Question: QUESTION 1 Use the following information to answer the next two questions. A currency trader believes the yen will depreciate relative to the dollar in

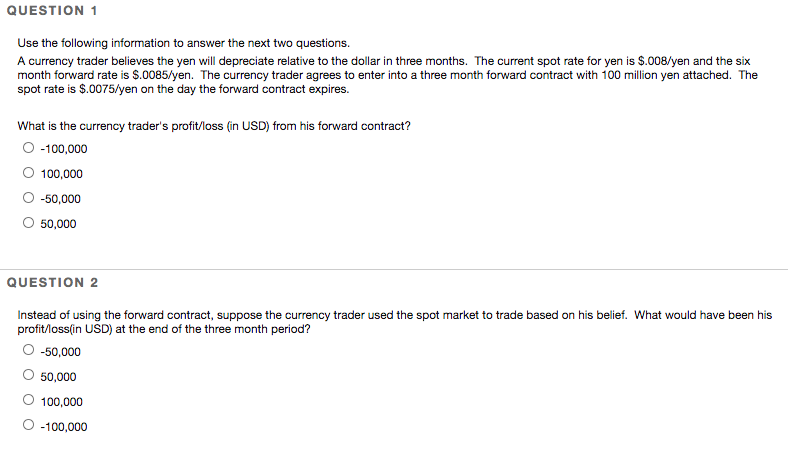

QUESTION 1 Use the following information to answer the next two questions. A currency trader believes the yen will depreciate relative to the dollar in three months. The current spot rate for yen is $.008/yen and the six month forward rate is $.0085/yen. The currency trader agrees to enter into a three month forward contract with 100 million yen attached. The spot rate is $.0075/yen on the day the forward contract expires. What is the currency trader's profit/loss (in USD) from his forward contract? - 100,000 100,000 -50,000 O 50,000 QUESTION 2 Instead of using the forward contract, suppose the currency trader used the spot market to trade based on his belief. What would have been his profit/loss(in USD) at the end of the three month period? -50,000 50,000 100,000 -100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts