is not affected by the demand for a related good. 4. A fixed sum which a person pays in taxation independent of that person's income, consumption of goods and services or wealth is called lump-sum tax

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts